Recent data from Konvoy highlights that as of mid-2024, securing funding for gaming companies has become increasingly challenging, reflecting broader shifts in the investment landscape. Over the past year, the once robust capital influx into the gaming sector has sharply declined, dropping from $14 billion in 2021 and 2022 to just $2.7 billion in 2023. This downturn is attributed to several factors, including the overwhelming focus on AI investments, higher interest rates, and reduced valuations.

Despite these difficulties, Konvoys predictions suggest that while the immediate future may remain tough, there are signs that growth equity investments could recover as early as 2025. In this article, we break down the latest findings, exploring why fundraising in gaming remains challenging in 2024 and what Konvoy's predictions are for future investment trends. You will also learn more about the impact of AI trends, interest rates, and valuations on the gaming industry.

Konvoy Reports on Fundraising Challenges in Gaming

Factors Causing Funding Challenges

Raising capital for gaming companies has become increasingly difficult as of mid-2024, continuing a trend that started over a year ago. Despite significant investments in previous years, the funding landscape has shifted dramatically, with notable declines in capital inflows observed across early and late-stage gaming enterprises.

- AI Dominance in VC Funding: The surge in AI-related investments has overshadowed other sectors, including gaming. AI-focused deals captured a substantial portion of global VC funding in Q2 2024, leaving less attention and capital available for gaming ventures.

- VCs Between Funds: Many venture capital firms are currently focused on raising new funds, delaying new investments in gaming. This cautious approach stems from the need to maintain fund activity and prepare for future market conditions.

- Impact of Interest Rates: Higher interest rates have raised the risk threshold for investors, leading to reduced valuations and fewer exits in the gaming sector. This cautious environment has stifled growth investments crucial for scaling gaming companies.

- Low Valuations: Valuations for gaming startups, from Pre-Seed to Series A rounds, have plummeted by significant margins compared to previous years. This decline has compelled many companies to reassess fundraising strategies and focus on operational efficiency.

Gaming VC Deals Down 22% QoQ in Q2 2024

What Can We Look Forward To?

Konvoy says that forecasting the future of investment in gaming is particularly challenging given the current macroeconomic climate, which is influenced by global conflicts, U.S. elections, fluctuating interest rates, aggressive regulatory scrutiny, and shifting investment sentiment. Despite this uncertainty, here are some key predictions for the gaming investment landscape.

Here is a detailed breakdown of Konvoy's predictions:

- Enduring Focus on Gaming: Investment firms, including venture capital, private equity, and hedge funds, will likely continue to prioritize gaming. As consumer engagement and spending increasingly center around gaming, leading investment entities will stay attuned to this sector’s growth.

- Evolving AI Investment Trends: Investment in artificial intelligence is expected to remain robust for the next two quarters before transitioning to a more moderate level. This change will potentially redirect capital and interest towards other sectors, including gaming, by early 2025.

- Slowdown in Gaming VC Activity: Venture capital activity in the gaming industry is projected to remain subdued for the rest of 2024 and potentially through the first half of 2025.

- Modest Interest Rate Reductions: Interest rates are forecasted to decrease slightly in late 2024, with reductions likely around 25-50 basis points. By mid-2025, the total cut may only be between 50-100 basis points. This gradual reduction will generate some excitement but may fall short of the more optimistic expectations for a swift economic rebound.

- Steady IPO Market: The initial public offering (IPO) market is expected to stay relatively quiet for the next 12-18 months. While some gaming companies will seek to go public for liquidity, the moderate reaction to interest rate cuts will likely result in a conservative IPO environment.

- Stable Startup Valuations: Valuations for gaming startups are anticipated to remain stable over the next 18 months. Significant fluctuations in valuation are not expected in the short term.

- Growth Equity Revival: Konvoy says they are optimistic about a resurgence in growth equity investments in 2025. As gaming valuations become more attractive and exit conditions improve, the team anticipates a notable increase in growth investment activity, potentially reaching $1-2 billion in new investments.

