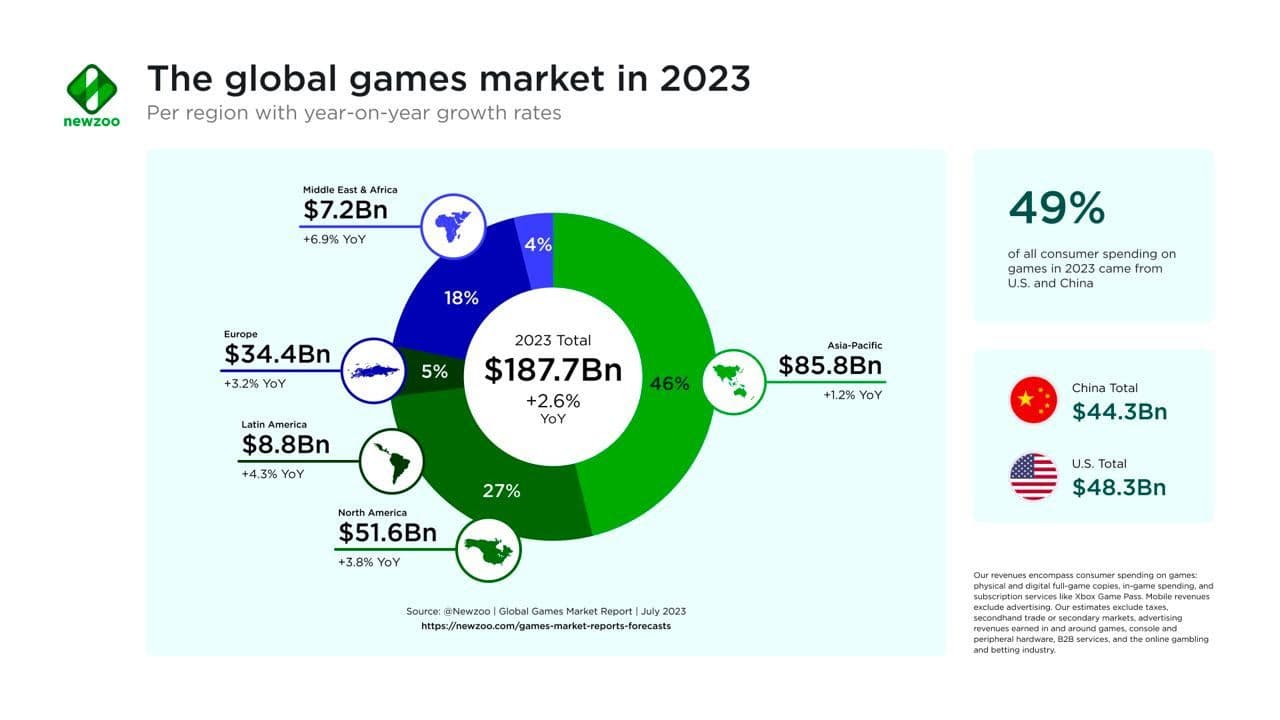

In its latest report, market intelligence firm Newzoo projects a positive trajectory for the global gaming market in 2024. With an estimated revenue of $189.3 billion, the industry is set to exhibit slow but steady growth, bouncing back from a slight dip in 2022. The compound annual growth rate (CAGR) from 2021 to 2026 is anticipated at 1.3%, signaling a resilient market.

Global Games Market To Hit $189 Billion

Global Games Market To Hit $189 Billion

The report emphasizes the optimistic outlook for PC and console segments, with a particular focus on the thriving install base of the Xbox Series and PlayStation 5 generation. Despite an anticipated lean year in terms of game releases, Newzoo expects live-service games and back catalogue sales to drive growth. The industry, however, faces challenges in a highly competitive market where retaining players in live-service games becomes crucial.

