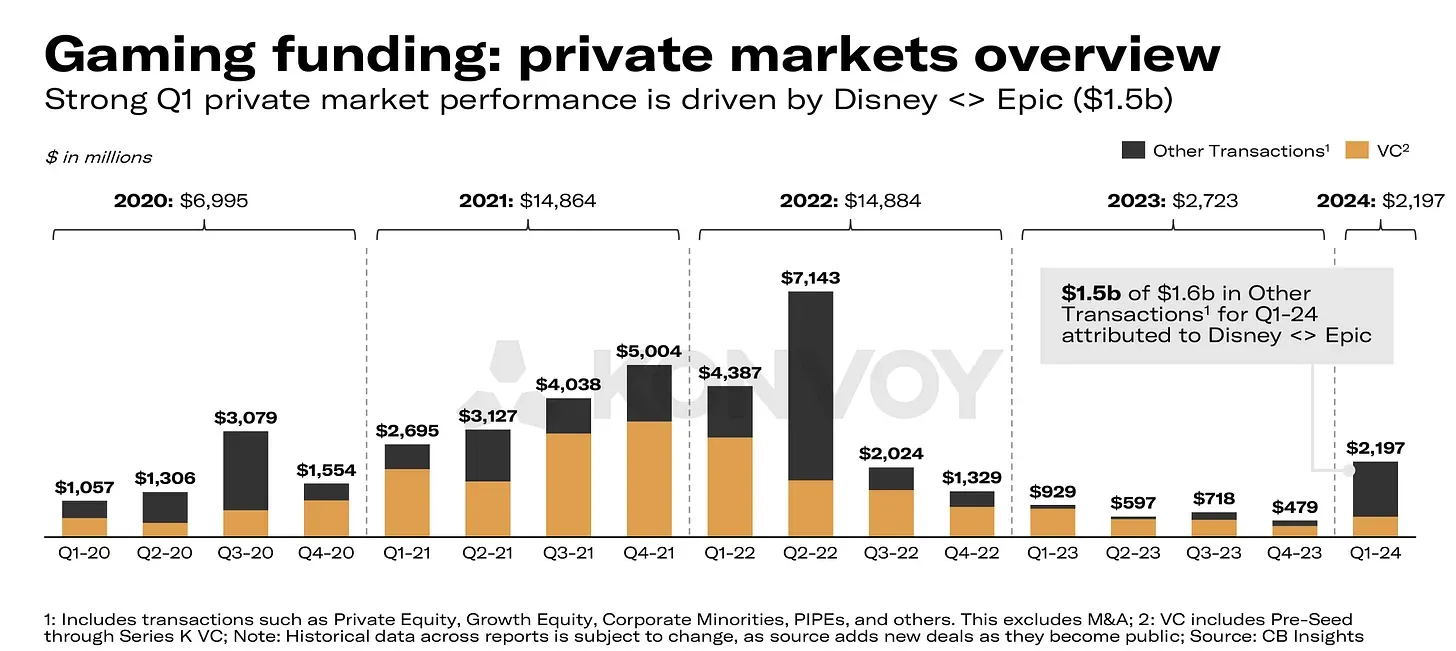

In the first quarter of 2024, the gaming industry witnessed a remarkable resurgence in investment activity, with private investments soaring to a near two-year high of $2.197 billion, according to the latest data from Konvoy. This impressive growth was largely driven by a blockbuster $1.5 billion deal between Epic Games and Disney.

Venture capital investments also hit a one-year high, totaling $594 million, marking a 94% increase from the previous quarter. This surge in financial activity, alongside notable deals and emerging trends, highlights the dynamic and evolving landscape of the global gaming industry.

In this article, we will break down Konvoy's Q1 2024 report, covering the latest trends, major deals, market shifts, and relevance to web3 gaming. We will also provide a detailed comparison between Konvoy's and Drake Star Partners' Q1 reports - looking at which blockchain gaming companies raised funding in Q1 of 2024.

Konvoy Gaming Industry Report Q1 2024

Market Overview

In the first quarter of 2024, private investments in gaming companies surged to a nearly two-year peak, totaling $2.197 billion. A significant portion of this sum, $1.5 billion, stemmed from a notable deal between Epic Games and Disney.

Gaming Funding: Private Markets Overview

Venture capital (VC) investments hit a one-year pinnacle, amounting to $594 million, marking a notable 94% surge from the preceding quarter in deal volume. A total of 124 deals were sealed, reflecting a substantial 28% uptick compared to the previous quarter, representing the highest count in the past year since Q1’23.

Gaming VC Funding: 4594m in Q1 2024

In the first quarter of 2024, 80% of the overall financing volume was attributed to just 23% of the deals, surpassing the figures from 2022 (19%), 2021 (12%), and 2020 (13%). This trend suggests a more robust investment market scenario.

Gaming VC: Healthier Funding Environment

Regarding capital distribution at early stages, from pre-seed to Series A, there's even more positive news: 80% of allocated funds were dispersed among 31% of companies. This achievement marks the most favorable performance since 2020.

Gaming VC: Early-Stage Capital Distribution

Josh Chapman, managing partner at Konvoy, commented: “The investment climate around gaming has now turned a corner. We believe the worst of this correction cycle is behind us and 2024 and 2025 will showcase a healthy VC investment pace, a few selective M&A events, notable IPOs next year, and continued secular growth for the industry."

