Global Gaming Market to Hit $257 Billion by 2028

Bain & Company's 2024 report analyzes the global gaming industry, noting growth trends, gamer behaviors, and evolving challenges, such as static console penetration and high marketing costs.

Bain & Company recently released a detailed report on the global gaming industry, outlining significant trends, growth projections, and challenges. The report sheds light on player demographics, spending habits, device usage, and emerging business dynamics that are shaping the sector. Despite a positive growth forecast, there are challenges, including stagnant console penetration rates and a mismatch between headcount increases and business performance.

Global Gaming Market to Hit $257 Billion by 2028

Key Insights

Bain & Company’s 2024 report underscores the gaming industry’s ongoing expansion and evolving player preferences.

- Market Growth: The gaming industry is projected to grow to $257 billion by 2028, with consistent demand from a broad player base.

- Player Engagement: Younger players are heavily engaged, and those involved in game-related activities tend to spend more on in-game content.

- Cross-Platform Compatibility: Player demand for device flexibility has pushed game studios to prioritize cross-platform play.

- Console Market Stagnation: Despite market growth, console penetration has remained stagnant for a decade.

- Mobile Gaming Risks: Smaller mobile gaming companies face high revenue volatility and substantial marketing costs.

- Workforce Efficiency: The rising workforce in gaming has not consistently led to improved business performance.

