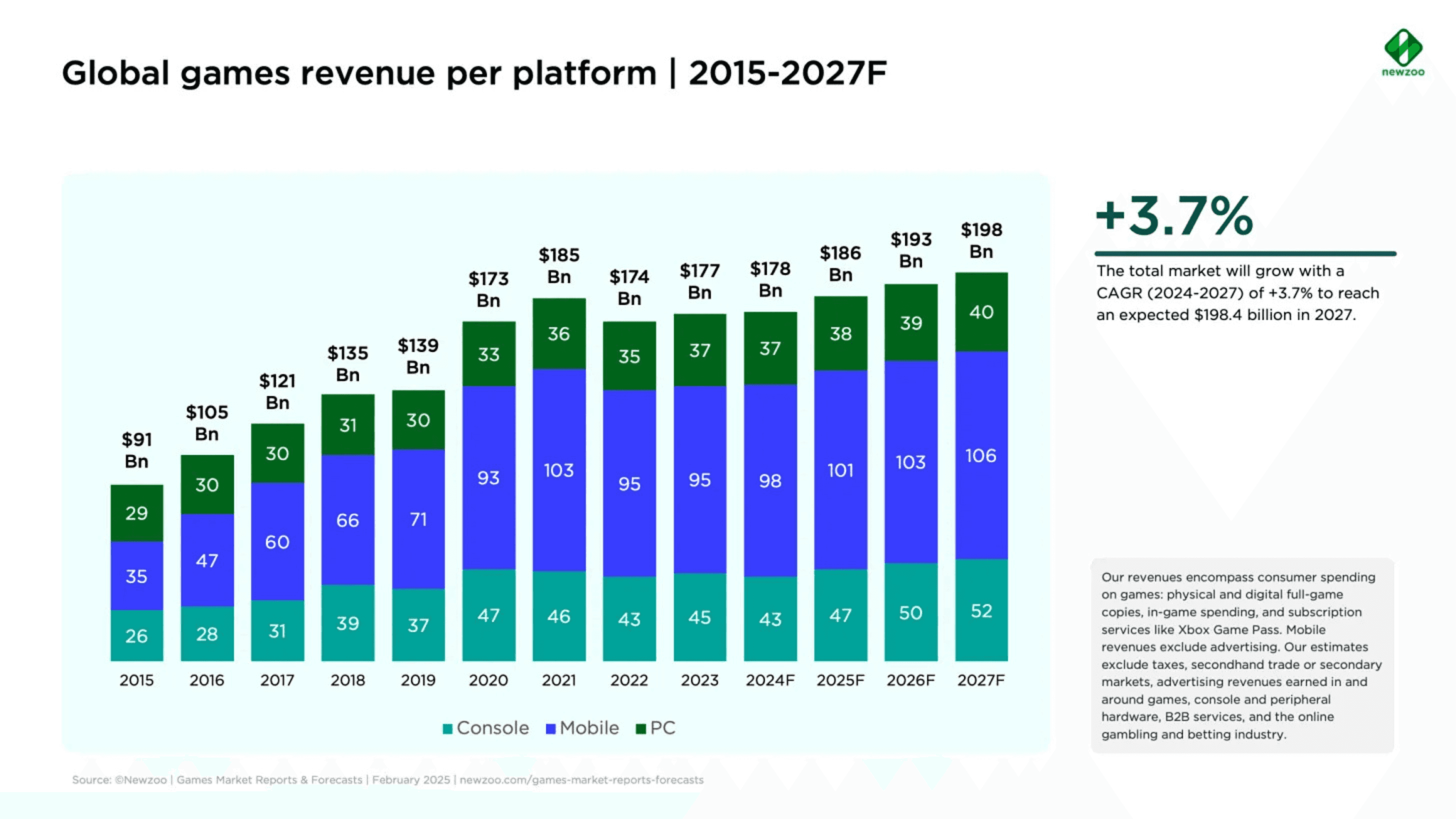

Newzoo and Tebex have published their latest findings on gaming payment behavior in 2025, focusing on the markets of North America and Europe. The research explores how players choose to pay for games, how much they spend, and what motivates them to make purchases, all within the context of a global gaming market valued at 188.9 billion dollars.

