The third quarter of 2024 presented a mix of growth and challenges for the gaming industry, according to Konvoy’s latest report. The analysis of Q3 2024 highlighted the evolving dynamics in venture capital funding, mergers and acquisitions (M&A), and regional market performance. This comprehensive report provides insights into the current state of gaming, with particular emphasis on emerging technologies such as artificial intelligence (AI) and blockchain.

Konvoy Q3 2024 Gaming Industry Report Highlights

Konvoy Q3 2024 Report

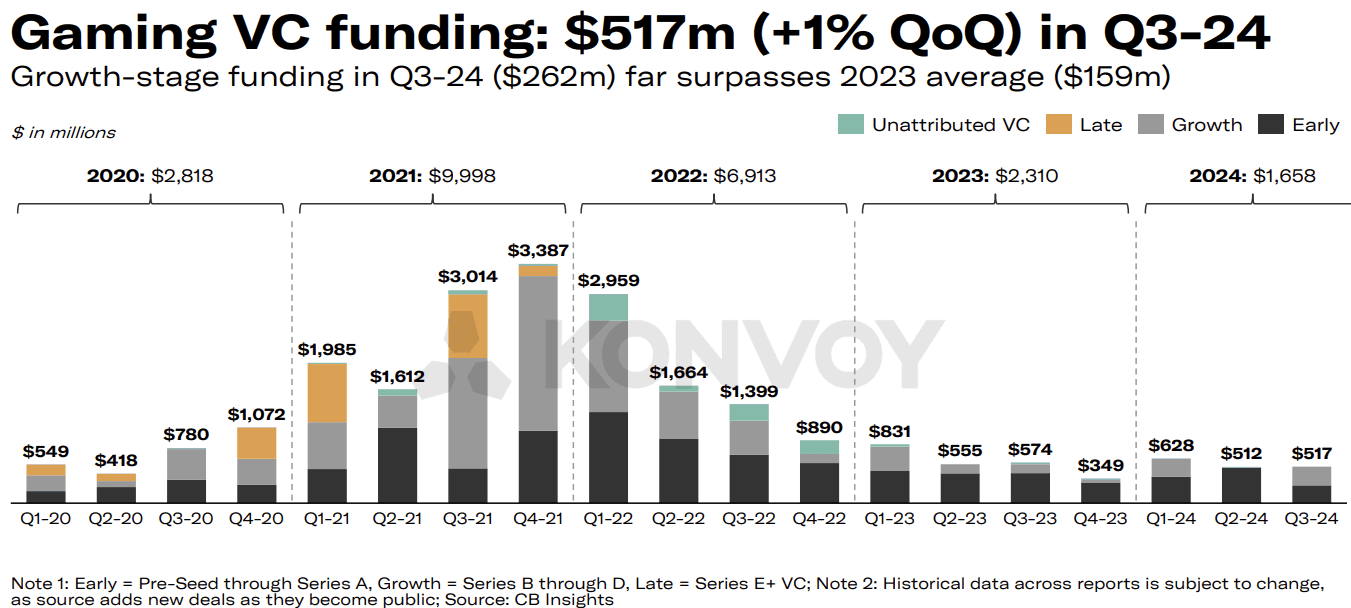

Venture capital (VC) funding for the gaming sector saw a modest rise in Q3 2024, with a 1% increase from the previous quarter, reaching $517 million across 92 deals. This growth was primarily driven by Pre-Seed through Series E+ investments, with Konvoy noting that the industry seems to be stabilizing at a “new normal” of $500-600 million in quarterly funding. Although the number of deals decreased by 14% quarter-over-quarter (QoQ), the overall funding amount suggests steady investor interest in the gaming market despite a more selective investment approach.

Growth-Stage Funding Rebounds

Growth-stage funding experienced a significant resurgence in Q3 2024, with $262 million spread across nine deals, mirroring the levels seen in Q1 2024. This followed a dip in Q2, where there was no growth-stage funding activity. The consistent return to higher growth-stage investments signals a continued appetite among investors for more established companies seeking expansion capital, contrasting with the more cautious early-stage funding environment.