Public Markets + M&A

During the first quarter of 2024, the ESPO (MVIS Global Video Gaming & eSports index) experienced a growth of 12.8%, while the S&P 500 exhibited a slightly lower increase of 10.8% over the same period.

Gaming inn Public Markets

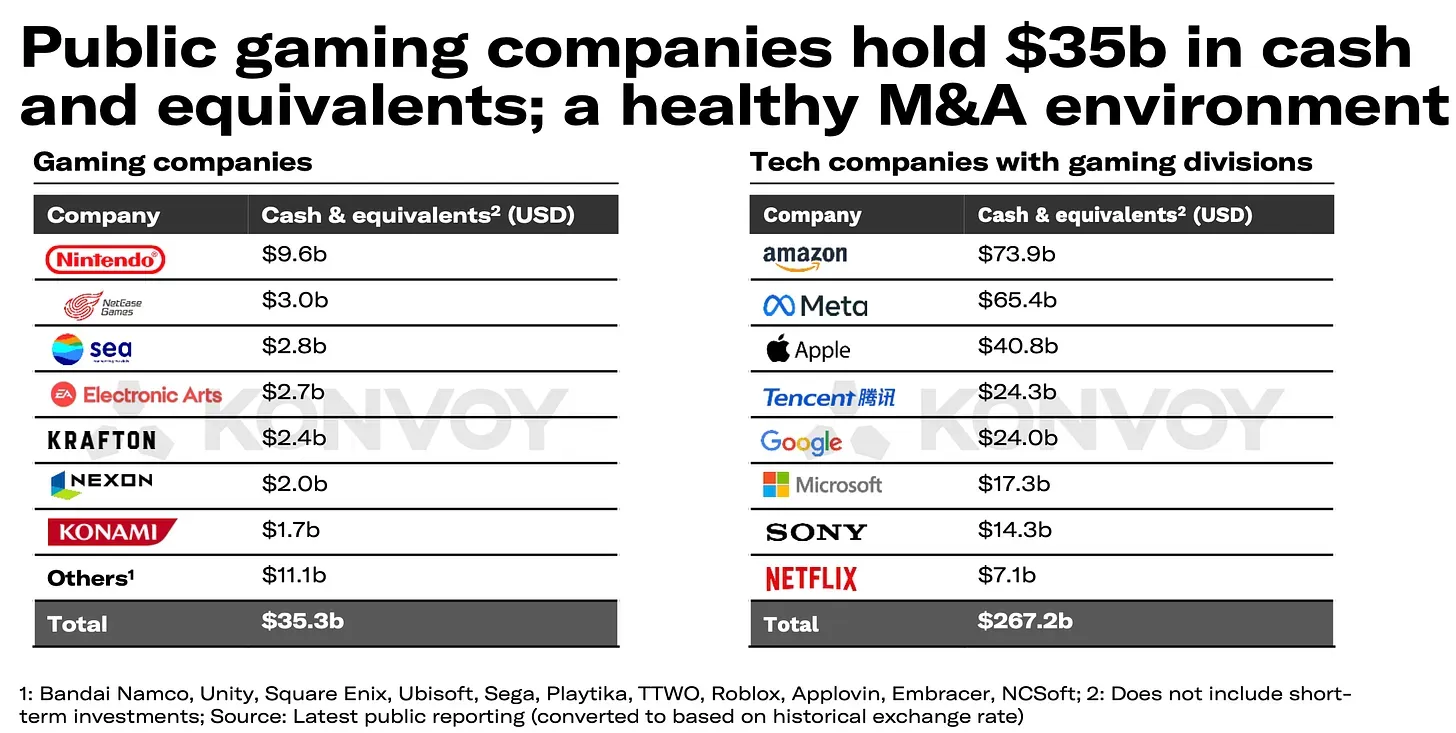

Public gaming companies boast $35.3 billion in cash reserves, not including the substantial $267.2 billion held by technology giants with gaming divisions such as Tencent, Sony, and Microsoft.

