The game industry in 2025 is undergoing significant changes, influenced by shifting employment trends, technological advancements, and evolving business strategies. A growing number of developers are working longer hours, while layoffs have become more common across various roles, particularly in narrative design and management positions. The use of AI tools in development and business processes has increased, though skepticism about their impact remains high.

At the same time, PC game development continues to rise, and web-based gaming has reached its highest level of interest in nearly a decade. Funding strategies vary, with many developers relying on self-financing, while some struggle with venture capital investments. As the industry navigates these changes, concerns about job security, work conditions, and unionization efforts continue to shape discussions about its future.

Game Industry Trends in 2025: Employment, AI, and Platform Preferences

Demographics and Employment Trends

The game development industry in 2025 reflects a diverse workforce with varying levels of experience. The majority of developers are between the ages of 25 and 34, accounting for 36% of respondents, followed by those aged 35 to 44, who make up 33%. In terms of gender distribution, 66% of respondents identify as men, 25% as women, and 6% as non-binary. The industry remains predominantly based in North America and Europe, with 58% of survey participants located in the United States, 7% in the United Kingdom, and 6% in Canada. The largest ethnic groups in the workforce include White/Caucasian (59%), Asian (16%), and Latino/Hispanic (10%).

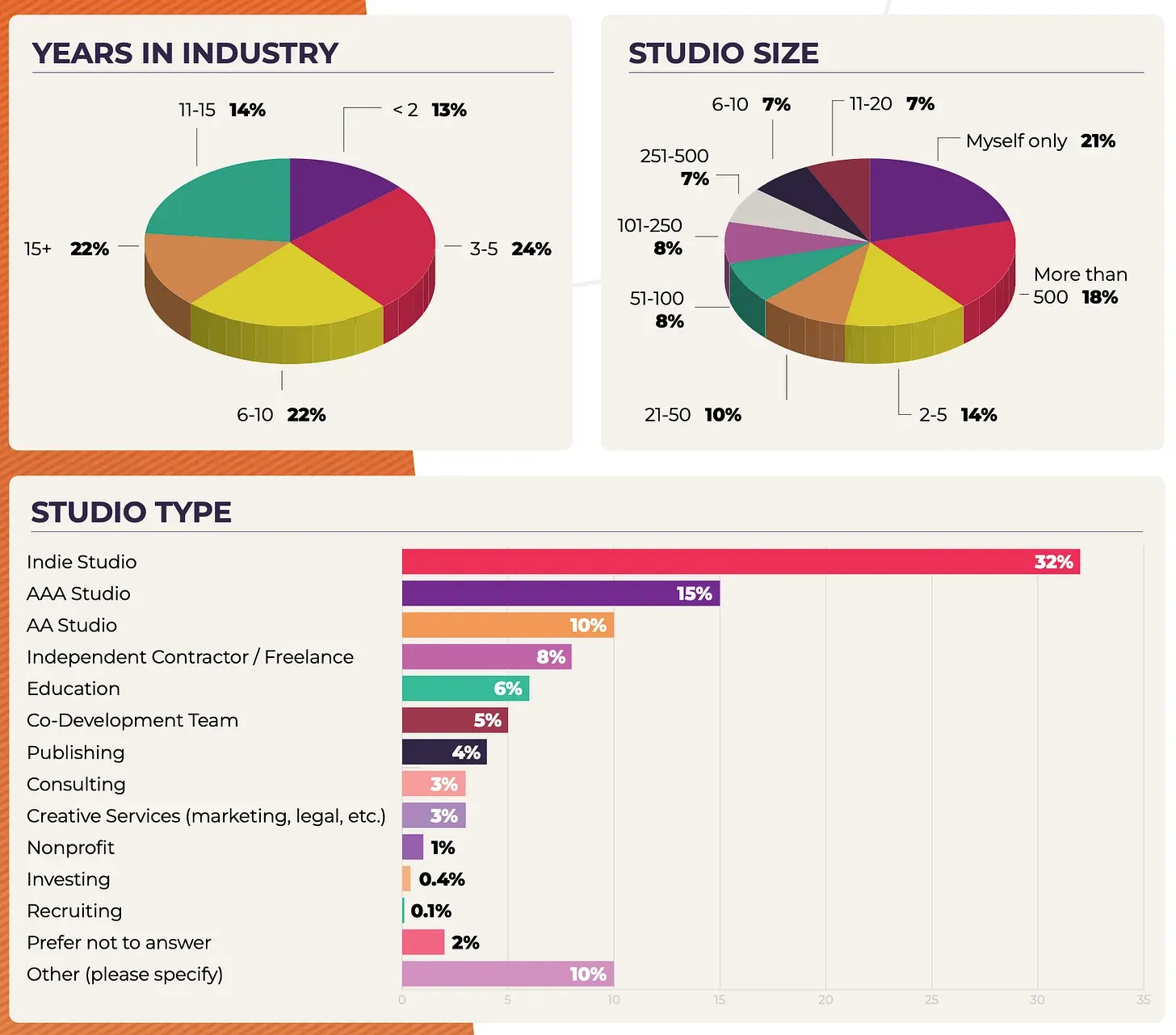

The survey also indicates that most respondents work as game designers (35%), programmers (34%), or production and team managers (31%). Industry experience varies, with 60% of developers having been in the field for less than 10 years, marking an increase compared to previous years. Studio sizes also differ significantly, as 21% of developers work independently, while 18% are employed at studios with more than 500 employees. The number of professionals working in large AAA studios has declined, suggesting a shift toward smaller teams and independent development.

Years in Industry, Studio Size, and Studio Type

Industry Layoffs and Job Security

The report highlights an increase in layoffs compared to the previous year. While 43% of respondents reported no layoffs in their companies, this figure has decreased from 53% in the prior year. Additionally, 11% of survey participants stated that they had been personally laid off, while 29% noted that layoffs had affected their direct colleagues. Another 18% mentioned that layoffs occurred in other departments within their companies, and 4% reported that their companies had shut down entirely.

