As of August 28, 2025, the gaming token market continues to exhibit subdued performance despite fluctuations in Ethereum prices. More than 70 gaming token launches have occurred in 2025, with 62 actively tracked for analysis by GamingChronicles. July was the largest month in terms of new token generation events (TGEs), recording 12 launches. This indicates that the pace of new token introductions remains high, although it has not translated into sustained market growth.

Gaming Tokens Market Update August

Market Volume and Concentration

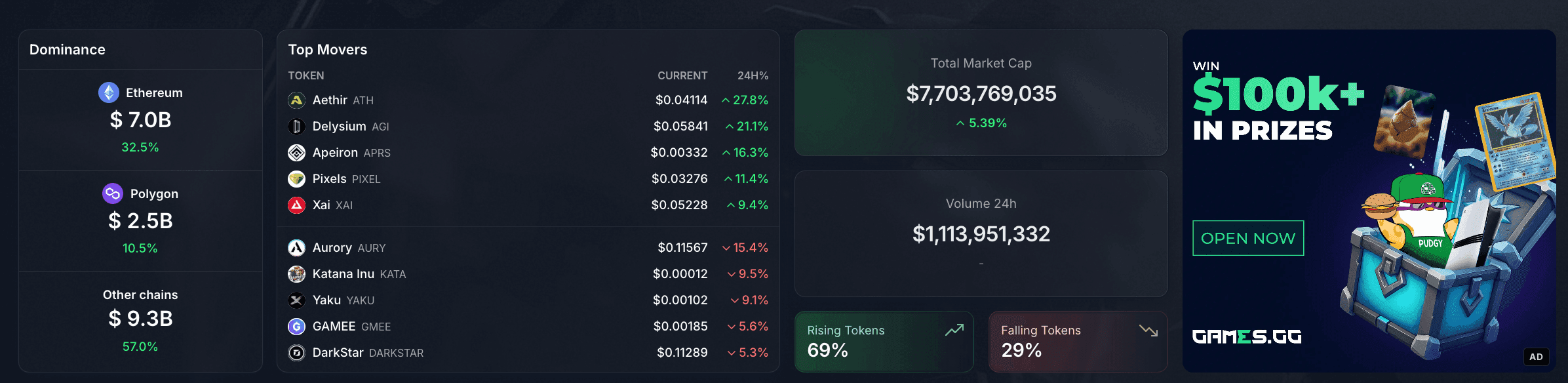