Healthy M&A Environment

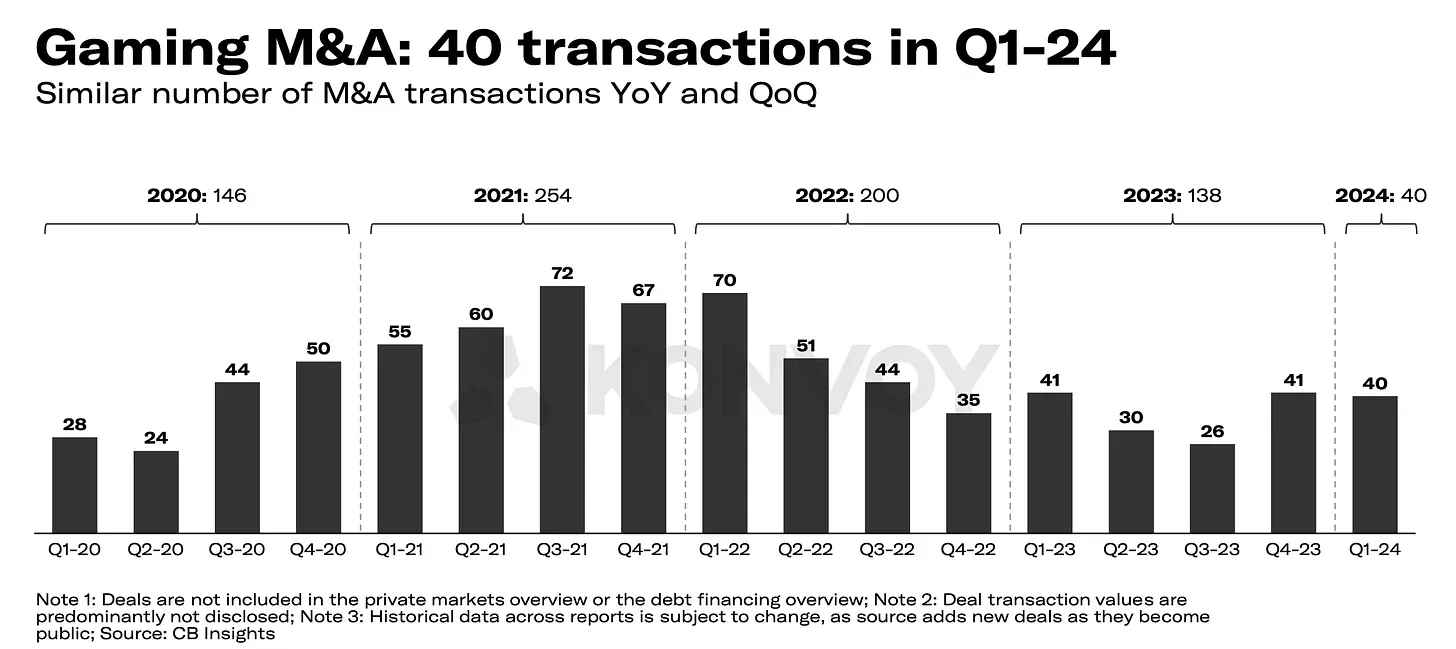

The number of mergers and acquisitions (M&A) deals in Q1’24 stayed consistent with the previous quarter, with 40 transactions recorded. Interestingly, Drake Star Partners' latest report revealed that there were 47 M&A transactions totaling $2.4 billion in disclosed funding during Q1 2024. While this transaction volume falls below 2022’s peak, it represents a 15% increase from the average deals closed per quarter in 2023.

Gaming M&A Overview

Largest VC Deals

According to Drake Star Partners' latest Q1 2024 report, blockchain gaming companies accounted for 40% of the quarter’s private placements, reflecting an upswing possibly mirroring the recent rally of cryptocurrency markets.

Some notable mentions include (but are not limited to):

Studio 369's blockchain game Metalcore, XPLA, Xterio's web3 IP Overworld ($10 Million), BlockGames, Helika's web3 analytics platform ($8 Million), Delabs, Elixir, Mythic Protocol, Pudgy Penguins, Immutable's NFT game Illuvium ($12 Million), Vermilion Studio's new crypto game Forgotten Playlands ($7 Million), Metacene's web3 MMORPG ($10 Million) and more.