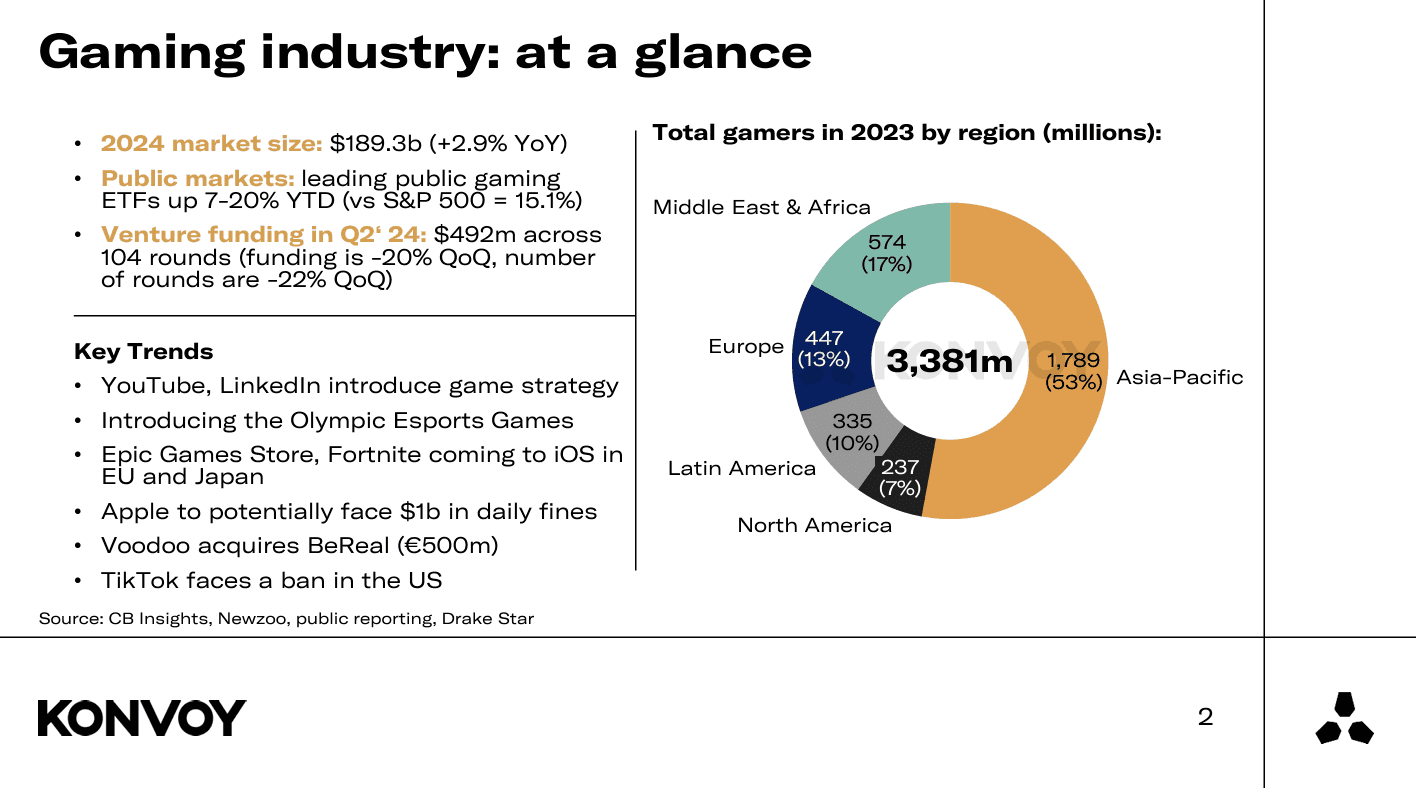

Gaming Industry at a Glance

Final Thoughts

The fundraising environment for gaming companies has faced significant headwinds over the past year, driven by a surge in AI investment, elevated interest rates, and declining valuations. These factors have collectively stifled capital flow and growth opportunities within the sector. However, as the macroeconomic landscape evolves, there are cautious expectations that growth equity investments could rebound in 2025.

For now, gaming companies must navigate a challenging funding environment with a focus on operational excellence and strategic planning, positioning themselves to capitalize on emerging opportunities when market conditions improve. Konvoy's insights underscore the complexities of gaming fundraising in 2024, highlighting both the current obstacles and future possibilities within the evolving investment landscape.