Recent research from Moloco provides a comprehensive analysis of the mobile gaming market, revealing significant trends in user acquisition (UA) spending and in-app purchase (IAP) revenue patterns across 195 countries. Based on data collected from September 2023 to September 2024, the study identifies patterns in high-value user segments, country-specific spending trends, and strategies for growth. While the analysis excludes data from mainland China, it offers a global perspective on key markets and growth opportunities heading into 2024.

Beyond Borders: Mobile Gaming Insights for Global Growth

Key Revenue Contributors

Moloco’s data highlights that only a small percentage of mobile gaming users drive a substantial portion of revenue. Notably, the top 2% of high-value users account for 35% to 45% of all IAP revenue, demonstrating that a concentrated base of users generates a disproportionately large share of revenue. This underscores the importance of targeting and retaining high-value users in mobile gaming. Additionally, Moloco’s findings reveal that 70-85% of IAP revenue is generated by the top 10% of users, emphasizing the value of a focused approach to user acquisition that prioritizes high-potential users.

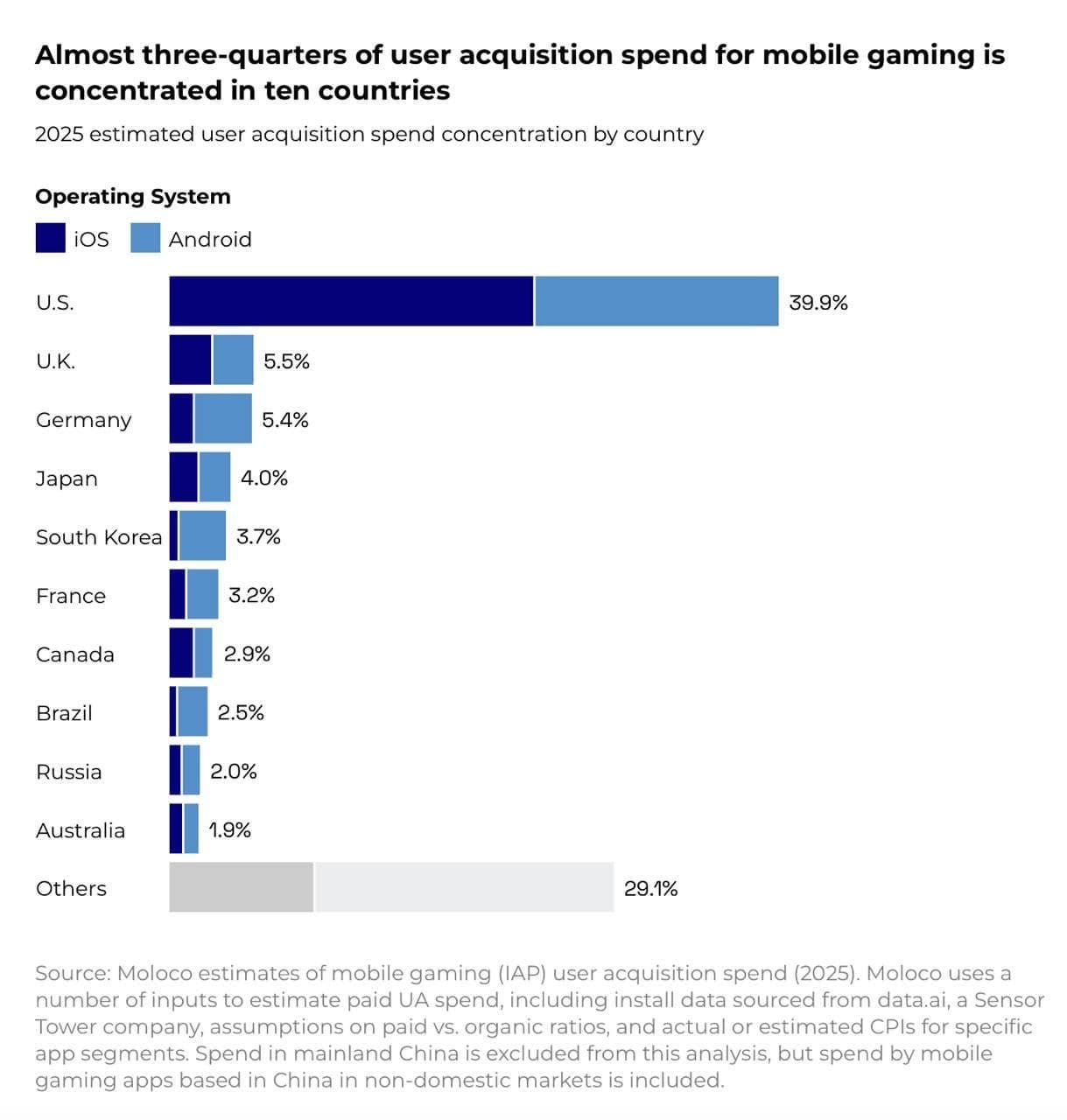

Almost 3/4 of UA Spend for Mobile Gaming is Concentrated in 10 Countries

Global Spending and Genre Breakdown

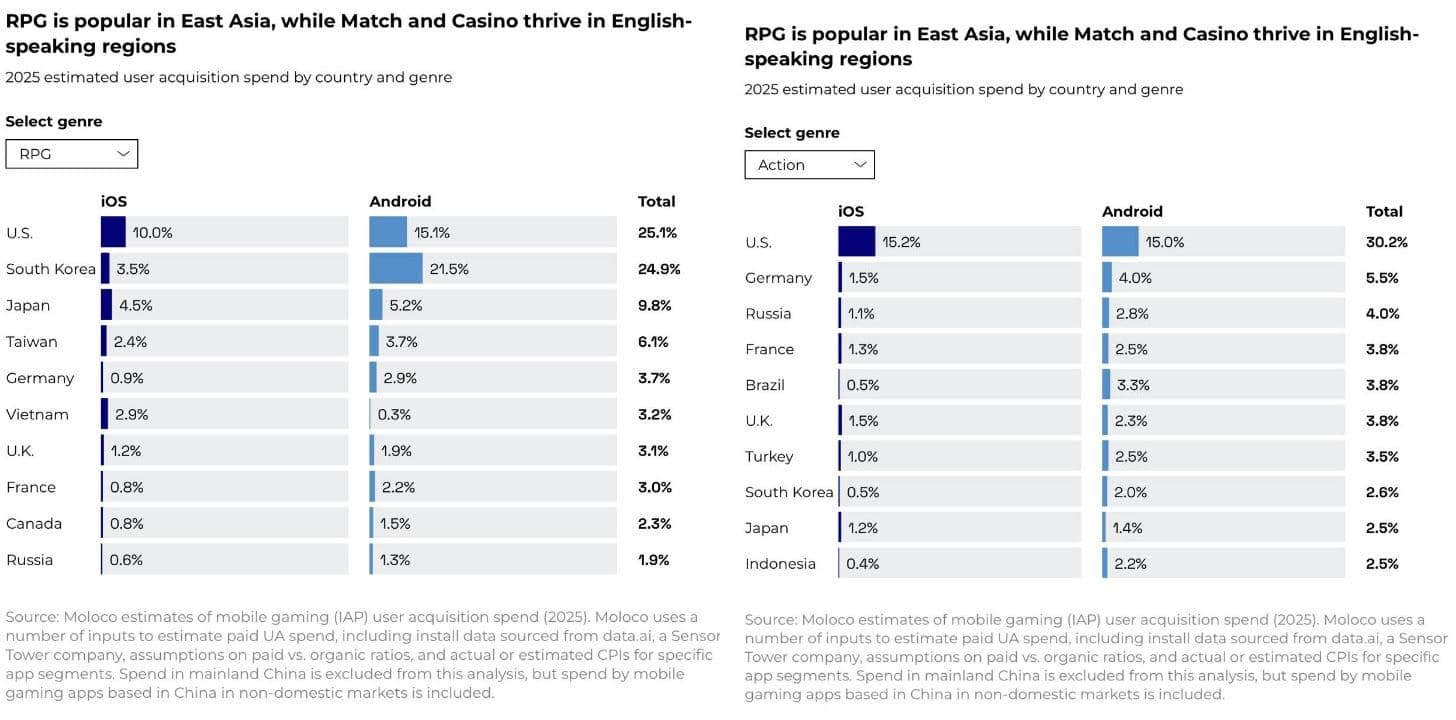

Moloco projects that mobile gaming companies will collectively spend $29 billion on user acquisition by 2025, with 71% of this budget concentrated in ten key markets. The United States alone is expected to capture 39.8% of global UA spending. However, spending patterns vary significantly by game genre and region. For instance, 65.5% of user acquisition spending for casino games takes place in the United States, while spending on RPG games is more evenly distributed between the United States (25.1%) and South Korea (24.9%).