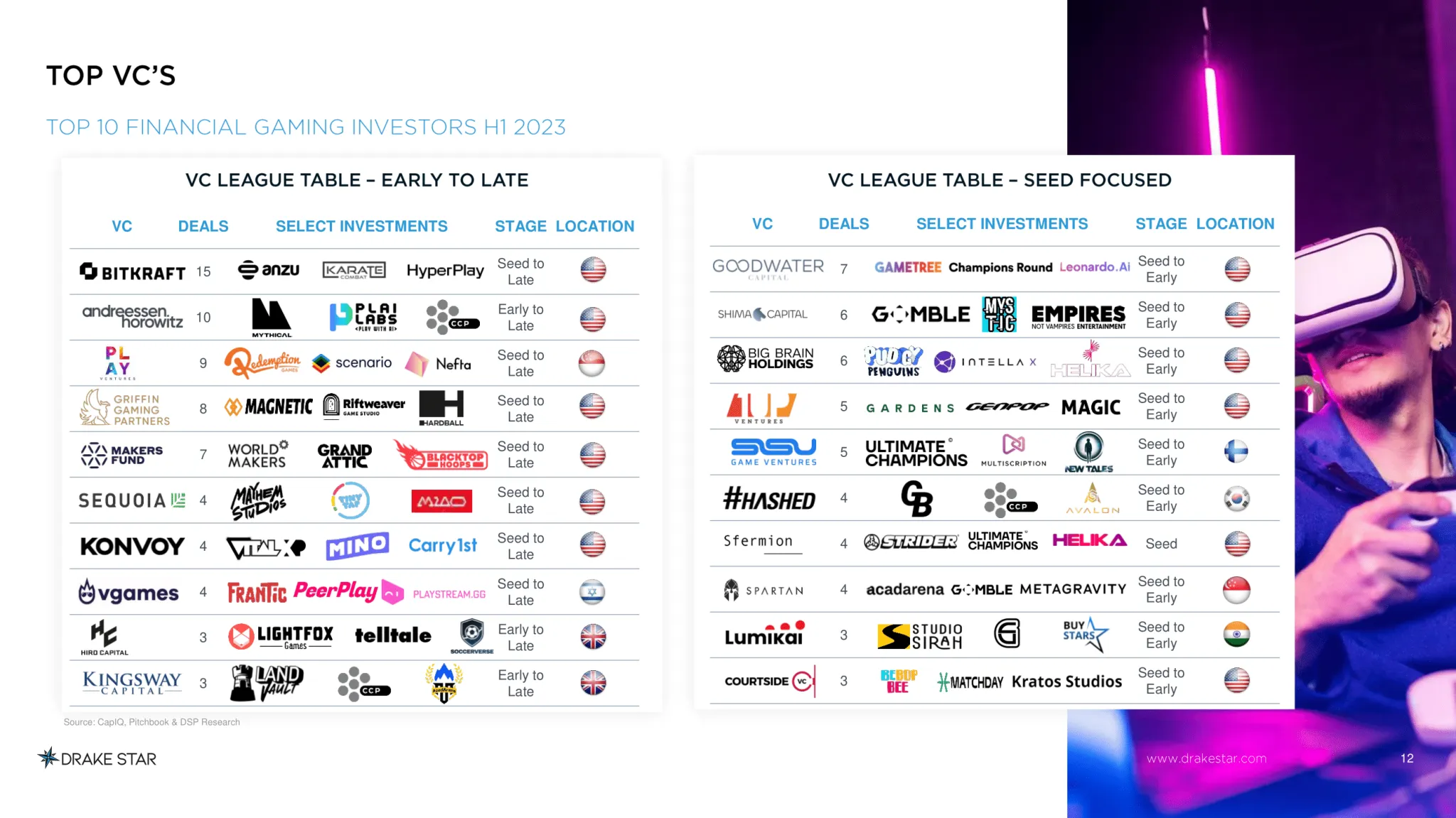

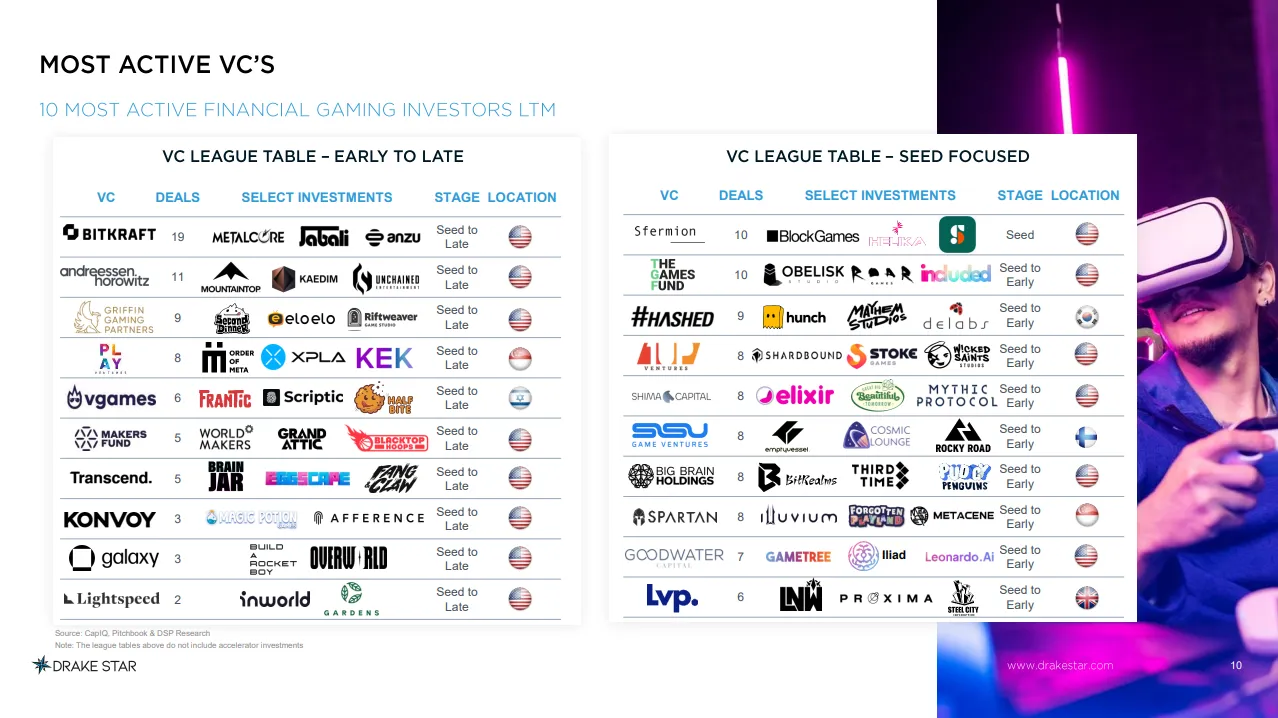

Most Active VC's According to Drake Star Q1 2024 Report

Please see the two sub-sections below for a more detailed comparison between Konvoy's and Drake Star Partners' Q1 reports - looking at which blockchain gaming companies raised funding in Q1 of 2024.