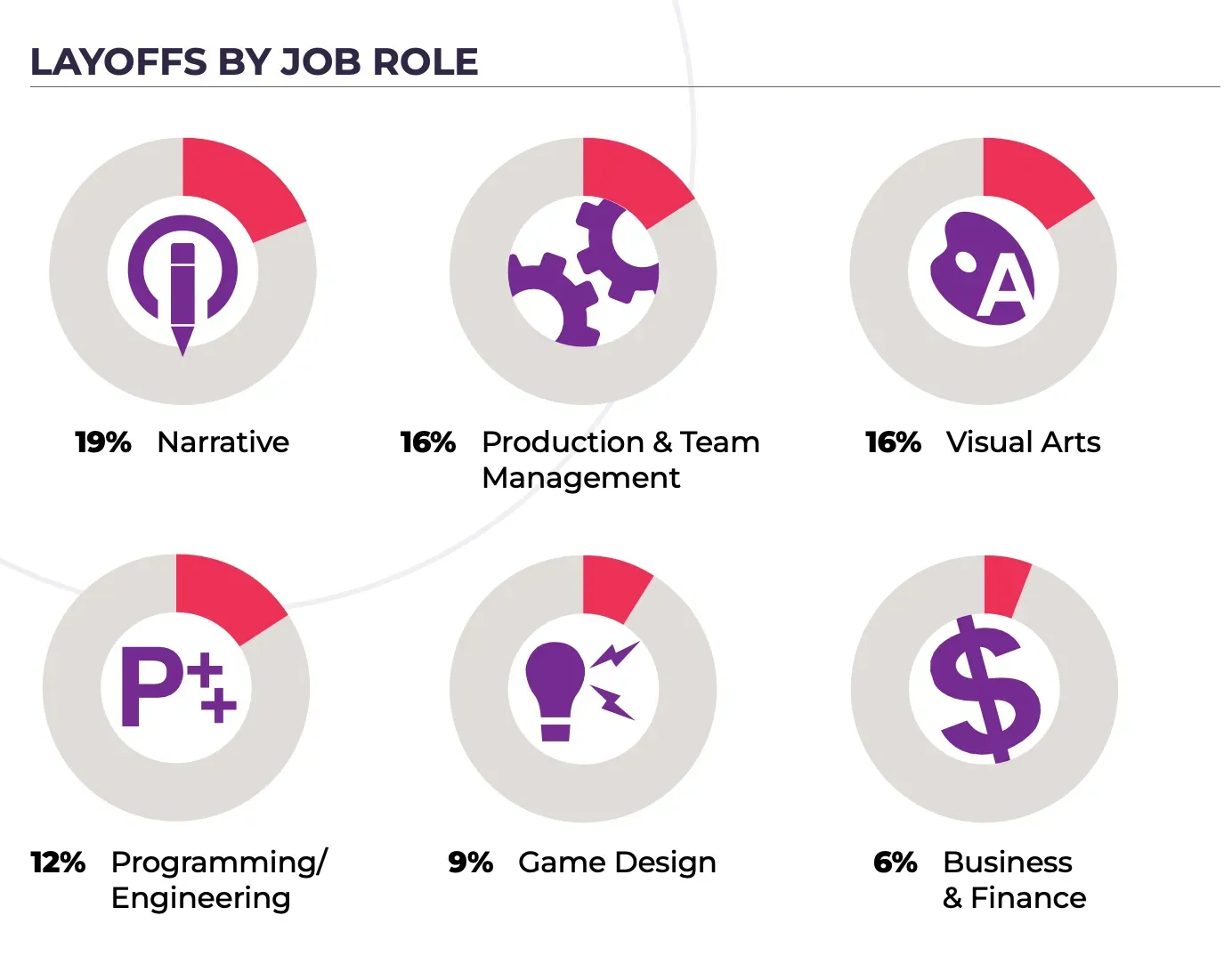

Concerns about job security remain prevalent, with only 30% of respondents expressing no fear of being laid off. A significant number of industry professionals did not answer the question, likely due to having already experienced job loss. Layoffs have had the greatest impact on narrative professionals (19%), managerial positions (16%), and artists (16%), whereas business and finance roles have been the least affected. The most cited reasons for layoffs include company restructuring (22%), declining revenue (18%), and shifts in the market (15%). Notably, 19% of those who lost their jobs were not provided with a clear explanation for their dismissal.