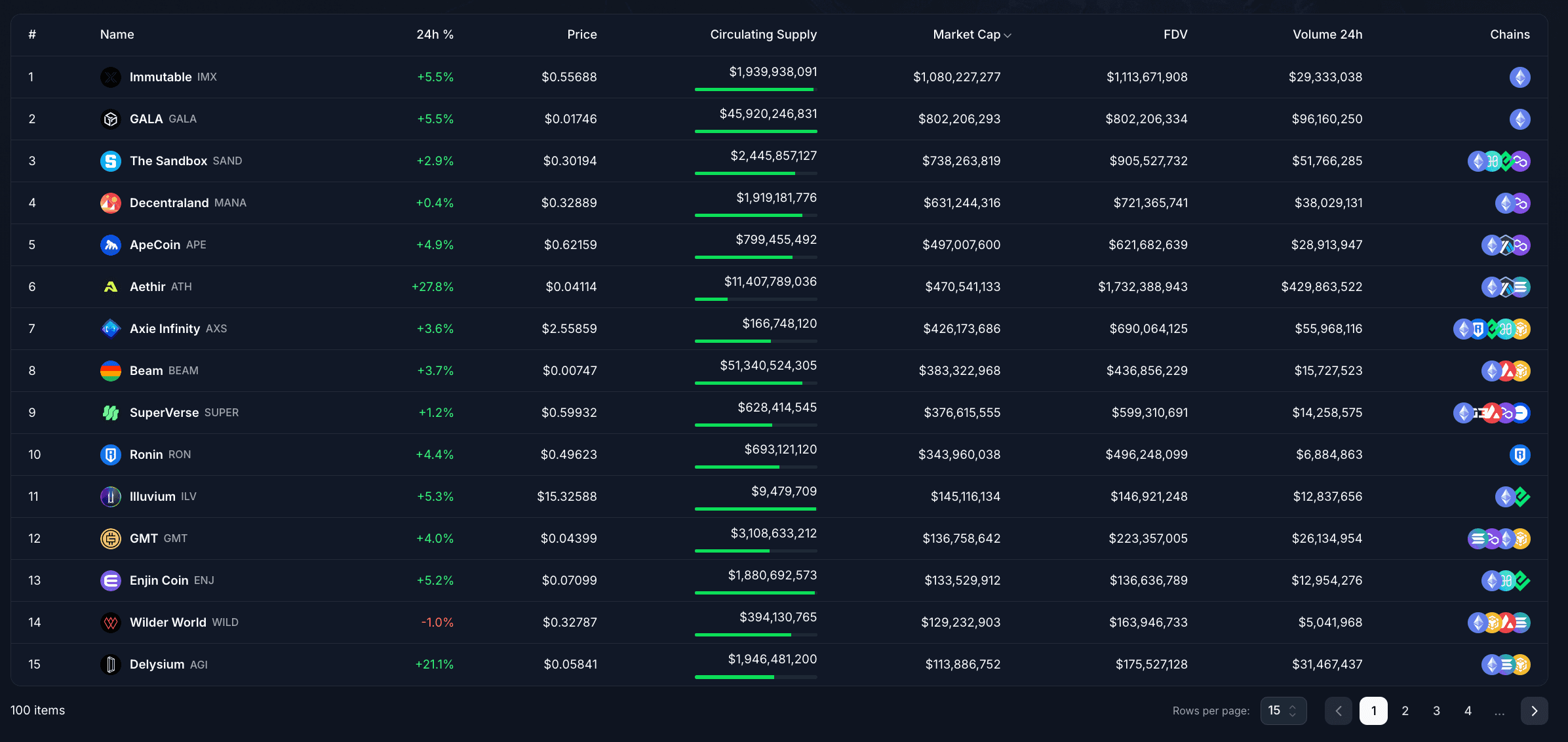

The average 24-hour trading volume for gaming tokens is reported at $15.2 million, a decrease from $26 million observed in previous periods. Analysts caution that short-term trading volumes may not provide a reliable indicator of overall market health. When excluding the top three tokens by volume, the average 24-hour volume falls to $3.1 million, suggesting that trading activity is highly concentrated among a small number of tokens. This top-heavy distribution indicates that most gaming tokens experience relatively low trading activity.