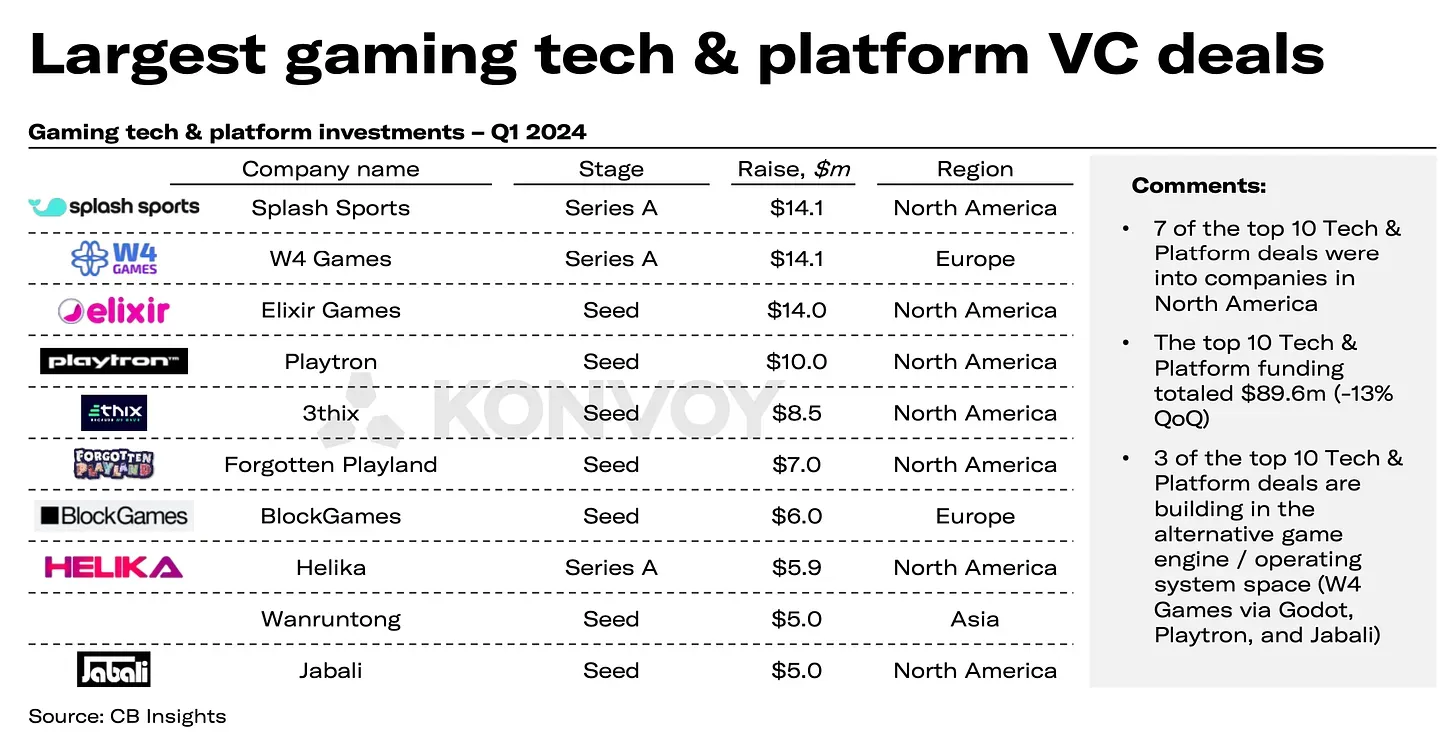

Gaming Tech and Platform VC Deals

According to Konvoy, the noteworthy VC deals involving technology gaming companies in the quarter, Splash Sports secured $14.1 million in Series A funding, alongside W4 Games and Elixir Games, both receiving $14.1 million in Series A and $14 million in Seed funding, respectively.

Special shoutout to web3 gaming tech and platforms: Elixir Games ($14 million), Forgotten Playland ($7 million), BlockGames ($6 million), and Helika ($5.9 million).