As the gaming landscape adjusts post-COVID and contends with increasing interest rates, companies are adopting risk reduction strategies. The industry is shifting away from funding massive new projects and prioritizing sequels and leveraging existing intellectual properties (IPs). Notable mentions include small-experience AAA titles like Assassin’s Creed Mirage and Marvel’s Spider-Man: Miles Morales.

Market Recovery and Continued Growth

Newzoo underscores the market's recovery, reaching $184 billion in 2023, with a projected CAGR of 1.3% through 2026, reaching $205.4 billion.

Global Games Market To Hit $189 Billion

Risk Aversion in 2024

Projects entering the competitive games market face challenges, with live-service games requiring prolonged player commitment, limiting opportunities for new projects. Post-2023 layoffs and unsuccessful gaming ventures make 2024 financially lean for many companies. The industry has been adjusting to post-COVID realities and rising interest rates but the pandemic-induced funding has diminished significantly.

To mitigate risks, companies opt for risk reduction strategies, favouring sequels and established IPs over new ones. The focus also includes small-experience AAA titles like Assassin’s Creed Mirage and Marvel’s Spider-Man: Miles Morales. The survey results show that 91% of experts completely disagree with new IPs dominating the market. 28% of leaders also believe that companies will take riskier bets with games while 64% completely disagree.

Global Games Market To Hit $189 Billion

Slowdown in Subscription Service Growth

The report predicts a deceleration in subscriber growth for gaming subscription services, supported by 82% of surveyed industry employees.

Global Games Market To Hit $189 Billion

Return to Premium Games

With high competition, gaming companies are returning to developing premium (buy-to-play) games, aligning with the views of 45% of industry representatives.

Global Games Market To Hit $189 Billion

Mobile Developers Shifting to PC and Consoles

Issues with user acquisition on mobile devices drive developers towards PC and consoles, according to 36% of surveyed gaming industry individuals.

Global Games Market To Hit $189 Billion

Nintendo's New Console with 3D Mario

Newzoo predicts that Nintendo is set to launch a new console later this year, marking almost seven years since the Switch's debut. They suggest that the next generation of console will be accompanied by a new 3D Mario game, while existing Switch users might be able to seamlessly transfer their Nintendo accounts to the new console, allowing for a smooth transition without losing their existing game libraries.

Global Games Market To Hit $189 Billion

Xbox Mobile Gaming Store on Android

A significant development, with 73% of the gaming industry agreeing that Xbox will launch a mobile gaming store on Android. Xbox also plans to launch a mobile app store on Android and an iOS release afterwards. Microsoft's $68.7 billion acquisition of Activision Blizzard, along with the earlier acquisition of King in 2015, reflects a strong interest in competing with Apple and Google in the gaming app store market. With access to a wealth of gaming IPs, including Candy Crush, Xbox aims to leverage its cloud gaming capabilities and Xbox Game Pass service for broader reach on mobile.

Global Games Market To Hit $189 Billion

Nostalgia's Impact on Service Games

Nostalgia emerges as a key factor in the success of service games, supported by examples like Fortnite OG and World of Warcraft Classic, garnering 82% agreement within the industry.

Global Games Market To Hit $189 Billion

Generative AI in Game Development

While generative AI is on the rise, 64% of the industry believes its significant impact on game production will be selective in 2024.

"Amidst all the controversy, many studios are already using AI tools. The use of generative AI tools will continue to ramp up to improve efficiencies in the coming years. However, the technology won't significantly impact game production at scale in 2024. AI may be advancing at unprecedented speeds, but in 2024, most use cases will be selective and already proven."

Global Games Market To Hit $189 Billion

Rise of Souls-like Games with Open Worlds

An influx of Souls-like games with open worlds is expected in 2024, featuring titles like Another Crab’s Treasure, Rise of the Ronin, Black Myth: Waking, Enotria: The Last Song, Flintlock: The Siege of Dawn, and additions to Elden Ring.

As the gaming industry evolves, Newzoo's insights provide a comprehensive overview of the trends shaping the landscape in 2024, from market dynamics to development strategies and emerging gaming experiences.