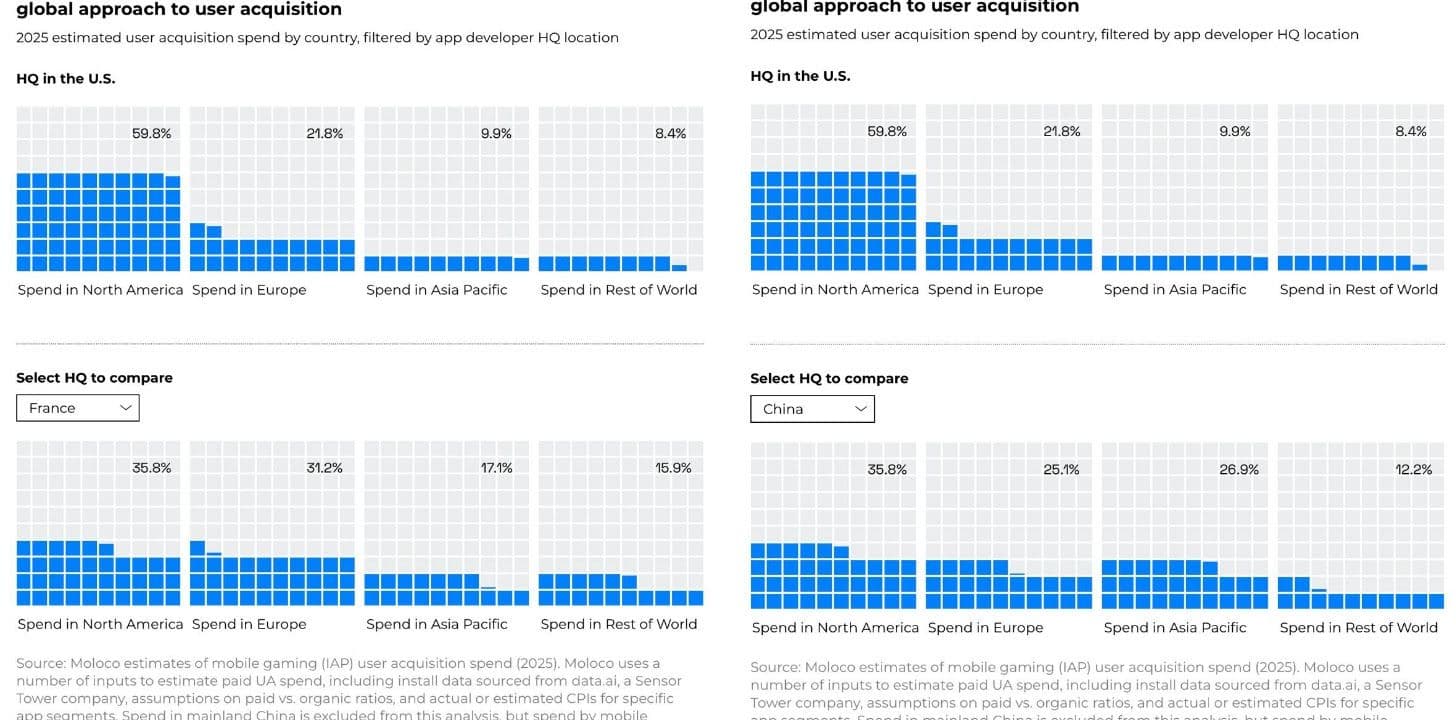

Moloco’s research also highlights a trend among companies to prioritize advertising in culturally familiar regions. American gaming companies, for example, spend 81.6% of their UA budget on Western markets, while Chinese companies allocate nearly three times more to Asian markets than their American counterparts. This indicates a strategy among advertisers to invest in regions with cultural or linguistic similarities, likely aiming to boost user engagement and retention.

Genre Breakdown by Region

User Acquisition and Revenue Correlations by Region

While the study observes a general correlation between high UA spending and IAP revenue, this trend does not hold consistently in all regions. In Asian markets such as South Korea and Japan, IAP revenue is notably higher than UA spending. Moloco analysts suggest that this disparity could reflect a lack of understanding of local market dynamics among some advertisers. These markets may require more tailored strategies to capture the full revenue potential.

Market Segmentation and Growth Framework

Moloco proposes a framework for approaching international markets, grouping regions based on language, culture, and market maturity. This segmentation includes distinct clusters such as English-speaking Tier-1 markets, East Asian countries, and Latin American Spanish-speaking markets. This structured approach allows gaming companies to optimize UA strategies by tailoring campaigns to culturally similar or linguistically compatible audiences, potentially improving engagement and conversion rates.