The Global Gaming Market in 2025

The Global Gaming Market in 2025

In 2025, the worldwide games market is valued at 188.9 billion dollars. North America and Europe together account for nearly half of global gaming revenue, with a combined share of 46 percent. However, these two regions represent only 20 percent of the total global player base, indicating that while fewer players are located there, they spend significantly more on games compared to other regions.

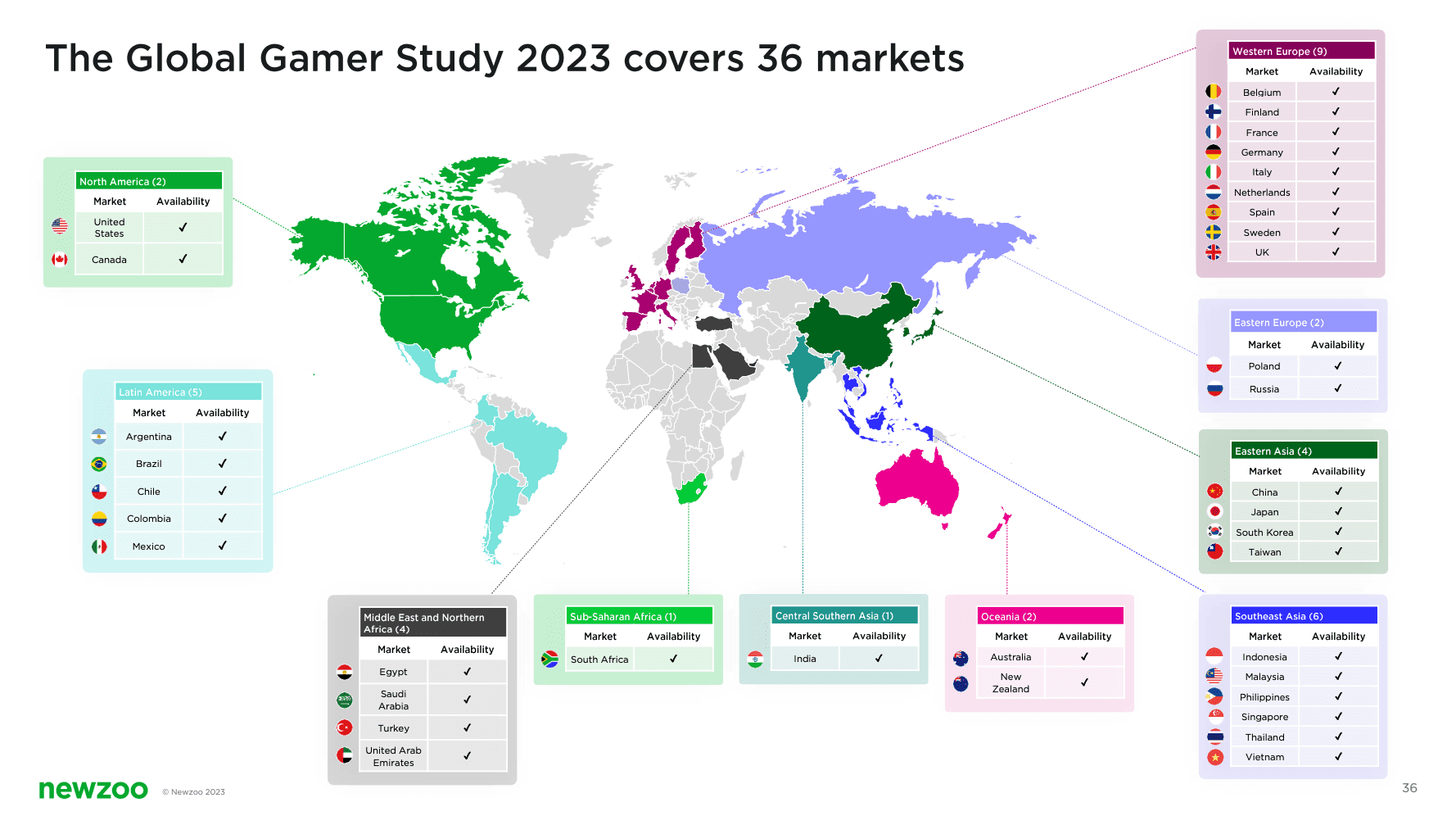

Newzoo’s figures provide, for the first time, a breakdown of paying players by region. The Asia-Pacific region leads with 742 million paying players, marking an annual growth of 3.9 percent. The Middle East and Africa follow with 222 million paying players, a year-on-year increase of 7.4 percent. Europe is third with 264 million paying players, growing at 3 percent annually. Latin America has 171 million paying players, with growth of 5.4 percent, while North America, despite its high revenue share, has only 162 million paying players, increasing by 1.6 percent year on year.

