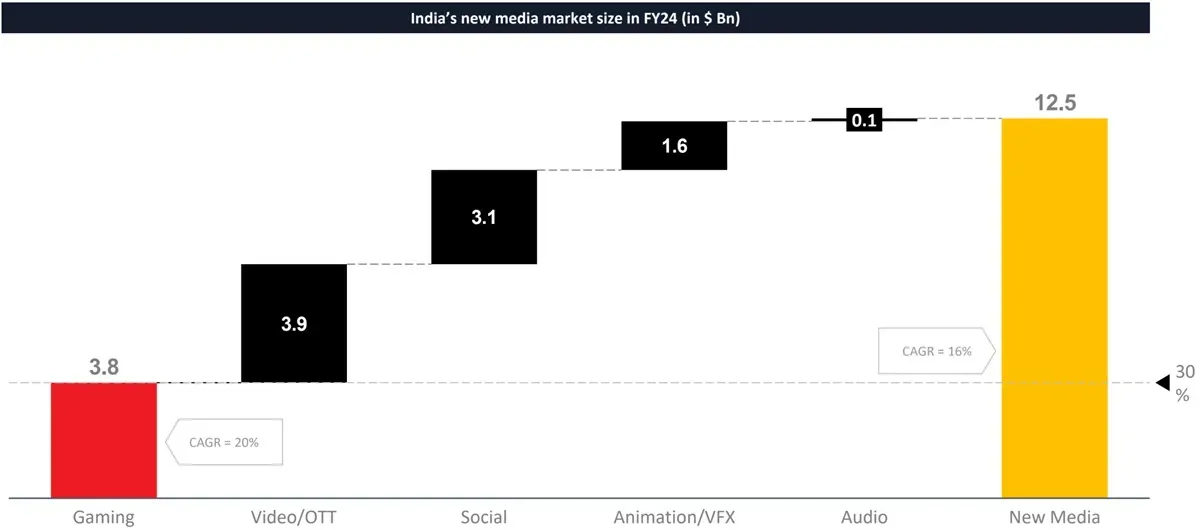

India’s gaming market, currently valued at $3.8 billion, is projected to grow to $9.2 billion by 2029, as outlined in a recent report by Lumikai, an India-based venture capital fund focused on the gaming industry. With a 20% compound annual growth rate (CAGR), the country’s gaming sector is expected to become a significant component of the broader new media industry, which is expanding at a rate of 16% per year. Lumikai’s data highlights that gaming is India’s fastest-growing segment within new media, accounting for nearly 30% of the country’s $12.5 billion media market.

Indian Gaming Market Set to Reach $9.2 Billion by 2029

Projected $9.2 Billion by 2029

The report emphasizes that India’s gaming sector is evolving similarly to China’s growth a few decades ago, marking it as a promising investment frontier. This rapid expansion, according to Aditya Deshpande, Senior Investment Associate at Lumikai, positions gaming to potentially surpass India’s longstanding Bollywood industry in revenue.