Gaming Report 2024 By Bain & Company,

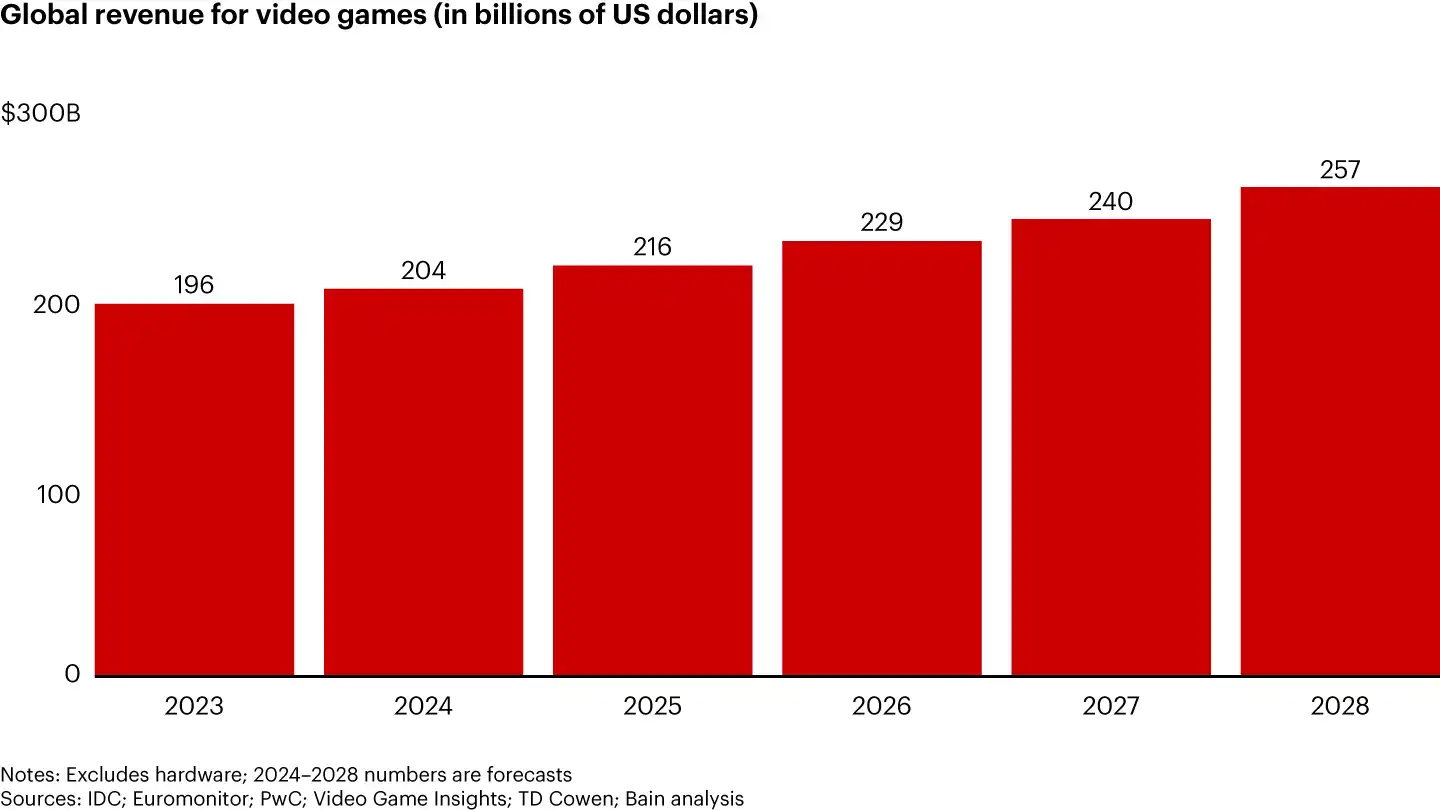

Industry Growth and Market Value

According to Bain & Company, the gaming industry in 2023 was valued at approximately $196 billion, surpassing the combined revenues of video streaming ($114 billion), music streaming ($38 billion), and box office earnings ($34 billion). By 2028, Bain projects the industry will grow at an average annual rate of 6%, reaching a valuation of $257 billion. This sustained growth is attributed to an increasing base of engaged gamers, especially among younger demographics, who spend significant portions of their budget on gaming-related expenses.

Global Revenue fo Video Games (In Billions of US Dollars)