Gaming VC Funding (Konvoy Q3 2024)

The Role of AI and Blockchain in Gaming Investments

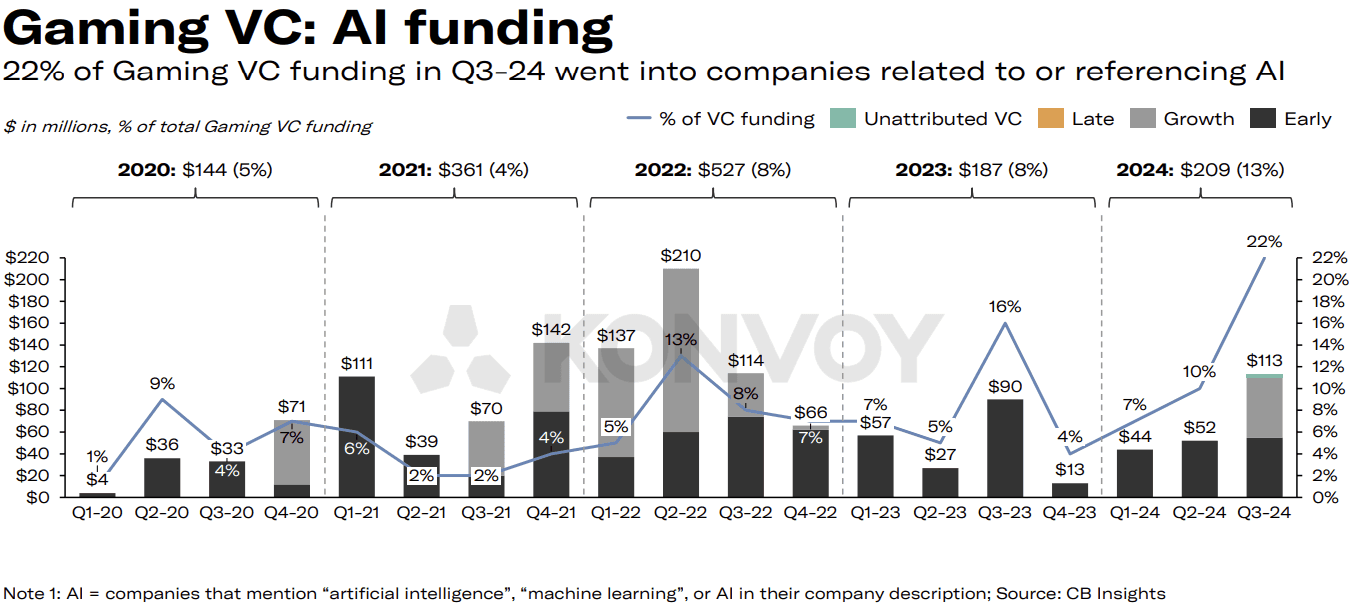

Konvoy’s report draws attention to the role of AI in gaming venture capital trends. In Q3 2024, AI-related companies attracted $113 million in VC funding, accounting for 22% of the total gaming VC investments. This marked the highest proportion of AI investment since at least early 2020. Noteworthy recipients of AI-focused funding included companies like Volley, which secured $55 million, and Series Entertainment, which raised $28 million.

Despite this peak in AI funding, it remains below the levels seen during the blockchain investment boom in 2021. For context, Q4 2021 witnessed $1.6 billion in combined blockchain and AI investments, which accounted for 51% of all gaming VC funding at that time. The current $275 million directed towards companies associated with either AI or blockchain in Q3 2024 suggests a more tempered enthusiasm from investors compared to the hype-driven surge seen in 2021-2022.

