Newzoo’s latest analysis offers a clear picture of how downloadable content has become a central part of single-player game revenue models. The study draws from the Game Performance Monitor and Revenue Add-on, covering April 2020 through May 2025 across major Western markets. It focuses on PC, Xbox, and PlayStation titles that provide post-launch content, highlighting how player spending patterns evolve long after a game’s initial release.

DLC’s Increasing Weight in the First Years After Launch

The report shows that DLC gains influence steadily during a game’s first year. Revenue share climbs through the early months, often reaching its strongest points around the sixth and twelfth months before settling into a more stable range. By the end of that first year, DLC accounts for roughly 9 percent of a game’s total revenue when base game purchases are included.

From the second year onward, DLC becomes an even more consistent contributor. Between years two and five, it maintains an average share of 23 percent of total revenue. While microtransactions remain part of the ecosystem, they display smoother patterns with less intense fluctuations around updates or launch windows. Newzoo notes that cosmetic microtransactions in single-player titles tend to generate steadier but less dramatic revenue lifts compared to DLC releases.

Genre Trends Driving DLC Performance

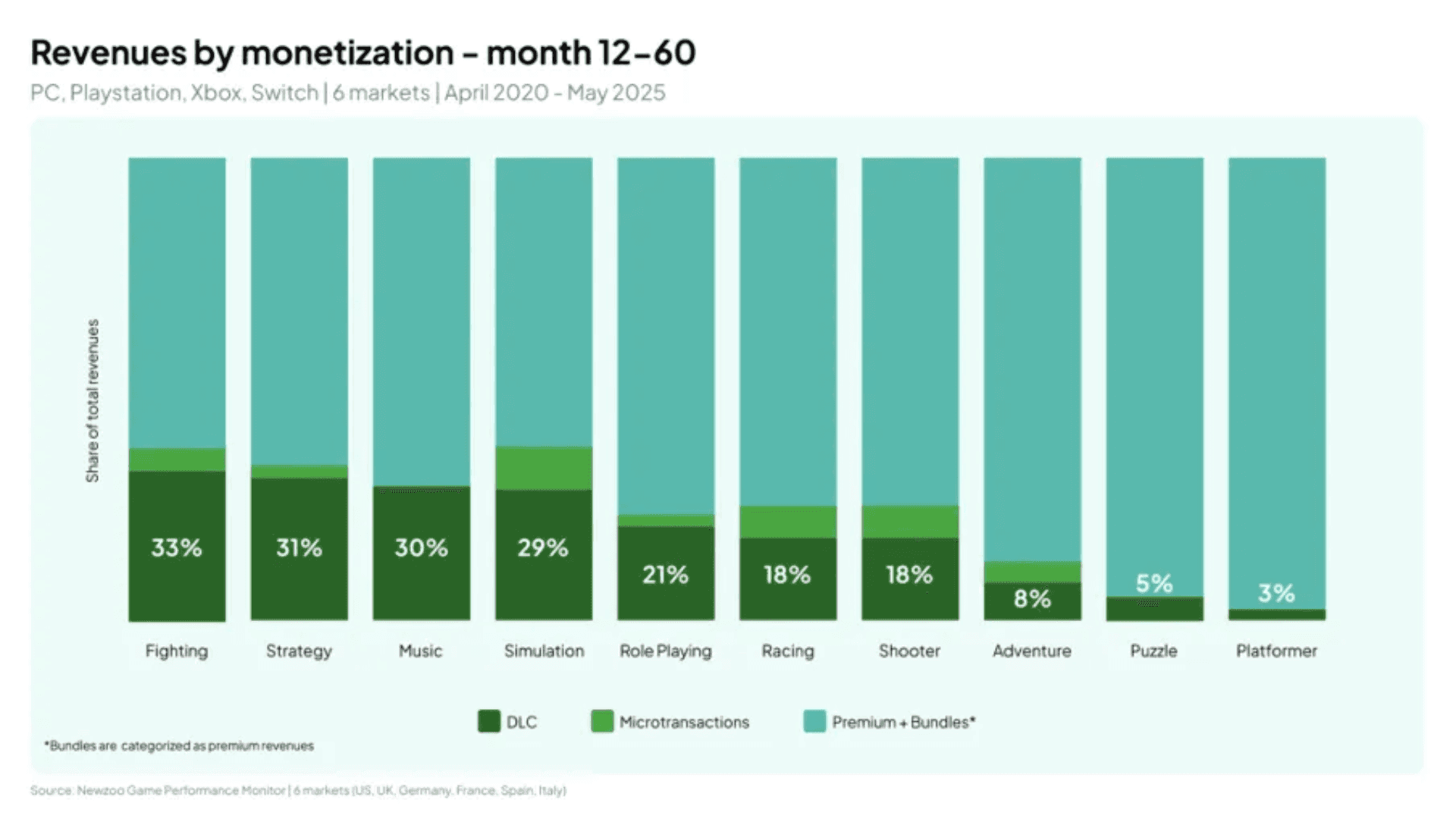

The impact of DLC is heavily influenced by genre. Once games reach the 12-month mark, revenue distribution begins to diverge significantly depending on how expandable each genre is. Fighting games, strategy titles, and music games show the strongest reliance on DLC, as these genres naturally support new characters, scenarios, and songs over long periods. RPGs also show a strong relationship between narrative expansions and continued player spending.

These findings support the idea that DLC helps games extend their lifecycle and remain visible in competitive markets. Long-running titles like The Hunter: Call of the Wild and Planet Zoo continue to hold their audience through steady post-launch updates. In fighting games, new fighter packs are not only common but essential for maintaining active engagement.

Hitman: World of Assassination Shows the Long Tail of DLC

The transition from Hitman 3 to Hitman: World of Assassination provides one of the clearest examples of DLC shaping a title’s long-term performance. After debuting with an episodic structure, the game shifted toward a broader content model that includes narrative additions like the Sarajevo Six, new modes such as Freelancer and Elusive Target Arcade, and cosmetic collaborations featuring figures including Jean-Claude Van Damme, Conor McGregor, and Eminem.