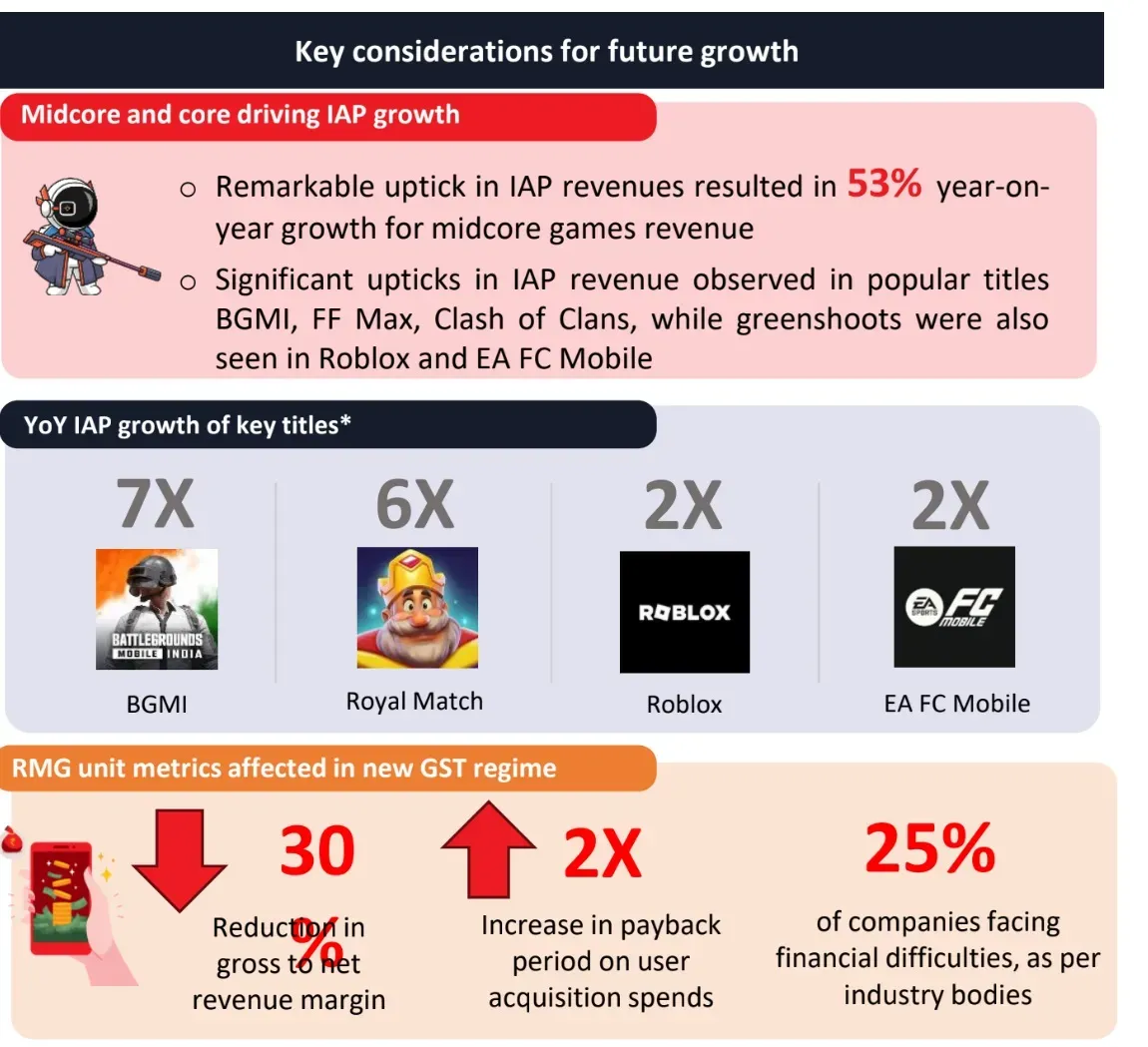

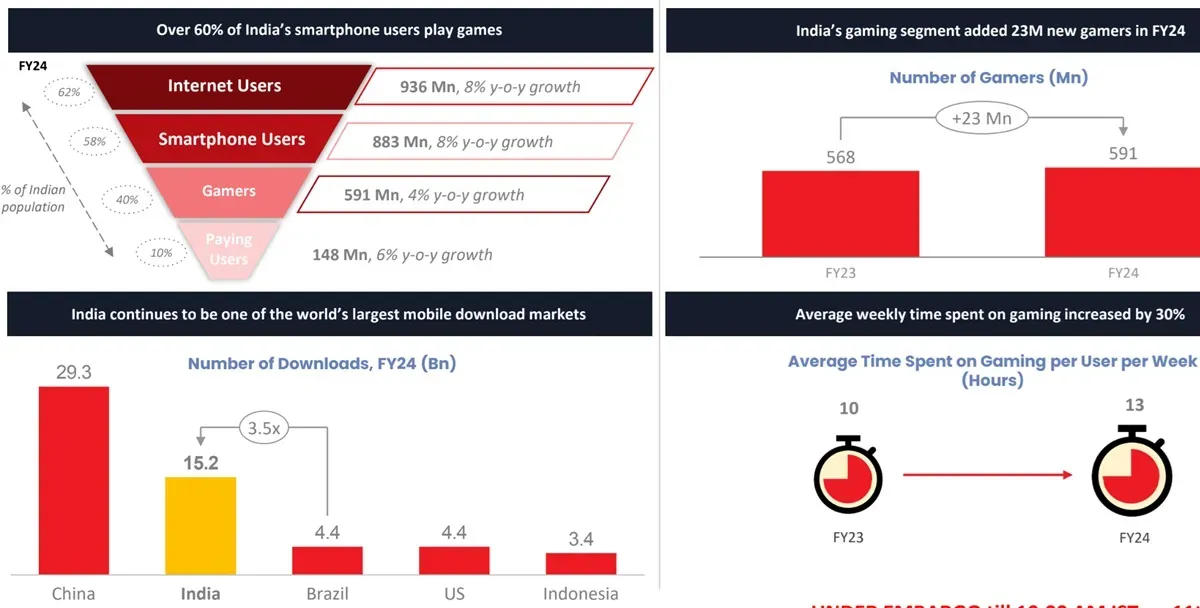

India's current base of 591 million gamers increased by 23 million over the past year, with paying users reaching 148 million. Average weekly gaming time among Indian gamers rose by 30%, now at 13 hours per week—double the time spent on social platforms. Additionally, in-app purchases surged by 41% year-over-year, driven mainly by mid-core games that appeal to India’s expanding mobile gaming audience. This rise in revenue from in-app purchases represents the fastest-growing segment within India’s gaming industry.