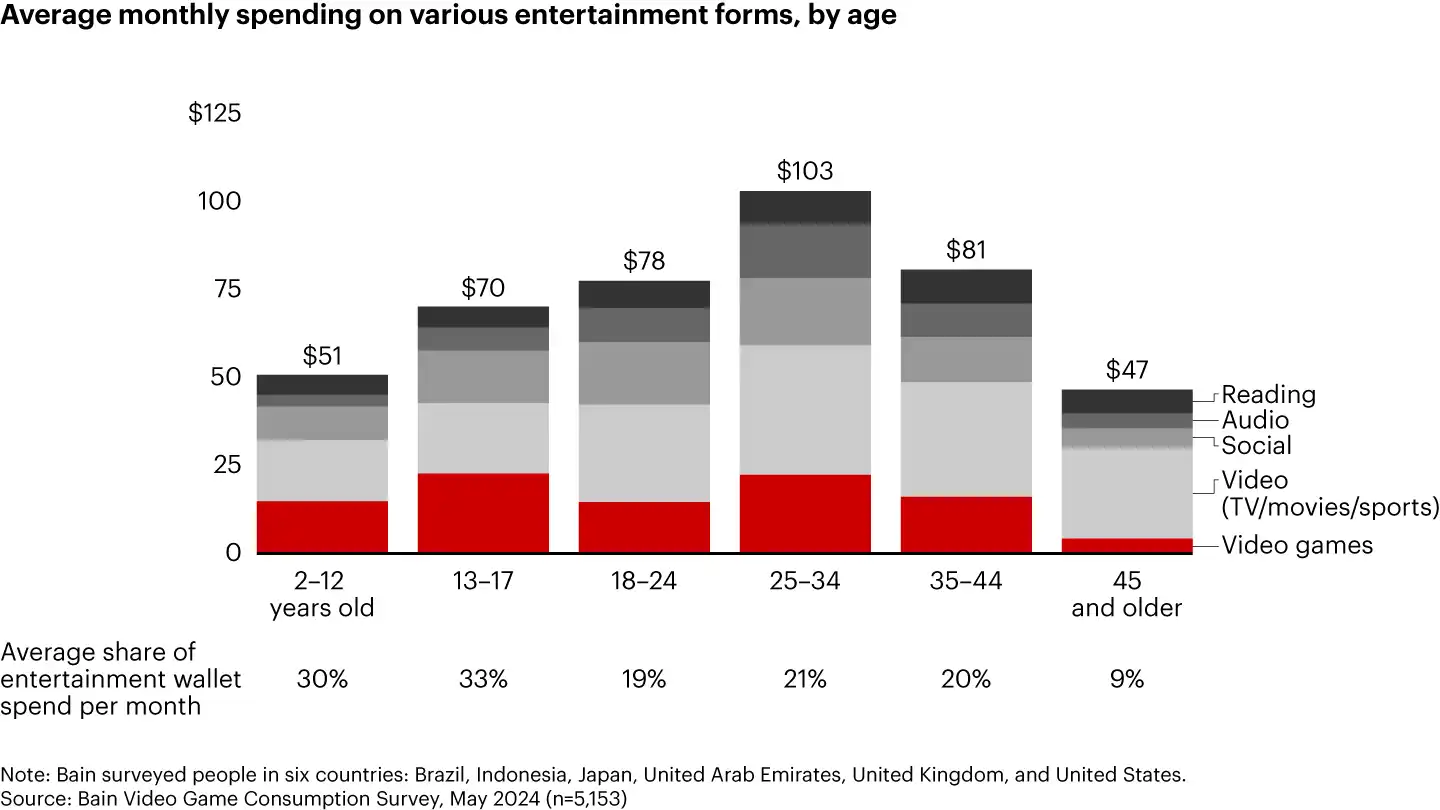

Gamer Demographics and Spending Behavior

Bain & Company’s survey of over 5,000 respondents from six countries highlights a broad and diverse gamer population. Approximately 52% of respondents reported playing games regularly. Young players (ages 2 to 18) were notably engaged, with nearly 80% dedicating 30% of their leisure time to gaming. For older players (ages 45 and above), this level of engagement drops to 31%.

In terms of spending, players between the ages of 25 and 34 lead, allocating the highest amounts on gaming and entertainment overall. Gamers are not only playing games but are increasingly engaging in related activities, such as socializing within game communities, watching gameplay videos, and purchasing game-themed merchandise. This broader engagement positively impacts in-game spending, with higher expenditures observed among players active in these secondary activities.

Average Monthly Spending on Various Entertainment Forms (By Age)