The Global Gaming Market in 2025

Spending Patterns and ARPPU Differences

North America continues to lead in terms of annual average revenue per paying user (ARPPU), which stands at 324.9 dollars. Europe shows lower figures, with an overall ARPPU of 125.4 dollars. Within Europe, Western European players spend more, at 170 dollars per year, compared to Eastern Europe, where the ARPPU is just 51.6 dollars.

Growth projections highlight a contrast between the two regions. Between 2023 and 2027, the number of paying players in North America is expected to rise by 1.1 percent per year. In Europe, the growth rate is projected at 3.1 percent annually, almost three times higher than North America. This indicates that while North America retains the highest individual spending levels, Europe is expanding more quickly in its paying player base.

The Global Gaming Market in 2025

Payment Preferences and Emerging Methods

Tebex, the direct-to-consumer payment platform from Overwolf, provides insight into how players choose to pay. In North America, Europe, Australia, and New Zealand, both buy now, pay later (BNPL) services and cryptocurrency payments record higher average transaction values (ATV) compared to more traditional methods such as card payments. Although the overall volume of BNPL and cryptocurrency transactions remains relatively small, the higher transaction size indicates a shift toward players using these methods for more expensive purchases.

Importantly, data shows that users who adopted BNPL did not reduce their transaction frequency compared to those relying solely on cards. Instead, the average monthly ATV grew from 30 dollars to 40 dollars in 2025. This trend suggests that players are responding to inflation by purchasing fewer, but more expensive and higher-value items, rather than reducing overall activity.

The Global Gaming Market in 2025

Content Types and Genre Preferences

Players rarely limit themselves to a single type of purchase. Spending is typically spread across a combination of microtransactions, downloadable content, and subscriptions. In the United States, the highest-earning genres are shooters, role-playing games, and puzzle titles. In Europe, sports games generate the most revenue, underlining a difference in regional preferences.

Consoles play a unique role in the United States, where subscriptions represent 21 percent of all spending. Despite this, premium game purchases remain strong, with 52 percent of console players still buying full titles. On PC, the figure is slightly lower at 49 percent. In Europe, spending behavior is broadly similar, but players engage more heavily with microtransactions across both PC and console platforms.

The Global Gaming Market in 2025

Profile and Motivations of Paying Users

The report also provides a profile of paying players in North America and Europe, based on surveys conducted with 2,794 participants in North America and 10,713 in Europe. In North America, the average paying user is 33.6 years old, more often male, and most commonly in low to medium income brackets. Over half of these users work full time.

In Europe, the demographic profile is similar, though respondents reported somewhat higher incomes. Motivations for making purchases, however, differ across the two regions. North American players are most likely to spend in order to unlock new content, to play with friends or family, or to personalize characters and build in-game items. European players, on the other hand, are more influenced by discounts and special offers and are less tolerant of advertising, with a notable portion paying to remove ads from their games.

The Global Gaming Market in 2025

Regional Payment Behaviour in Perspective

The findings highlight significant differences in how North American and European players approach spending. North America remains the strongest market in terms of individual player revenue, but Europe is experiencing faster growth in its base of paying users. BNPL and cryptocurrency payments are emerging as meaningful alternatives to traditional methods, even if they represent only a small share of overall transactions. Motivations for spending also reflect cultural differences, with North American players focused on access and personalization, while European players prioritize value and an uninterrupted experience.

These insights suggest that publishers and developers will need to tailor their monetization strategies by region, balancing established payment methods with growing interest in BNPL and cryptocurrency, while also aligning content offerings with distinct player motivations.