According to a recent analysis by Memento, the October 2025 update marks another checkpoint in tracking the ongoing evolution of gaming NFTs. With the year nearing its end, the data shows that while new projects continue to emerge, market sentiment remains cautious. Across the past two months, the NFT space has seen both steady mint activity and persistent challenges in sustaining value, particularly within web3 gaming ecosystems.

A total of 113 mints were tracked in October, with estimates suggesting more than 130 overall. This represents a modest increase from the August report, which indicates that development within the space remains active. However, despite this growth, most projects still struggle to maintain momentum after launch. Roughly three-quarters of these mints required payment, yet around 80 percent now trade below their original mint price, signaling ongoing difficulties for teams to reach product-market fit before going public.

Ronin and Abstract Remain Core NFT Hubs

The majority of new NFT collections continue to mint on Ronin and Abstract, with Ethereum following closely behind. Both Ronin and Abstract have seen steady adoption from gaming studios and creators, largely due to their growing ecosystems and supportive infrastructure. However, recent months have introduced more diversity among chains, with projects increasingly appearing on Immutable (IMX) and SOMI. This spread suggests developers are exploring different environments to test new monetization models and community structures.

While Ronin-based NFTs have remained relatively stable when priced in RON, the decline in RON’s overall value has affected dollar-denominated returns. Developers and collectors alike are adjusting to these fluctuations, which highlight the complex relationship between token performance and NFT valuation.

Market Performance and Player Sentiment

The broader market trend remains downward. Over 90 percent of mints are currently trading below their initial price, which aligns with the cautious sentiment surrounding web3 gaming assets. Paid mints continue to dominate the landscape, driven by two primary factors: free mints often attract short-term traders looking for quick exits, and teams use paid mints as a way to raise initial funds for development.

The distribution of collection sizes appears balanced between smaller sets of under 2,000 NFTs and mid-range collections of up to 7,000. Interestingly, high-price, low-supply projects - those with fewer than 1,000 NFTs - have performed better in dollar terms. Titles such as SUP Foundation, Oh Baby Games, Tokyo Games, and Monsters.Fun showed early gains following their mints, although sustaining these levels has proven difficult for most projects.