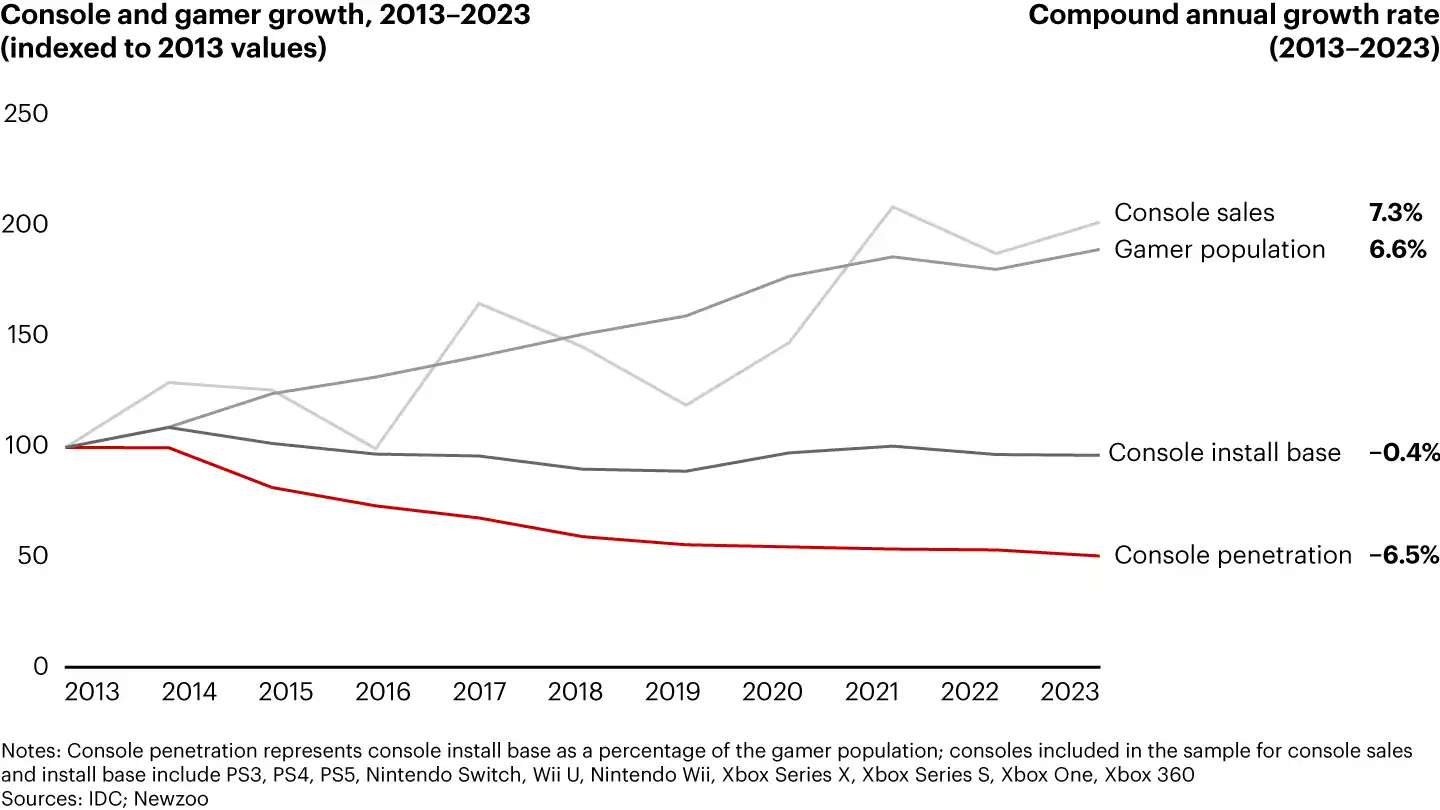

Device Usage and Cross-Platform Play

Nearly 70% of gamers utilize multiple devices for gaming, reflecting a preference for flexibility and accessibility. Cross-platform compatibility is becoming increasingly important; 48% of players prioritize the ability to play with friends across different platforms and to maintain their progress across devices. This demand has influenced game studios, with 95% of those with over 50 employees currently working on cross-platform support, a trend that aligns with broader shifts in player expectations for accessibility and continuity in gaming experiences.

Console And Gamer Growther 2013-2023 (Indexed to 2013 Values)