According to Newzoo, DLC revenue for the game ranged from 150,000 to 1.4 million dollars per month over four years. Across that period, DLC represented about 21 percent of total revenue. As the overall revenue curve softened with time, DLC’s share increased, signaling its role in sustaining the game’s earning potential even as new player acquisition slowed.

Subscription services and platform promotions also influenced DLC performance. When Hitman 2 arrived on PlayStation Plus in September 2021, DLC revenue for the broader franchise nearly doubled. The announcement of the trilogy’s launch on Xbox Game Pass in January 2022 led to a sharp rise in DLC purchases the month prior, likely due to renewed interest from existing players. Despite major discounts on the base game - sometimes at 90 percent off - the average lifetime value per paying player reached 28.7 dollars.

Newzoo also emphasizes that not all DLC is designed to generate direct revenue. Some updates exist to re-engage players, strengthen community activity, or support ongoing live operations strategies. Seasonal content and mode updates often contribute to retention more than immediate financial returns.

The Larger Shift in Single-Player Monetization

Taken together, the findings reflect a broader shift in how single-player games evolve after launch. DLC now plays a structural role in extending a game's presence in the market, shaping how publishers build post-launch plans, and influencing how players interact with long-term content. As live ops tools and web3-driven systems continue to expand across the industry, more developers are expected to integrate varied forms of ongoing content to support both player retention and predictable revenue streams.

Source: Newzoo

Frequently Asked Questions (FAQs)

How much revenue does DLC typically generate for single-player games?

Newzoo’s data shows that DLC represents about 9 percent of total revenue in the first year and averages 23 percent between years two and five.

Which genres rely most on DLC?

Fighting games, strategy titles, and music games show the highest DLC revenue share, as these genres naturally support frequent content additions.

Do microtransactions play a major role in single-player games?

They contribute revenue but tend to follow smoother patterns than DLC, showing fewer sharp increases around specific release periods.

How did DLC affect Hitman: World of Assassination’s performance?

The game generated between 150,000 and 1.4 million dollars per month from DLC, accounting for about 21 percent of total revenue over four years.

Do platform services like Game Pass increase DLC sales?

Yes. Newzoo’s report shows that additions to services such as PlayStation Plus and Game Pass can significantly boost DLC revenue by reactivating interest among existing players.

Is all DLC meant to drive direct revenue?

Not always. Some DLC exists primarily to bring players back through seasonal content, new modes, or quality-of-life updates, supporting long-term engagement rather than immediate sales.