Gaming VC AI Funding (Konvoy Q3 2024)

Mergers and Acquisitions Remain Strong

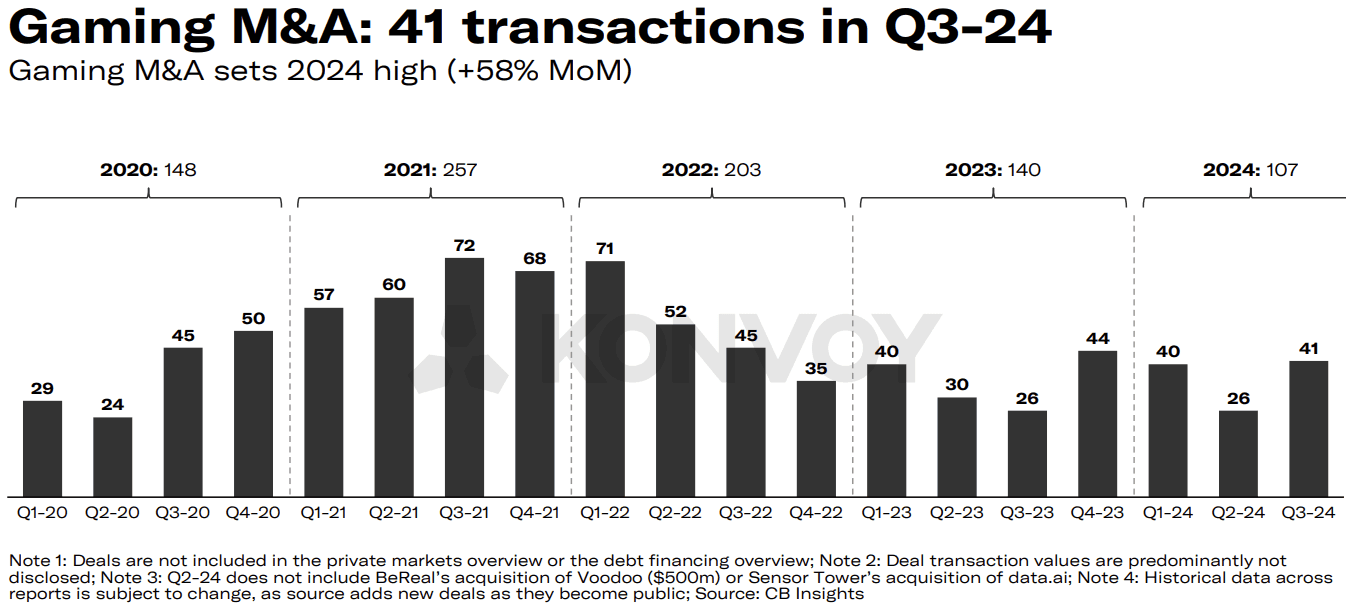

The gaming M&A landscape remained active in Q3 2024, with 41 public transactions taking place. Konvoy anticipates that M&A activity will continue at a robust pace throughout the rest of 2024, potentially surpassing the levels seen in 2023. This sustained interest in acquisitions points to ongoing consolidation efforts as companies seek to expand their portfolios and capitalize on synergies within the gaming industry.

Investment in Gaming Technology vs. Content

VC funding for the top 10 gaming technology and platform companies in Q3 2024 experienced a slight decline of 7% QoQ, indicating relative stability. However, on the content side, there was a dramatic 73% increase in funding for the top 10 deals, largely driven by HYBE IM’s substantial $80 million round. This outlier significantly influenced the funding landscape for game development studios, signaling continued interest in content creation despite broader market fluctuations.