Console Penetration and Content Consolidation

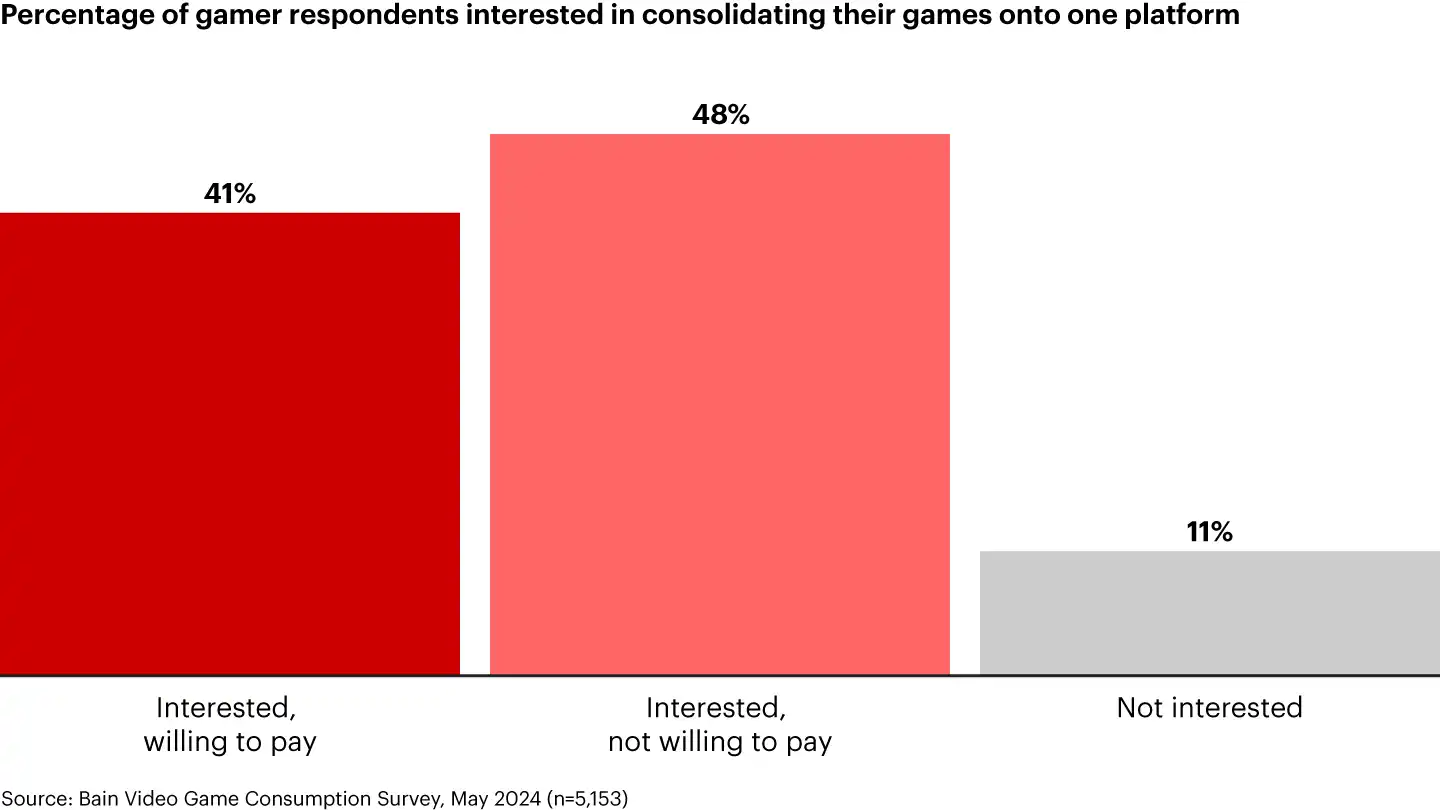

A key finding in Bain’s report is that despite the growth in the gaming market, console penetration has remained unchanged over the past decade. This static penetration rate suggests that while the gaming audience continues to grow, it has not led to an equivalent increase in console adoption. Furthermore, the report reveals that 41% of gamers are interested in a single platform to consolidate game content, although only a subset is willing to pay for this feature, with 48% expressing interest but unwillingness to pay.

Percentage of Gamer Respondents Interested in Consolidating

Mobile Gaming and Marketing Dynamics

Bain’s report highlights the unique challenges in mobile gaming, particularly for companies with annual revenues below $10 million. Small gaming firms in the mobile market face a 55-70% likelihood of revenue decline over a three-year period, a significantly higher risk compared to other industries like software development (10-20%) or retail (10-25%).