Market Capitalization Trends

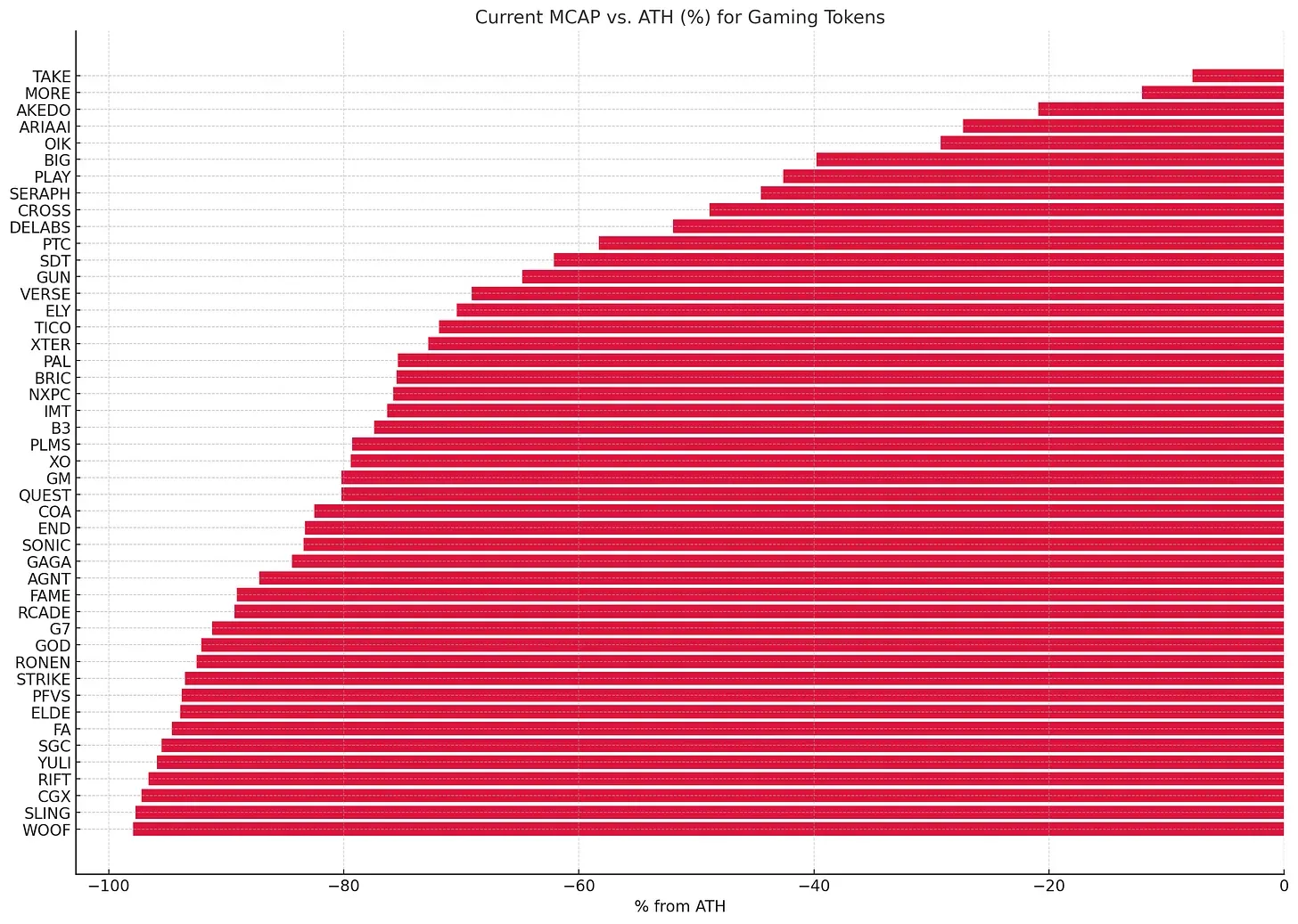

The average market capitalization of gaming tokens is approximately $12.6 million, down from $16.7 million in prior observations, representing a 24 percent decline. Excluding the top three tokens, the average market capitalization drops further to $7.2 million. Gaming tokens continue to trade significantly below their all-time highs, with an average market cap decline of 69 percent, consistent with trends observed in previous months.

NXPC remains the largest gaming token by market capitalization and fully diluted valuation (FDV), with a market cap of $145.6 million and an FDV of $734.3 million. Compared to mid-July, NXPC has experienced a 27 percent decrease in market cap and a 31 percent decrease in FDV.

Gaming Tokens Market Update August

Overall Market Performance

According to CoinMarketCap data, the total market capitalization of gaming tokens stands at $19.4 billion, down from $23.93 billion at the start of 2025 and $22.6 billion on July 21. This represents a decline of $3.2 billion despite Ethereum trading at higher prices over the same period, moving from $3,758 on July 21 to $4,582 on August 28. While CMC’s data may include certain tokens that could skew the total, such as VIRTUAL and FLOKI, it remains the most practical source for measuring the overall gaming token market.

The trend suggests that the broader gaming token sector has not benefited from Ethereum’s recent gains. Analysts note that the 2025 token generation landscape continues to face structural challenges, including an oversupply of tokens, persistent selling pressure, and a limited pool of buyers. These factors contribute to a generally subdued market environment.

Gaming Tokens Market Update August

Notable Token Performers

Despite the broader market challenges, some gaming tokens have demonstrated comparatively better performance. PLAY has shown positive momentum, supported by analysis from Haitzu, and SOMI has also performed well, although it launched after the latest assessment period. These exceptions highlight that while most gaming tokens face downward pressure, individual projects can still attract attention and achieve relative success in the web3 gaming space.

In conclusion, the gaming token sector continues to experience a period of consolidation. Market participants remain attentive to new token launches, trading volumes, and market capitalization trends as indicators of the sector’s ongoing developments within the web3 gaming ecosystem.