Gaming M and A (Konvoy Q3 2024)

Regional Differences in Gaming VC Activity

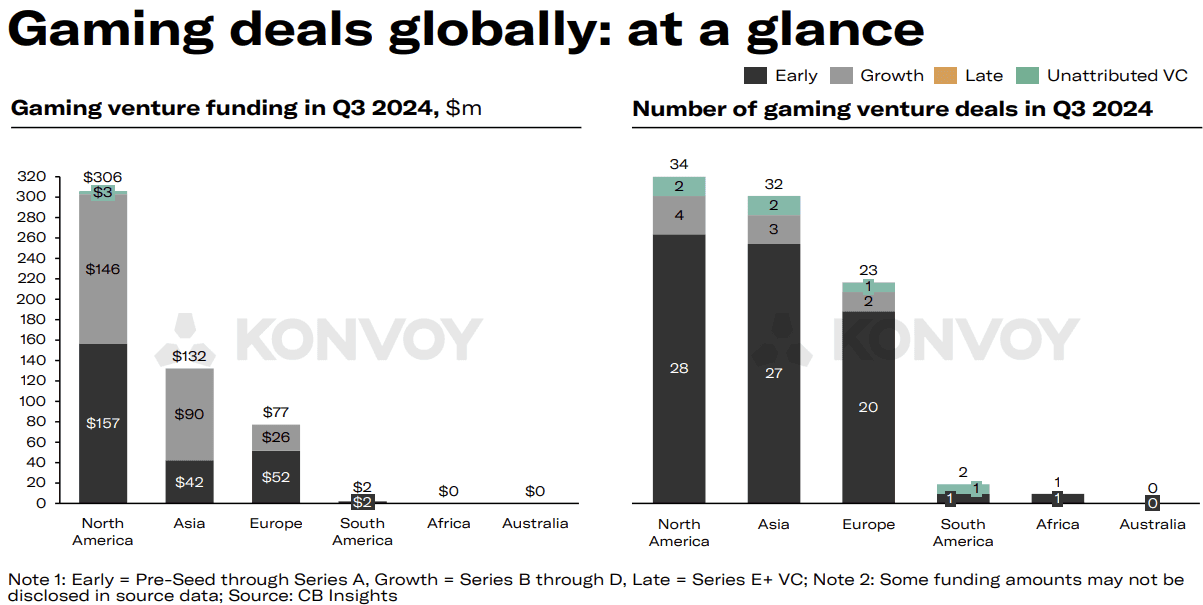

Regional analysis revealed stark contrasts in gaming VC activity, with North America and Asia executing a comparable number of deals but differing significantly in funding amounts. North American companies attracted $306 million in investments, more than doubling Asia’s $132 million. This disparity reflects the region's strong presence of well-capitalized firms and a more mature investment ecosystem, which continues to draw substantial funding.

Gaming Market Outlook for 2024

The gaming market is projected to reach $188 billion in 2024, reflecting a year-over-year growth of 2.1%. Public market data indicates a positive performance for top gaming ETFs, which have seen gains of up to 36.1% since the beginning of 2024, significantly outpacing the S&P 500’s 21.4% growth over the same period. Furthermore, public gaming companies are holding considerable cash reserves amounting to $33.4 billion, with leading tech companies having $214 billion, suggesting solid financial positioning within the industry.

Gaming Deals Globally (Konvoy Q3 2024)

Key Industry Themes and Events

Several themes and developments have shaped the gaming industry landscape in Q3 2024. These include Epic Games’ legal battle against Apple and Google in the EU, Discord’s launch of its “Activities” feature, and key AI partnerships such as Google’s collaboration with Character.ai and Canva’s with Leonardo.ai. Additionally, the US Senate's passage of online child safety legislation and the FTC’s lawsuit against TikTok for violating the Children's Online Privacy Protection Act (COPPA) have been significant developments.

Unity's complete removal of the Runtime Fee has also been a major point of interest for developers, signaling an industry-wide response to feedback. The Savvy Games Group's partnership with Xsolla is another strategic move to watch, potentially reshaping distribution and monetization in gaming. Lastly, Keywords Studios' $2.8 billion privatization deal was trending in Q3.

Looking Ahead

The Q3 2024 gaming report from Konvoy provides valuable insights into the market's direction as it navigates economic uncertainties and technological evolution. With growth-stage funding rebounding and AI investments peaking, the gaming industry continues to adjust to new norms while maintaining a dynamic M&A environment. As market trends unfold, attention will be on the balance between investment in technology and content, as well as regional funding disparities. Read the full report here.