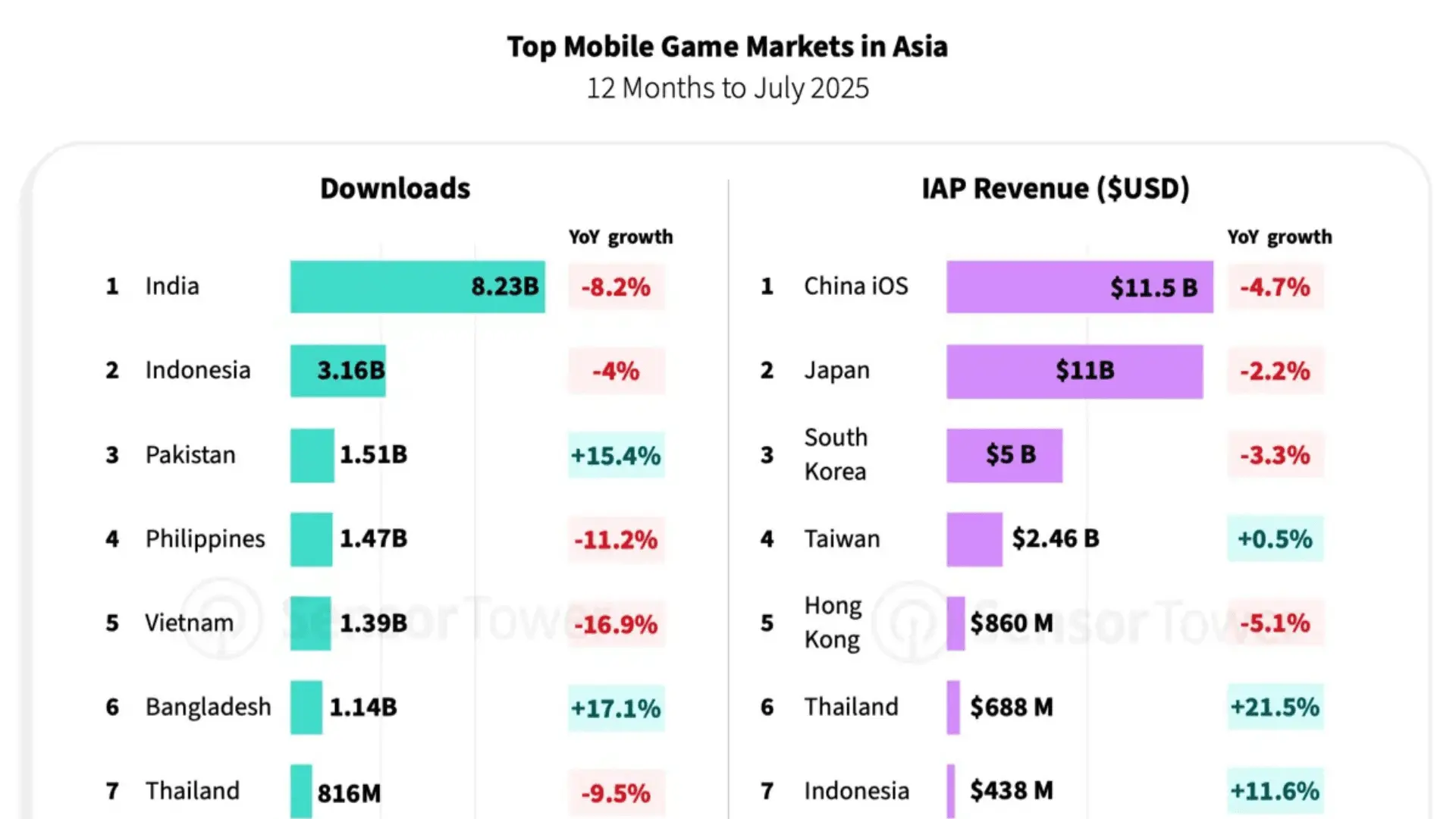

Japan is planning to expand government support for its video games and broader content industries, aiming to position the sector as a key driver of national economic growth. Overseas sales of Japanese content, which include video games, anime, and manga, reached approximately ¥5.8 trillion ($37.7 billion) in 2023, surpassing the value of semiconductor exports and signaling the global demand for Japanese media.

The government has set a long-term goal of increasing annual overseas sales to ¥20 trillion ($130 billion) by 2033. Current public funding for the content industry is ¥25.3 billion ($164 million), but lawmakers have proposed raising this to over ¥100 billion ($651 million), citing the advantages of stronger public-private partnerships seen in countries such as South Korea and the United States.

Funding and Investment Plans

Prime Minister Sanae Takaichi’s administration has allocated an additional ¥35 billion ($228 million) in a supplementary budget for fiscal 2025 as part of a multiyear strategy to support the content industry. The government plans to focus on improving global distribution networks, implementing anti-piracy measures, and leveraging AI-driven translation tools to reach wider international audiences.

These initiatives are intended not only to boost sales but also to strengthen Japan’s intellectual property protections. The Japan Content Overseas Distribution Association recently requested that OpenAI stop using works from its member companies to train AI models such as Sora 2, citing concerns over copyright infringement. Companies including Aniplex, Bandai Namco, Studio Ghibli, Square Enix, Kadokawa, and Shueisha supported the request, reflecting industry-wide interest in safeguarding creative assets while expanding international reach.

Implications for the Gaming and Content Industries

For the Japanese gaming and content sectors, the expanded support could improve access to overseas markets and increase revenue streams from international audiences. By combining funding with technological tools such as AI translation, Japanese companies are likely to see greater efficiency in distributing content globally. Anti-piracy efforts will also play a critical role in maintaining the value of creative works, particularly in the manga and anime markets, which have faced challenges from unauthorized distribution in recent years.

The government’s focus on content aligns with broader economic strategies that aim to diversify Japan’s growth beyond traditional industries. Video games, anime, manga, and other digital media are increasingly recognized as assets with global appeal, capable of generating significant revenue and promoting cultural influence abroad.

Source: PocketGamer

Make sure to check out our articles about top games to play in 2026:

Best Nintendo Switch Games for 2026

Best First-Person Shooters for 2026

Best PlayStation Indie Games for 2026

Best Multiplayer Games for 2026

Most Anticipated Games of 2026

Top Game Releases for January 2026

Frequently Asked Questions (FAQs)

What is Japan’s goal for overseas content sales?

Japan aims to increase annual overseas sales of its content industries to ¥20 trillion ($130 billion) by 2033.

How much funding is currently allocated to the content industry?

Public funding currently stands at ¥25.3 billion ($164 million), with proposals to increase this to over ¥100 billion ($651 million).

Which areas will new government support focus on?

New measures will target global distribution, anti-piracy efforts, and AI-driven translation tools to improve international reach.

Why did the Content Overseas Distribution Association involve OpenAI?

The association asked OpenAI to stop using its members’ works to train AI models such as Sora 2 due to potential copyright infringement, a request supported by major Japanese companies.

How could this impact Japanese video games?

Expanded support and AI translation tools could make it easier for Japanese games to reach global markets, while anti-piracy measures help protect intellectual property.