Layoffs By Job Role

AI Adoption and Industry Perspectives

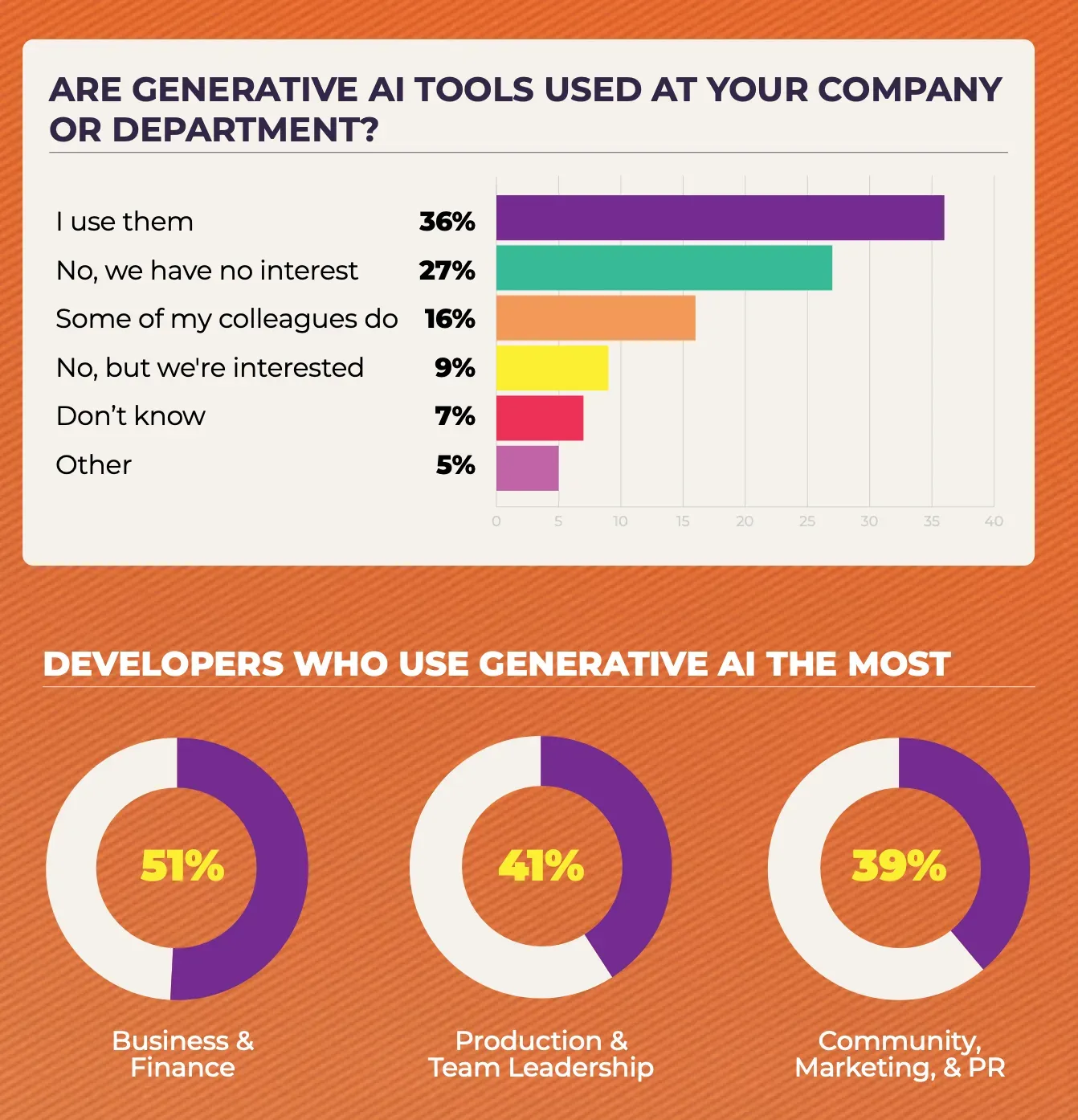

Generative AI tools are being used by a growing number of developers, with 52% reporting that they incorporate AI into their work. However, 27% stated that they do not use AI and do not plan to do so. Interestingly, older employees have adopted AI tools more frequently than their younger colleagues. AI is primarily utilized in business processes and finance (51%), team management (41%), and marketing and communications (39%).

More companies are implementing policies regarding AI, with 51% of respondents indicating that their workplaces have formal guidelines on its usage. This figure is even higher in large AAA studios, where 78% have AI-related policies in place. Despite this, only 4% of employees are required to use AI as part of their job, though this figure has doubled compared to the previous year.

The overall perception of AI in the industry has become more negative over time. Only 13% of respondents believe AI will bring positive changes, a decrease from 21% the previous year. Meanwhile, 30% think AI will have a negative impact, an increase from 18% last year. Some survey participants believe that AI itself is not the primary issue but that the timing of its introduction coincides with broader industry challenges, leading to increased skepticism.