Mobile gaming is particularly dominant, as India is the world’s second-largest mobile gaming market with 15.2 billion downloads, far outpacing markets like Brazil and the U.S. Android devices account for about 90% of the market share in India, driven by the affordability of smartphones, which typically cost between $200 and $400. This high smartphone penetration, combined with some of the world’s lowest data costs, supports extensive mobile data usage and further promotes gaming activity.

India's Gaming Market Size by Revenue in FY24 (in $ Bn)

Shifts in Demographics and Consumer Behavior

The demographic breakdown reveals growing engagement from younger players, especially first-time earners aged 18 to 30. Notably, female representation has increased, with female gamers now accounting for 44% of the user base. Lumikai also found that 66% of players come from non-metro regions, reflecting the spread of gaming culture beyond India’s major cities.

Digital payment preferences are evolving, with 83% of users choosing digital wallets or UPI for in-game transactions. Further supporting growth, ad tolerance among gamers is high, with 47% preferring ad-supported models over paid subscriptions, while in-app microtransactions are on the rise.

India's New Media Market in Size FY24 (in $ Bn)

Market Trends and Game Development

Lumikai’s report emphasizes the increasing demand for games that resonate with Indian culture, a trend that several companies are capitalizing on. Mayhem Studios, for instance, is developing a battle royale game rooted in Indian themes, reflecting the growing popularity of games designed around local cultural narratives. This push for culturally relevant content aligns with consumer demand for games that reflect players’ own experiences and backgrounds. According to Lumikai’s Salone Sehgal, this trend underscores the success of games that prioritize cultural relevance, with an increasing number of Indian developers now focusing on building intellectual property (IP) that reflects local culture.

Indian game developers are transitioning from contract-based work for global companies to developing independent IP for the local market. Many are entrepreneurs with previous experience in work-for-hire projects, taking advantage of India’s competitive development costs. Additionally, there is a rise in Indian diaspora developers returning to build in their home country, alongside international investors looking to establish a foothold in this emerging market.

Opportunities in Esports and Social Gaming

India’s esports market, though a small segment within the broader gaming ecosystem, is showing robust growth in viewership. Social gaming platforms are also seeing increased engagement, with players spending significantly more time on interactive social media than on traditional platforms. Casual gaming saw a 20% increase in time spent in 2024, aligning with broader trends of engagement with interactive and community-oriented gaming experiences.

Key Considerations for Future Growth

Lumikai Insignia Summit and Industry Collaboration

The release of Lumikai’s report coincides with its annual Insignia Summit, featuring prominent figures such as filmmaker SS Rajamouli and representatives from international gaming and technology sectors. The event underscores growing global interest in India’s gaming market and highlights the country’s potential as a key player in the global gaming industry.

Lumikai’s partnerships with entities like Google and Deloitte underscore the credibility of its research, which is based on comprehensive data collection from nearly 3,000 mobile users, third-party analytics, and expert interviews. By providing investors with in-depth insights into India’s gaming industry dynamics, the summit aims to foster strategic investment in this high-growth market.

India’s gaming industry, powered by mobile access, low data costs, and increased engagement in culturally relevant games, is positioned to become one of the world’s most vibrant gaming markets. As more global and local companies invest in the region, India’s game development landscape is set to diversify further, providing an environment ripe for innovation, acquisition, and sustained growth.

Lumikai’s Data Highlights

Relevance to Web3 Gaming

The rapid growth of India's gaming market and the increasing emphasis on culturally relevant, community-focused content presents a significant opportunity for the web3 gaming ecosystem. With high engagement from young, mobile-first audiences and a fast-growing segment of digital-first, in-app-purchasing gamers, India is primed for the decentralized, player-owned economy that web3 gaming offers.

The popularity of digital wallets and UPI for in-game payments suggests a readiness for blockchain-enabled transactions, while the high tolerance for ad-supported and microtransaction-based models aligns well with web3’s play-to-earn and NFT-based mechanics. As India’s game developers increasingly focus on locally resonant IP and ownership models, web3 can provide them with tools to build sustainable, community-driven economies that reward players and creators alike, positioning India as a pioneering hub in the global web3 gaming landscape.

Source: GamesBeat