Largest Gaming Tech and Platform VC Deals

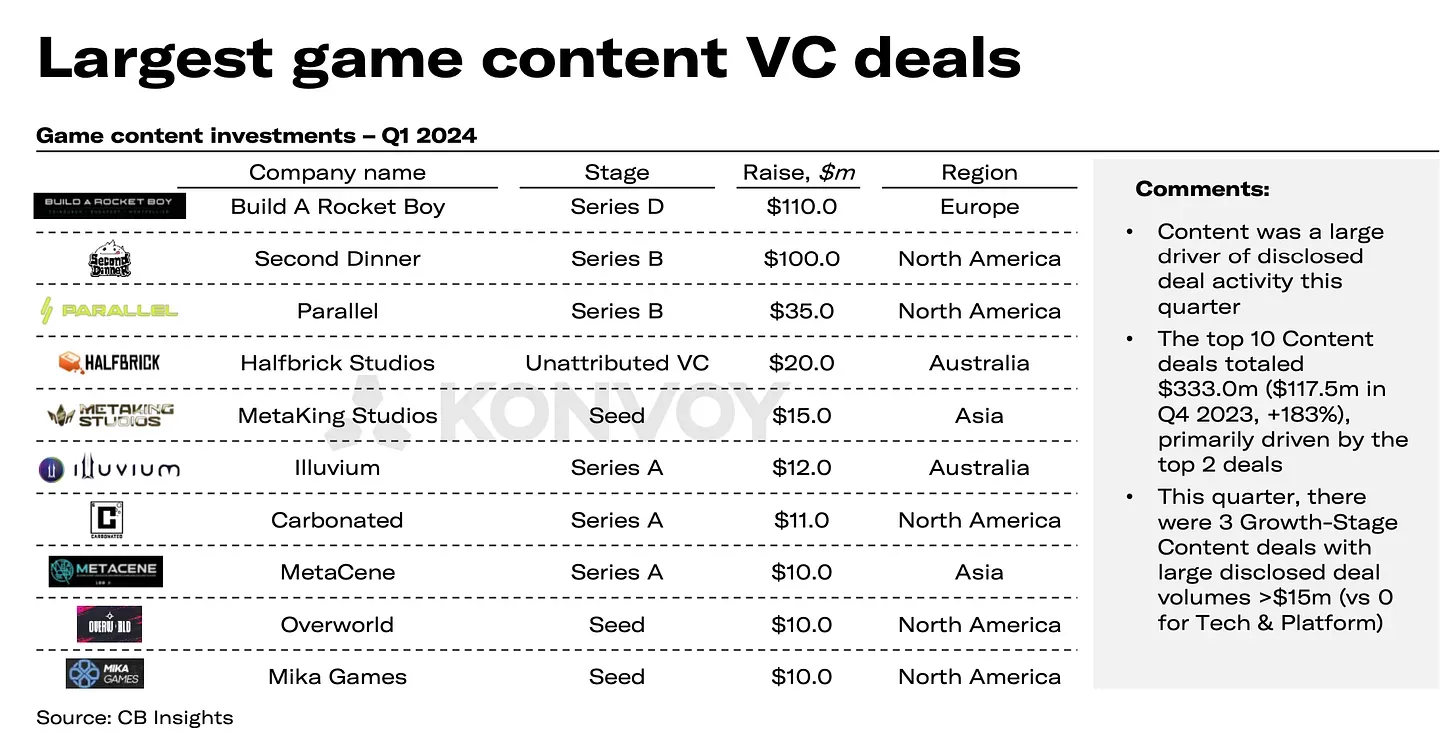

Game Content VC Deals

The most significant deals involving content producers in the quarter included Build a Rocket Boy securing $110 million in Series D funding, Second Dinner receiving $100 million in Series B funding, and Parallel securing $35 million in Series B funding.

Special mention to web3 gaming studios: Parallel ($35 million), Metaking Studios ($15 million), Illuvium ($12 million), MetaCene ($10 million) and Overworld ($10 million).