Developers Who Use Gen AI The Most

Platform and Engine Preferences

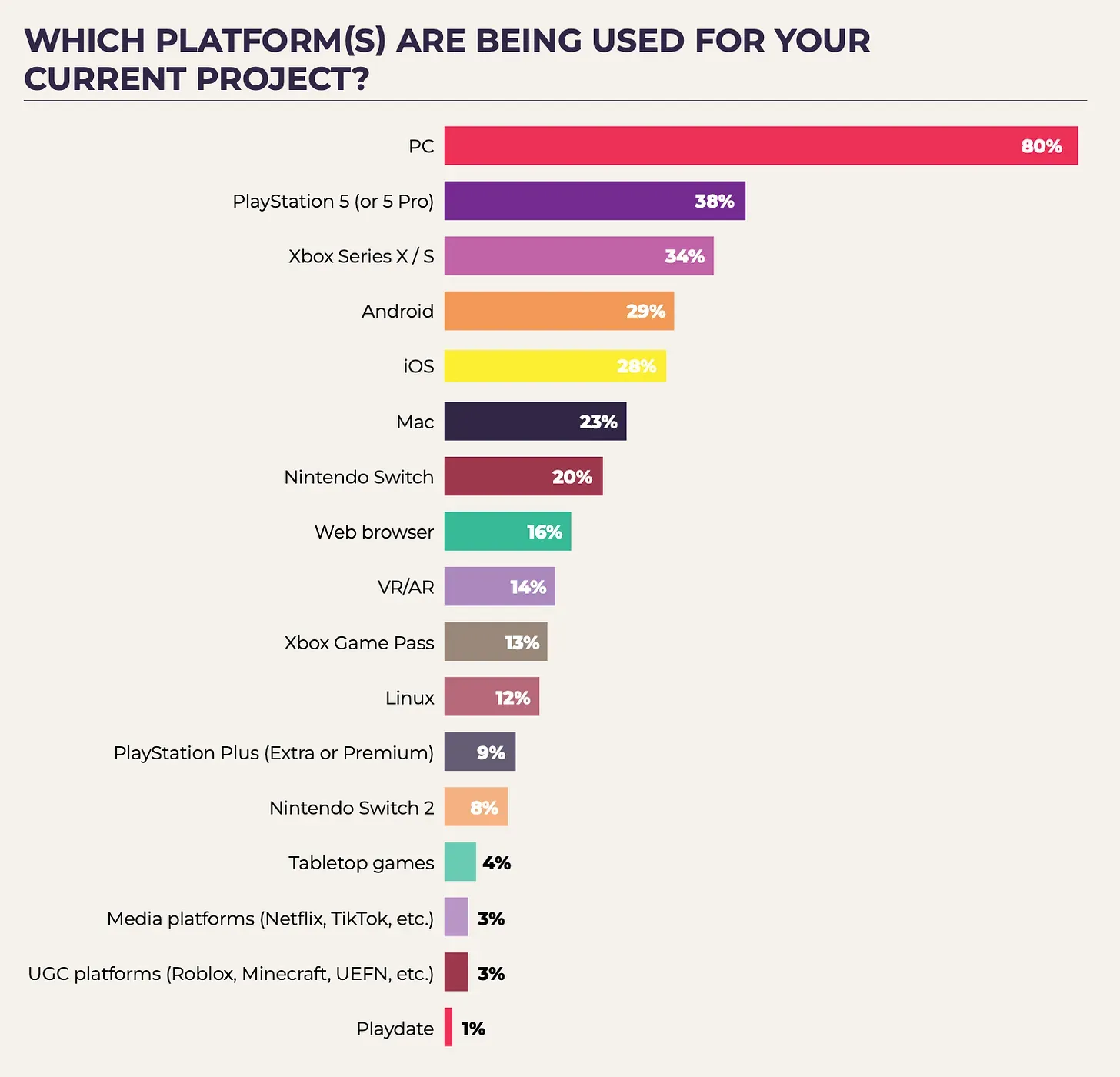

PC remains the dominant platform for game development, with 80% of developers working on PC titles. This marks an increase from the previous year, when 66% reported focusing on PC games. Mobile game development has also grown, with 28-29% of developers working on iOS and Android projects, up from 23-24% the year before. This growth is largely driven by developers in regions such as Brazil, the Middle East, and Asia.

Web-based game development has gained traction, with 16% of developers working on web projects, compared to 9% last year and 11% the year before. This represents the highest percentage of web-focused development since 2015. Meanwhile, Meta Quest remains the most widely used and most appealing virtual reality (VR) and augmented reality (AR) device among developers.

Regarding game engines, Unity and Unreal Engine continue to be the most widely used, with 32% of respondents working with each. Additionally, 13% of developers use proprietary engines. Despite criticism surrounding Unity’s Runtime Fee policy, usage of the engine has remained relatively stable compared to the previous year.

Over 80% of Developers Are Building PC Games

Business Models and Funding Strategies

Monetization strategies in the game industry vary, with 13% of respondents expressing interest in developing games as a service (GAAS) and 16% already working on such projects. However, 42% of developers stated that they do not wish to engage in GAAS. Among AAA studios, a higher percentage of developers (33%) are working on live-service projects. The primary metric for evaluating the success of a service-based game is stable concurrent user count (CCU), cited by 62% of respondents, followed by daily active users (DAU) at 40% and the percentage of paying users at 32%.

Developers are also exploring ways to expand their intellectual properties beyond games. Currently, 13% of respondents are involved in adapting their game franchises into movies or television series, while 5% have received proposals to do so. Another 14% have had internal discussions about potential adaptations. Among major AAA developers, nearly one-third are actively working on bringing their franchises to television or film.