Global Approach to UA

D7 ARPPU Leaders and Promising Markets

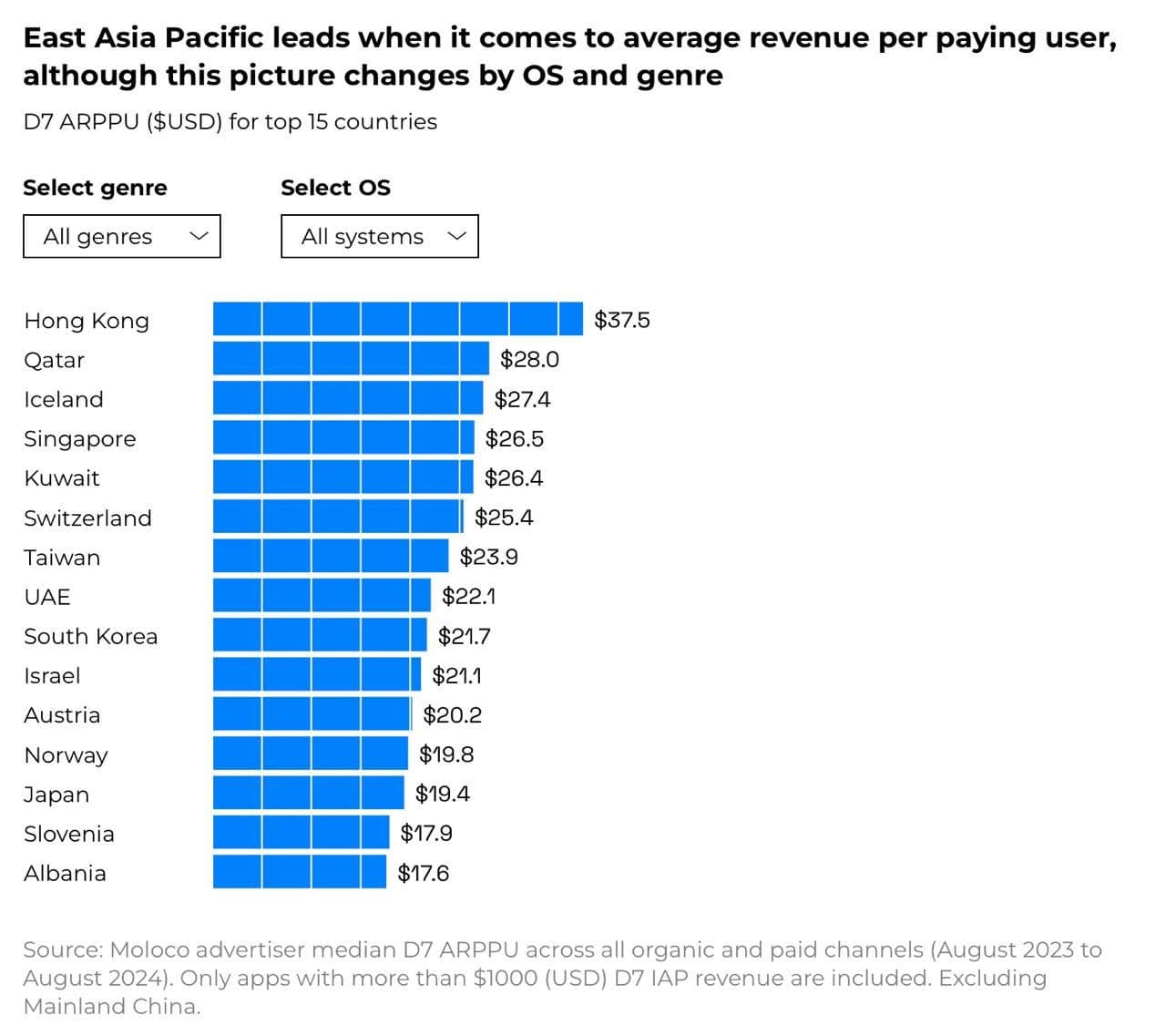

Average Revenue Per Paying User (ARPPU) on day seven after acquisition, or D7 ARPPU, is a critical metric Moloco uses to assess market potential. The highest D7 ARPPU figures were recorded in Hong Kong ($37.5), Qatar ($28), and Iceland ($27.4). These markets demonstrate strong early revenue potential from new users, suggesting they may offer a substantial return on investment for companies focusing on initial user engagement.

Interestingly, Moloco identifies markets as "promising" based on low acquisition costs for paying users (CPP) coupled with relatively high ARPPU. However, this list of promising markets includes established, high-revenue regions like the United States, South Korea, and Japan, which have long been considered core markets for mobile gaming. This suggests that while acquisition costs in these markets may be favorable, they also carry a competitive landscape due to their mature user bases and developed revenue potential.

D7 ARPPU for Top 15 Countries

Relevance to Web3 Gaming

This analysis of mobile gaming market dynamics and user acquisition trends is highly relevant to the evolving web3 gaming sector. With web3 gaming focused on decentralized ownership, player-driven economies, and blockchain integration, understanding high-value user behavior, regional spending trends, and culturally aligned marketing becomes crucial.

In web3 games, where players can own, trade, and monetize in-game assets, attracting and retaining top spenders will be even more impactful. The insights from Moloco’s study on market segmentation and the unique value of specific user bases can guide web3 developers in targeting regions where users are more likely to adopt new monetization models, fostering sustainable growth in decentralized gaming ecosystems.

Final Thoughts

Moloco’s analysis of the mobile gaming market in 2024 points to significant opportunities for growth and optimization, particularly through targeted user acquisition efforts in culturally aligned regions. The data underscores the importance of understanding regional market dynamics, as well as the concentration of high-value users who drive a substantial portion of IAP revenue. As mobile gaming companies prepare for 2024, insights from this report may help refine strategies to capture and retain the most valuable users in key global markets.

Source: Moloco