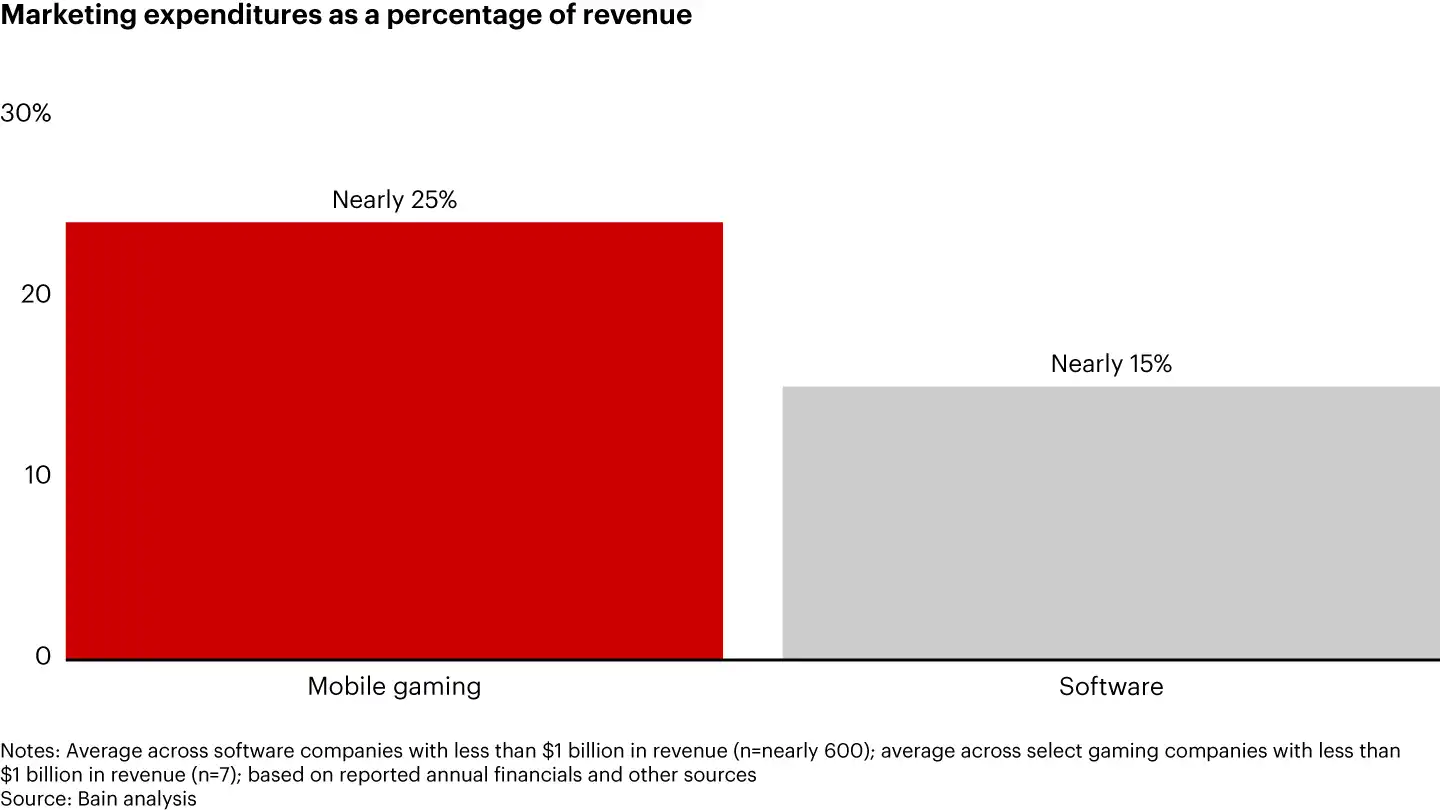

Marketing expenditures are another critical factor in mobile gaming. Companies with less than $1 billion in annual revenue allocate approximately 25% of their budgets to marketing, a figure substantially higher than average software industry spending. Mobile gaming companies that fail to capture and retain players often struggle to maintain revenue levels due to the competitive and high-turnover nature of the mobile gaming market.