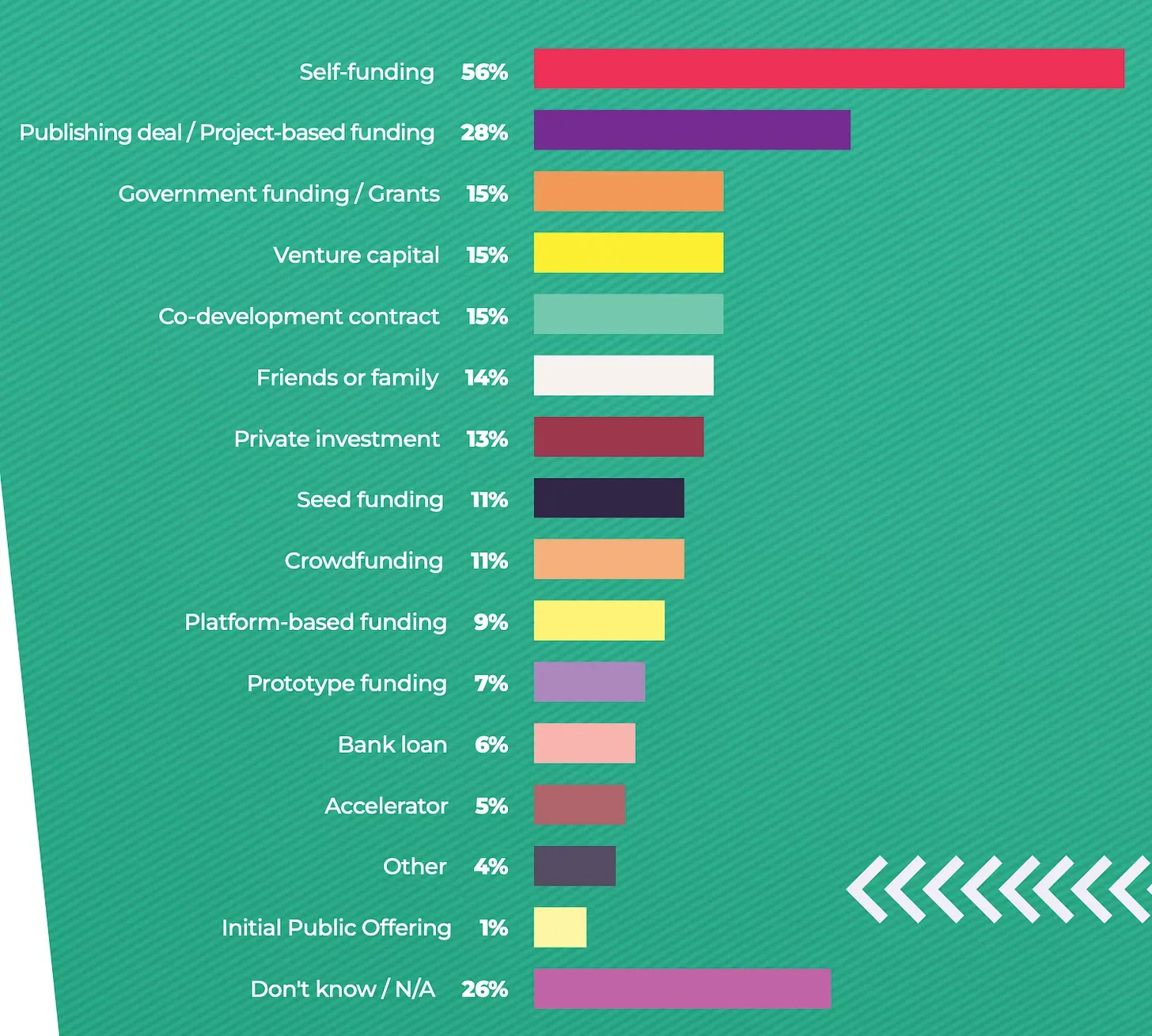

Funding strategies vary across the industry. Self-funding remains the most common method, used by 56% of developers. Other funding sources include publisher financing (28%), grants (15%), venture capital (15%), and co-development agreements (15%). While venture capital funding is sought after by some, 32% of respondents who pursued this option reported negative experiences. In contrast, self-funding and co-development have received the most positive feedback.

Top Fundraising Strategies

Work Conditions and Social Initiatives

Work conditions have shifted, with an increase in working hours for the first time since 2019. The proportion of developers working 40 hours or less per week has declined from 64% last year to 57% this year. Additionally, 13% now work more than 51 hours per week, up from 8% previously. The reasons for working longer hours vary, with 67% of respondents indicating that they work extra hours voluntarily. Another 23% do not perceive it as overtime, while 14% fear potential layoffs and 12% feel pressured by management.

Social initiatives remain a focus for the industry, with many companies continuing efforts to improve accessibility, diversity, equity, inclusion (DEI), and sustainability. The number of developers who have faced natural disasters in the past year has increased to 16%, a significant rise compared to previous decades.

Unionization efforts are also gaining momentum, particularly among narrative professionals and quality assurance (QA) specialists, who often face job insecurity. Younger developers are more likely to support the formation of industry unions, reflecting growing concerns about job stability and working conditions.

Unionization Efforts

Final Thoughts

The 2025 game industry landscape is shaped by a combination of workforce changes, economic pressures, and emerging technologies. While layoffs and longer working hours present challenges, developers continue to adapt through shifts in platform focus, business strategies, and the adoption of AI tools. The increasing interest in web-based games, mobile platforms, and live-service models highlights ongoing industry evolution, while discussions around unionization and job security reflect broader concerns about the sustainability of careers in game development.

Source: GameDevReports