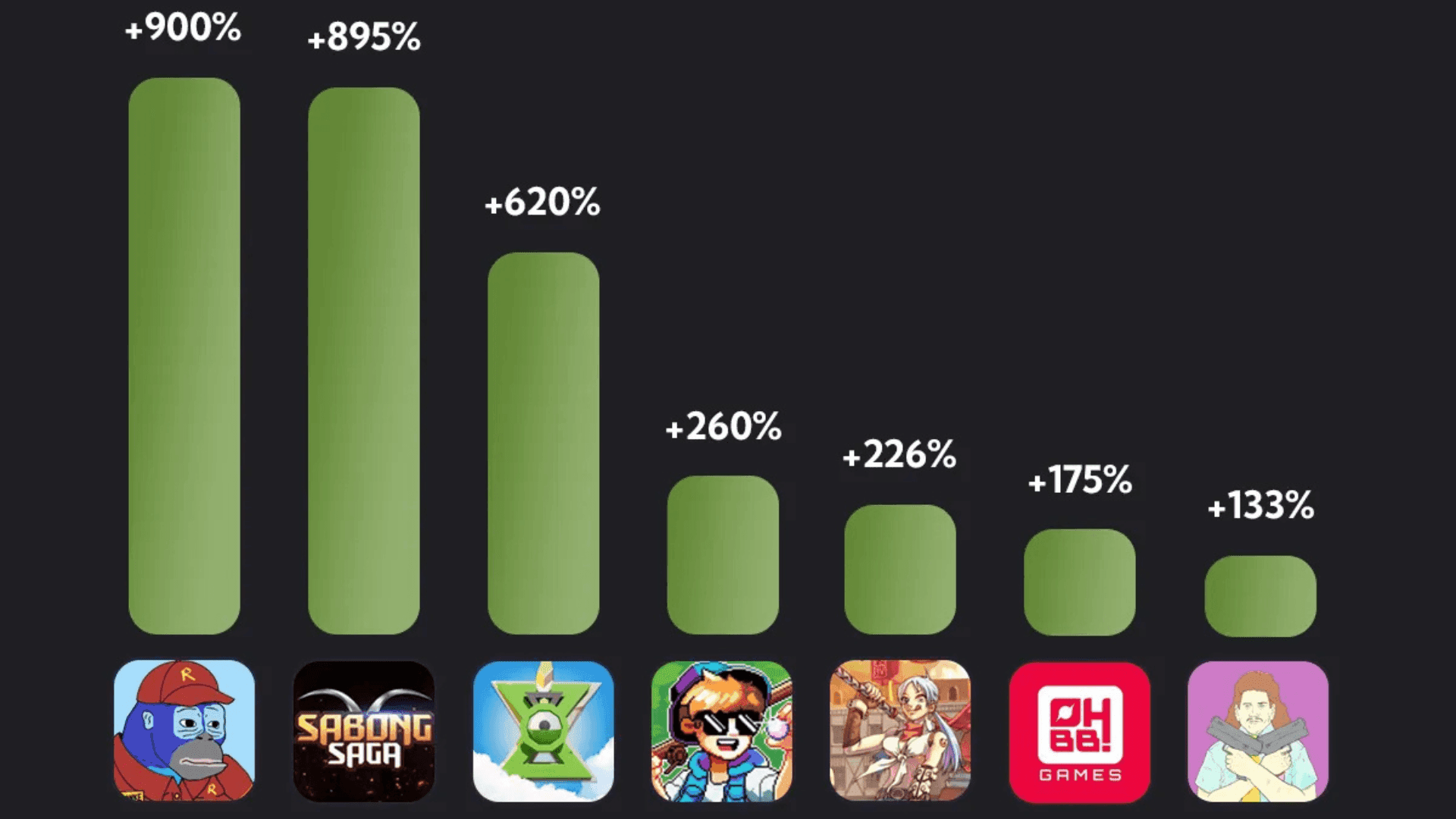

Top Performing Projects This Month

Several collections managed to outperform the broader market. Ronke and Sabong Saga led the month with gains of nearly 900 percent when measured in RON, while Zeeverse Oath, Fishing Frenzy, and Rag Landv also delivered notable returns. On Ethereum, OBB and Gigaverse ROMs stood out, offering the most substantial profits in absolute dollar terms. And MulletCop on Somnia saw a +133% increase. These examples remain exceptions, as most collections continue to face declining demand and reduced liquidity.

Outlook for Year-End

Market sentiment has shifted back to “slightly negative,” reflecting both fatigue and caution among players, investors, and creators. While some of the strongest gaming NFTs have maintained their value, the majority of projects have struggled to deliver consistent updates or clear utility. The slowdown in momentum suggests that the web3 gaming sector is still working toward defining sustainable business models that can survive beyond initial mint hype.

As 2025 draws to a close, the industry appears to be consolidating around quality over quantity. Teams that can demonstrate clear gameplay integration, transparent development, and community-driven progress may stand the best chance of defining the next phase of gaming NFTs heading into 2026.

Source: Memento

Frequently Asked Questions (FAQs)

What are gaming NFTs?

Gaming NFTs are digital assets that represent in-game items, characters, or collectibles that players can own, trade, and use within blockchain-based ecosystems.

Which blockchain is most popular for gaming NFTs?

Ronin and Abstract currently lead in gaming NFT activity, followed by Ethereum. Other chains such as Immutable (IMX) and SOMI are emerging alternatives.

Are gaming NFTs still profitable in 2025?

Profitability remains limited. While a few projects such as OBB, Gigaverse ROMs, and Ronke have performed well, most collections are trading below their original mint prices.

Why are most NFT prices declining?

The decline is linked to a mix of token depreciation, oversupply of projects, and a lack of sustainable player engagement. Many collections also struggle to deliver long-term value or gameplay integration.

What is the outlook for 2026?

The outlook remains cautious but not without potential. As web3 gaming continues to mature, success will depend on teams developing games that prioritize player experience and long-term value over speculative trading.