Marketing Expenditures as a Percentage of Revenue

Workforce Growth and Changing Roles in Gaming

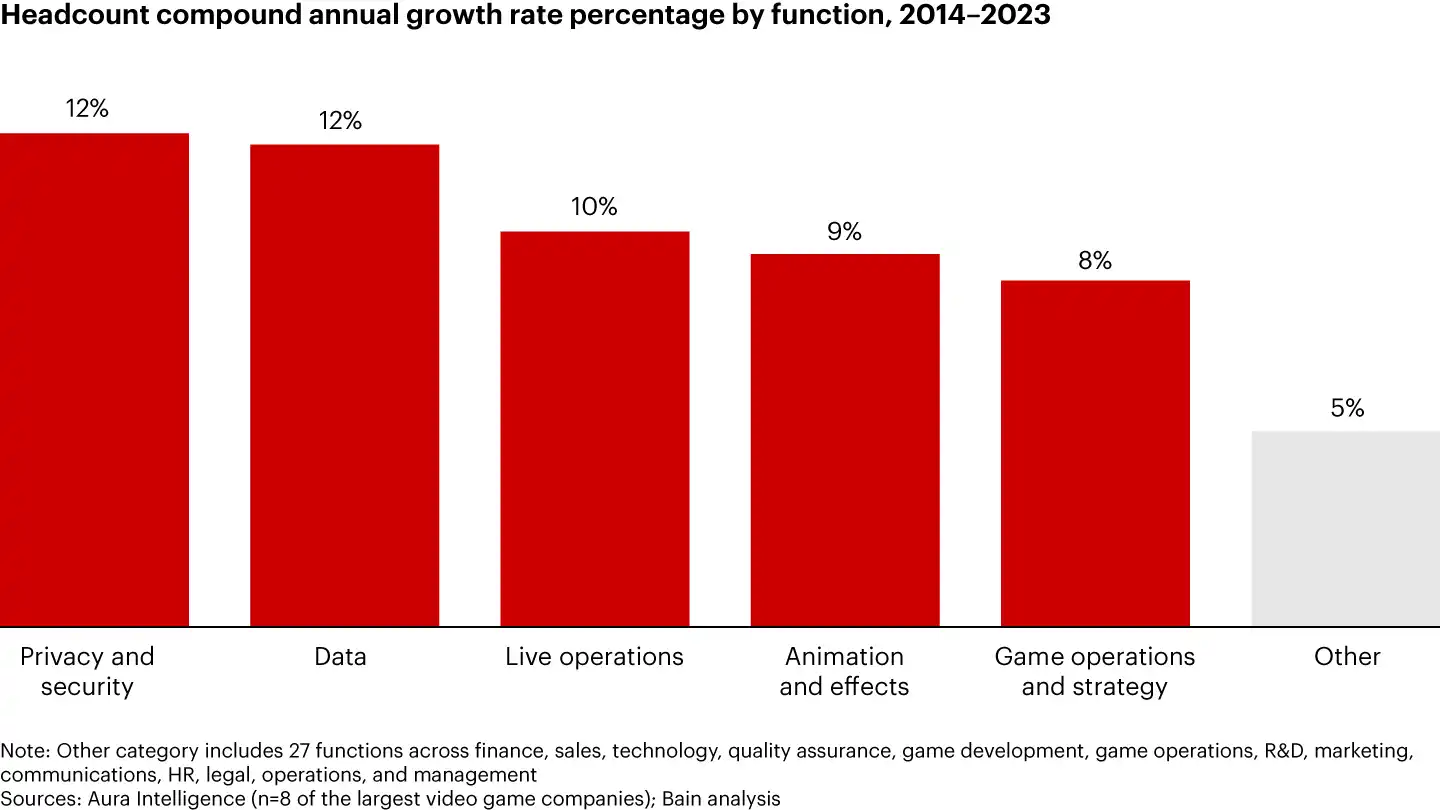

The past decade has seen shifts in the staffing priorities of gaming companies, particularly in specialized roles. Bain reports that positions in data, security, animation, LiveOps, and project operations have grown at twice the hiring rate of other roles. This trend reflects the industry’s increasing complexity and the need for specialists in areas crucial to modern game development and ongoing operations.

However, a concerning trend is the weak correlation between workforce growth and business efficiency. Over the past 10 years, large gaming companies have experienced an average revenue growth rate of 6% annually, while their workforces have expanded by 7% per year. This discrepancy points to potential inefficiencies, as an increased headcount has not consistently translated into enhanced business performance.

Headcount Compound Annual Growth Rate

Final Thoughts

The findings from Bain & Company’s 2024 report highlight trends that are particularly relevant to the emerging web3 gaming space. As players increasingly seek cross-platform compatibility, ownership of digital assets, and community-driven experiences, web3 technologies such as blockchain and decentralized networks could offer compelling solutions. The report’s insights on player engagement, particularly the value of social interactions, user-generated content, and secondary activities like digital asset trading, align with the core promises of web3 gaming: enabling true ownership, interoperability, and immersive communities.

Additionally, the focus on mobile gaming’s high-risk landscape underscores a potential opportunity for web3 models to mitigate revenue volatility through decentralized economies and player-to-player transactions. For web3 gaming developers and investors, Bain's report underscores the potential for blockchain-based solutions to meet evolving player demands while addressing current industry challenges in engagement, monetization, and platform accessibility.

About the author

Eliza Crichton-Stuart

Head of Operations

Updated:

November 5th 2024

Posted:

November 5th 2024