Stockholm-based venture capital firm node.vc has announced the closure of $77.3 million (€71 million) for its latest fund, drawing support from 70 prominent Nordic entrepreneurs. The newly raised fund reflects growing confidence in the region’s startup and gaming ecosystems, particularly amid a challenging investment climate. Despite widespread caution in venture capital, the substantial backing by institutional investors and successful founders signals a vote of confidence in node.vc’s founder-first, sector-agnostic investment strategy.

Node.vc Raises $77.3 Million for New Fund

About Node.vc

Node.vc operates on a founder-first model, focusing on providing more than just capital to its portfolio companies. The firm’s approach leverages an extensive network of successful entrepreneurs to support and scale innovative tech startups. Co-led by veterans with backgrounds in leading startups and scaleups such as Tobii, Tobii Dynavox, and Paradox Interactive, node.vc’s leadership brings a wealth of experience to the table.

The firm’s strategy emphasizes building an interconnected ecosystem where established entrepreneurs actively contribute to the growth and success of early-stage companies. This approach aims to accelerate growth by connecting emerging startups with seasoned founders who can offer valuable insights, support, and industry connections.

Backing Nordic Game Changers

Sector-Agnostic Focus with Early Investments in Tech

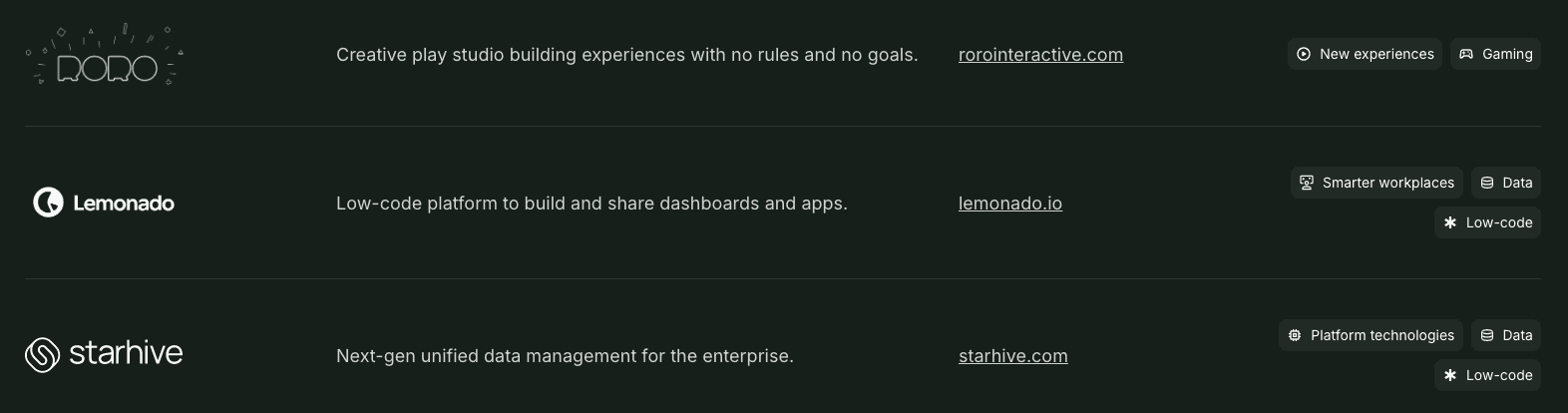

While node.vc’s investment philosophy remains sector-agnostic, some of its early investments indicate a strong inclination toward technology-driven ventures. The firm has already made three investments in Sweden, spanning diverse fields:

- Lemonado: A no-code platform that enables the creation of software and applications without extensive programming knowledge.

- Roro: A creative play studio focused on designing engaging and innovative play experiences.

- Starhive: A data management platform that aims to revolutionize enterprise-level data handling and integration.

These investments highlight node.vc’s belief that disruptive innovation can emerge from any industry, provided that there is a robust support system for entrepreneurs. The firm aims to back companies that are not only redefining their respective sectors but also driving broader trends in areas such as web3 gaming, AI, enterprise technology, and interactive entertainment.

Investment Portfolio

Building an Entrepreneur-Backed Ecosystem

The new fund is supported by cornerstone investors, including Saminvest, a Stockholm-based venture capital company formed by the Swedish government to promote sustainable ventures. The backing from Saminvest, alongside other institutional investors, underscores the broad confidence in node.vc’s vision and approach.

Node.vc’s investor base includes entrepreneurs from some of the most successful Nordic companies, such as Axis Communications, Yubico, Polarium, Cint, Evolution, PriceRunner, and Polar Structure. This network of founders not only contributes capital but also plays an active role in identifying, evaluating, and supporting new portfolio companies. According to managing partner John Elvesjö, this approach has helped node.vc establish itself as one of the largest entrepreneur-backed early-stage venture capital firms in the Nordics.

Over 40+ Investments Made

Aiming for Disruption Across Industries

Node.vc’s investment thesis revolves around the belief that significant change can come from any sector. By focusing on building a founder-first ecosystem, the firm aims to support companies that are poised to lead in transforming industries. The investment firm’s approach is particularly relevant in today’s fast-evolving business landscape, where the dynamics of work, technology, and entrepreneurship continue to shift.

The fund seeks to identify companies at the forefront of change, whether they are advancing virtual work solutions, driving AI innovation, or unlocking new frontiers in digital entertainment, blockchain gaming, and enterprise technology. This broad scope allows node.vc to pursue diverse investment opportunities while fostering a supportive environment for entrepreneurs navigating the complexities of scaling a business.

New Experiences in Digital Entertainment and Gaming

Final Thoughts

Node.vc’s founder-first approach resonates with its leadership, as many of its team members have experience as founders themselves. Managing partner John Elvesjö emphasized that node.vc’s strategy is to partner with entrepreneurs, leveraging its team's collective expertise, networks, and insights to support founders throughout their journey. He stated in an interview with GamesBeat, "The Node.vc team started as founders and operators ourselves; we know what it takes to build and scale successful companies. That’s why we always put founders first."

Magnus Skåninger, CEO of cornerstone investor Saminvest, also expressed confidence in node.vc’s vision, highlighting the firm’s ability to drive a new wave of entrepreneur-backed success. He noted that node.vc is well-positioned to seize the best investment opportunities in the tech landscape.

Node.vc’s recent $77.3 million fund closure represents a significant step in building a robust Nordic startup ecosystem. By harnessing the experience and networks of successful entrepreneurs, the firm aims to provide comprehensive support to early-stage companies across various sectors. As venture capital firms continue to navigate uncertain investment climates, node.vc’s founder-first, ecosystem-focused approach offers a promising path forward for fostering innovation and growth.