India is on track to become one of the most significant gaming markets globally, according to a 2025 report from Niko Partners. The research firm identifies India as the fastest-growing games market among all Asian and MENA regions it tracks. This growth is being fueled by a combination of rising player numbers, increasing engagement, and higher in-game spending, excluding the real money gaming segment that had previously influenced market estimates.

By 2025, India is expected to have around 500 million gamers, marking a major milestone for the country’s games industry. Player spending on games is projected to surpass $1 billion, reflecting a steady shift toward monetization across a broader range of titles and genres.

Mobile Gaming as the Industry Backbone

Mobile devices remain central to gaming in India. The report shows that 95% of Indian gamers play on smartphones, reinforcing mobile as the dominant platform for both casual and competitive experiences. Affordable devices and widespread access to mobile data continue to shape how games are developed and distributed in the region, with most publishers prioritizing mobile-first strategies.

This platform focus has also influenced content formats, session lengths, and monetization models, all of which are increasingly tailored to short, frequent play sessions common among mobile users.

A Changing Player Demographic

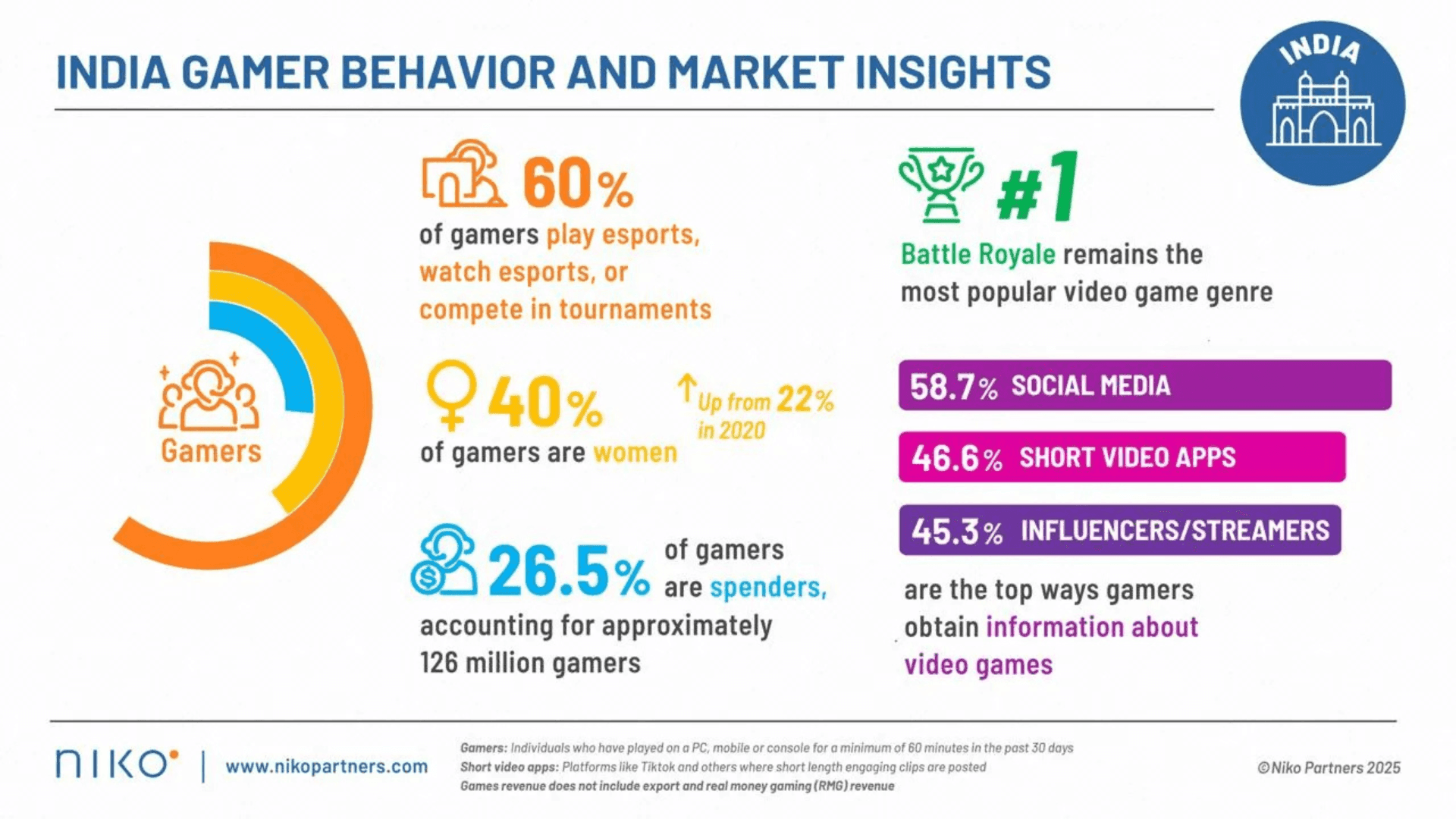

The demographic makeup of India’s gaming audience is evolving. Women now represent 40% of all gamers in the country, a significant increase from 22% in 2020. This shift suggests broader cultural acceptance of gaming and points to a more diverse audience engaging with games across genres and platforms.

As the player base expands, developers are finding new opportunities to address different preferences, themes, and social play styles, particularly within mobile and online multiplayer titles.

Competitive Gaming Gains Wider Reach

Esports engagement continues to grow alongside the broader market. Niko Partners reports that 60% of Indian gamers interact with esports in some form, whether through playing competitive games, watching tournaments, or participating in organized competitions. This level of engagement highlights esports as a mainstream part of gaming culture rather than a niche interest.

Battle Royale titles remain the most popular genre in the country. Around 40% of surveyed gamers said they expect to play Battle Royale games over the next year, underlining the genre’s continued influence on player habits and content trends.

How Indian Gamers Discover New Titles

Game discovery in India is largely driven by digital platforms. Social media remains the most common source of information about new games, followed closely by short-form video apps. Streamers and influencers also play a major role, reflecting the growing importance of creator-led promotion in the Indian market.

These discovery patterns continue to shape marketing strategies, with publishers increasingly relying on community engagement and creator partnerships rather than traditional advertising alone.

Spending Habits and Market Outlook

While the player base is massive, monetization is still developing. The report indicates that 26.5% of Indian gamers spend money in games, translating to roughly 126 million paying players. This figure highlights both the scale of current revenue and the long-term potential for growth as payment systems, pricing strategies, and localized content improve.

Looking ahead, Niko Partners projects the Indian games market will reach $1.5 billion by the end of 2028. The total number of gamers is expected to grow to 724 million by 2029, placing India on par with China in terms of player population. With continued mobile adoption, rising esports visibility, and expanding demographics, India is positioned to remain a key focus for the global games industry.

Frequently Asked Questions (FAQs)

How many gamers are there in India in 2025?

India is expected to have approximately 500 million gamers in 2025, making it one of the largest gaming populations in the world.

What platform do most Indian gamers use?

Mobile gaming dominates the market, with about 95% of gamers in India playing on smartphones.

How much is the Indian gaming market worth in 2025?

Player spending on games is projected to exceed $1 billion in 2025, excluding real money gaming.

What genres are most popular in India?

Battle Royale games are the leading genre, with a large portion of players planning to continue playing titles in this category.

How engaged are Indian gamers with esports?

Around 60% of Indian gamers engage with esports by playing competitive games, watching tournaments, or participating in events.

What is the future outlook for the Indian gaming market?

The market is expected to grow to $1.5 billion by 2028, with the gamer population reaching around 724 million by 2029, signaling sustained long-term growth.