Largest Game Content VC Deals

Regional Distribution

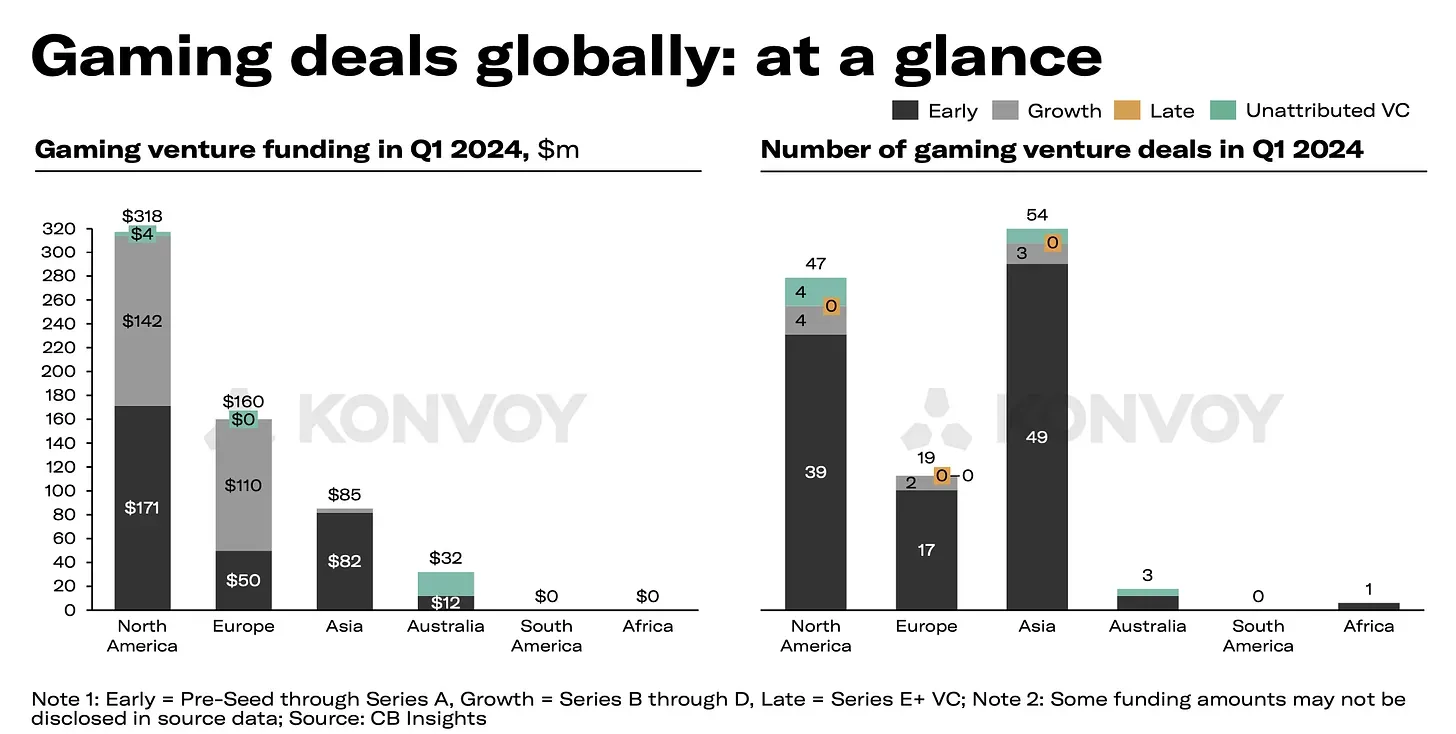

North America led in investment volume with $318 million, followed by Europe at $160 million, Asia at $85 million, and Australia at $32 million. Deal numbers were highest in Asia (54), with North America (47), Europe (19), and Australia (3) trailing. A single deal was noted in Africa.

Gaming Deals Globally Overview

North America and Europe both achieved annual highs in deal volume, with North America seeing a 111% increase and Europe a 113% rise compared to the previous quarter. Asia reported its highest deal number since Q4 2022, though the total volume was $85 million due to undisclosed transaction sizes.

Asia High Deal Count

Australia’s investment volume in Q1 2024 comprised 74% of its total for 2023, with three deals, the highest since Q3 2022. No VC deals were reported in South America since Q2 2023. Africa saw one deal with Carry1st raising funds from the Sony Innovation Fund, though the amount was undisclosed.

Africa Sees Only 1 Deal Done

Trends and Insights

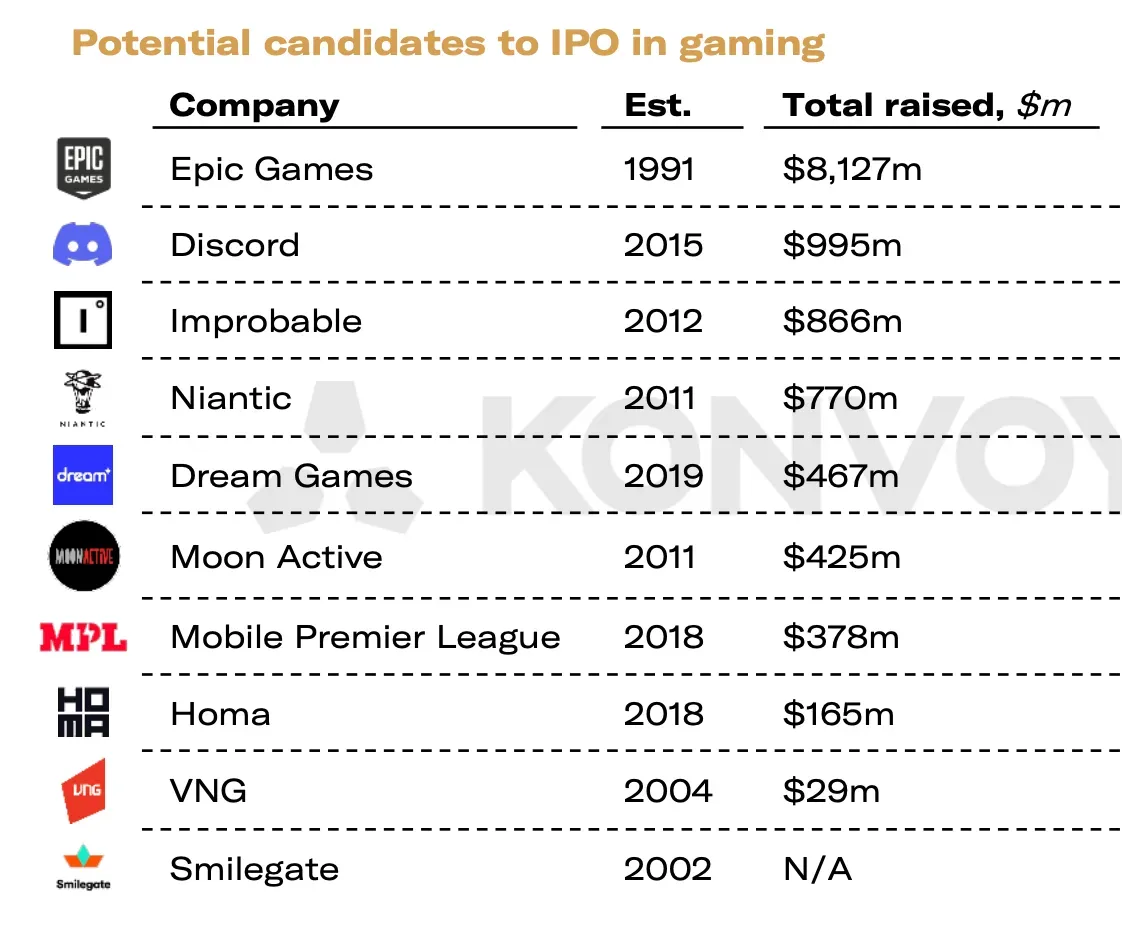

Key trends observed in Q1 2024 include a growing number of companies preparing for IPOs, such as Epic Games, Discord, Improbable (building Yuga Labs web3 metaverse called Otherside), Niantic, and Dream Games. The potential U.S. ban on TikTok could significantly impact the advertising market and corporate trust.

Major brands are increasingly investing in gaming, exemplified by Disney’s investment in Epic Games, Mattel's new publishing venture, and Warner Bros.' upcoming GAAS projects. Apple continues to face global pressure to allow third-party stores on iOS, while its Vision Pro has yet to make a significant impact on the VR/AR market.

IPO in Gaming 2024

Q1 2024 Trends Breakdown

- The market witnesses a growing number of candidates preparing for IPOs, including Epic Games, Discord, Improbable, Niantic, and Dream Games.

- There's speculation about the potential ban of TikTok in the USA, which could have significant ramifications on the advertising market and erode trust in US-based companies.

- Leading brands are showing active interest in gaming ventures, with Disney investing in Epic Games, Mattel venturing into publishing, and Warner Bros. gearing up to launch several Games as a Service (GAAS) projects.

- Apple remains under pressure from governmental bodies across different countries, who are advocating for the inclusion of third-party stores on iOS.

- Despite high expectations, Apple Vision Pro failed to revolutionize the VR/AR market.

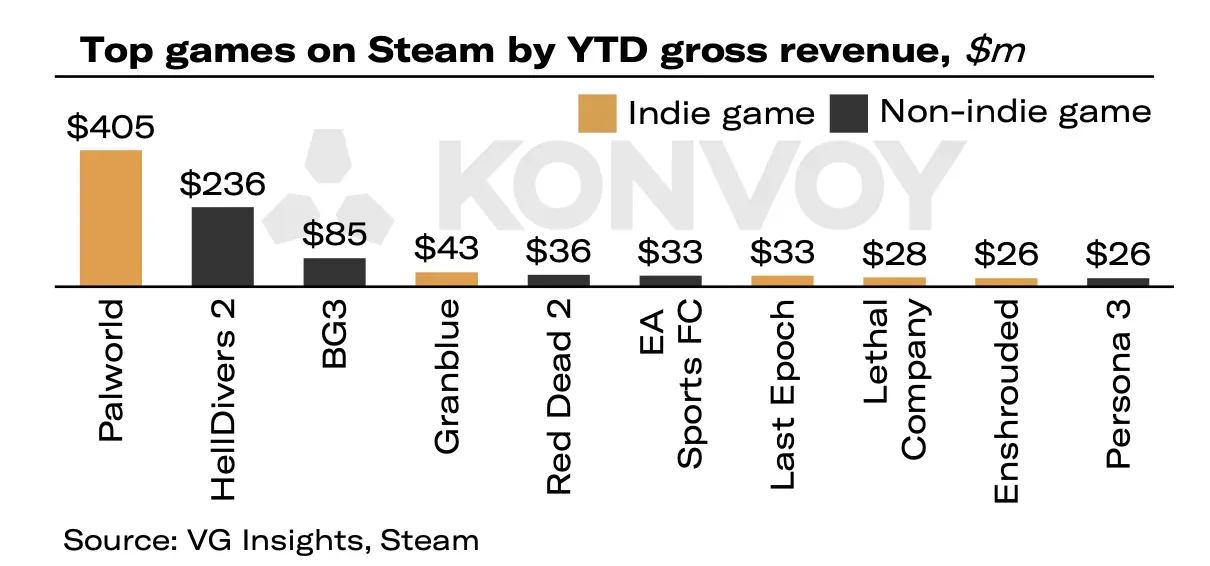

- Small developers are making notable strides in the industry, with success stories like Palworld ($405 million), Last Epoch ($33 million), Lethal Company ($28 million), and Enshrouded ($26 million).

Top Games on Steam by YTD Gross Revenue ($million)

The Konvoy Gaming Industry Report for Q1 2024 highlights a dynamic and growing investment landscape, with significant deals and emerging trends shaping the future of the gaming industry. With strong performances across regions and promising developments from both major and smaller players, the sector is poised for continued growth and innovation.

Final Thoughts

These findings underscore the dynamic landscape of the gaming industry and its intersection with emerging technologies like blockchain. As companies gear up for IPOs and major brands increasingly invest in web3 gaming ventures, there's a palpable shift towards decentralized platforms and blockchain integration.

The potential ban of TikTok in the USA highlights the importance of trust and data sovereignty, driving interest in decentralized alternatives. Moreover, the success of small developers in the market underscores the democratization of game development, which aligns with the principles of web3.

With ongoing pressure on tech giants like Apple to open up their ecosystems and the quest for innovation in VR/AR, the stage is set for web3 gaming to leverage upcoming trends in the traditional gaming markets and help redefine the future of interactive entertainment. You can read the full Konvoy Gaming Industry Report for Q1 2024 here.