The Konvoy Gaming Industry Report for Q2 2024 offers an in-depth examination of the current state of the gaming market, focusing on key trends in funding, regional investment activity, and emerging industry themes. This quarter, the gaming sector experienced a notable 20% decline in venture capital funding compared to the previous quarter, totaling $492 million across 104 deals. Despite this reduction, early-stage investments reached a new high, signaling robust growth potential.

The report also highlights significant shifts in investment focus towards gaming technology and infrastructure, with a substantial increase in funding for these areas. Additionally, the report provides insights into regional investment dynamics, particularly in Asia, and discusses recent strategic moves by major tech companies entering the gaming space.

Konvoy Gaming Industry Report for Q2 2024

Gaming Industry Report: Q2 2024

In this article, we break down the data, looking at the specifics of private and public market funding, regional investment activities, and key industry developments, providing valuable insights for stakeholders looking to navigate the evolving gaming landscape. We also take a deep dive into YouTube and LinkedIn which have recently entered the gaming sector, intensifying competition in interactive media.

This move follows Netflix's 2019 shift, which saw the company invest over $1 billion in gaming to rival platforms like Fortnite. Netflix now offers around 100 games, mostly from external developers. YouTube has launched 75 games, including Angry Birds Showdown and Trivia Crack, marking its return to gaming after shutting down Stadia. LinkedIn has also introduced three new games aimed at boosting professional engagement. As these platforms dive into gaming, their strategies and market positions remain to be seen.

Konvoy Gaming Industry Report for Q2 2024

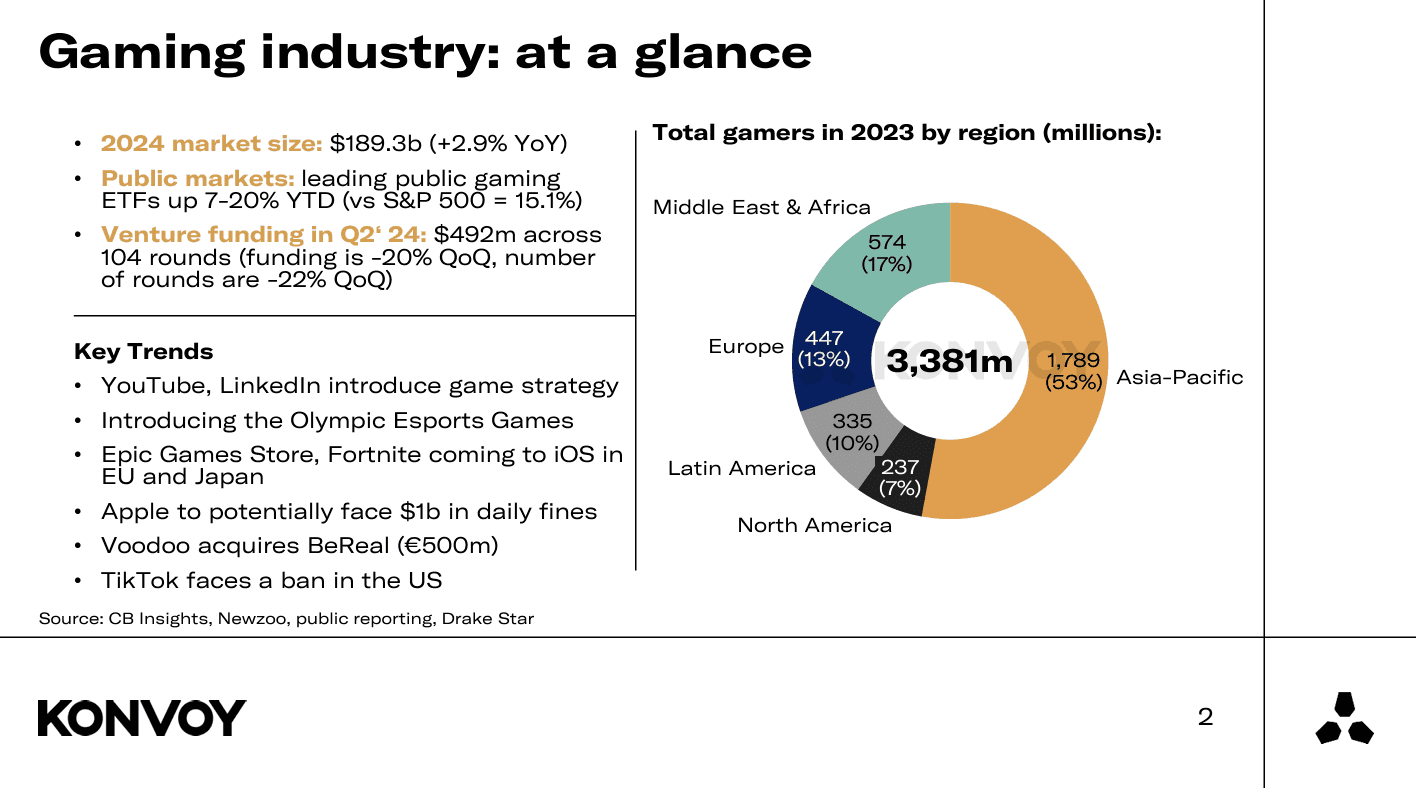

Key Market Indicators

- Gaming Market Size: Expected to reach $189.3 billion in 2024, a 2.9% increase YoY.

- VC Funding: Totaled $492 million in Q2 2024, marking a 20% QoQ decline.

- Deal Volume: 104 deals were completed in Q2 2024, reflecting a 22% QoQ decrease.

- Public Market Performance: Gaming ETFs have performed well, with top ETFs up by 19.7% since the start of 2024, compared to the S&P 500's 15.1% rise.

- Cash Balances: Public market-leading gaming companies held $33.4 billion, while big tech companies amassed $223.9 billion.

Konvoy Gaming Industry Report for Q2 2024

Overview of Venture Funding Trends

The gaming industry experienced a 20% decrease in venture funding between Q1 2024 and Q2 2024, totaling $492 million across 104 deals. This decline follows a similar pattern observed between Q1 and Q2 in 2023, reflecting seasonal quarter-over-quarter (QoQ) changes. However, when compared year-over-year (YoY), the funding also dropped by 7%, with a notable 12% decrease in the number of deals, down from $529 million across 118 deals in Q2 2023.

Despite the overall decline, early-stage funding (Pre-Seed through Series A) saw significant growth. Q2 2024 marked the highest amount of early-stage funding in the past 12 months. Historically, early-stage investments constituted about 80-85% of overall funding, which has now increased to approximately 90%.

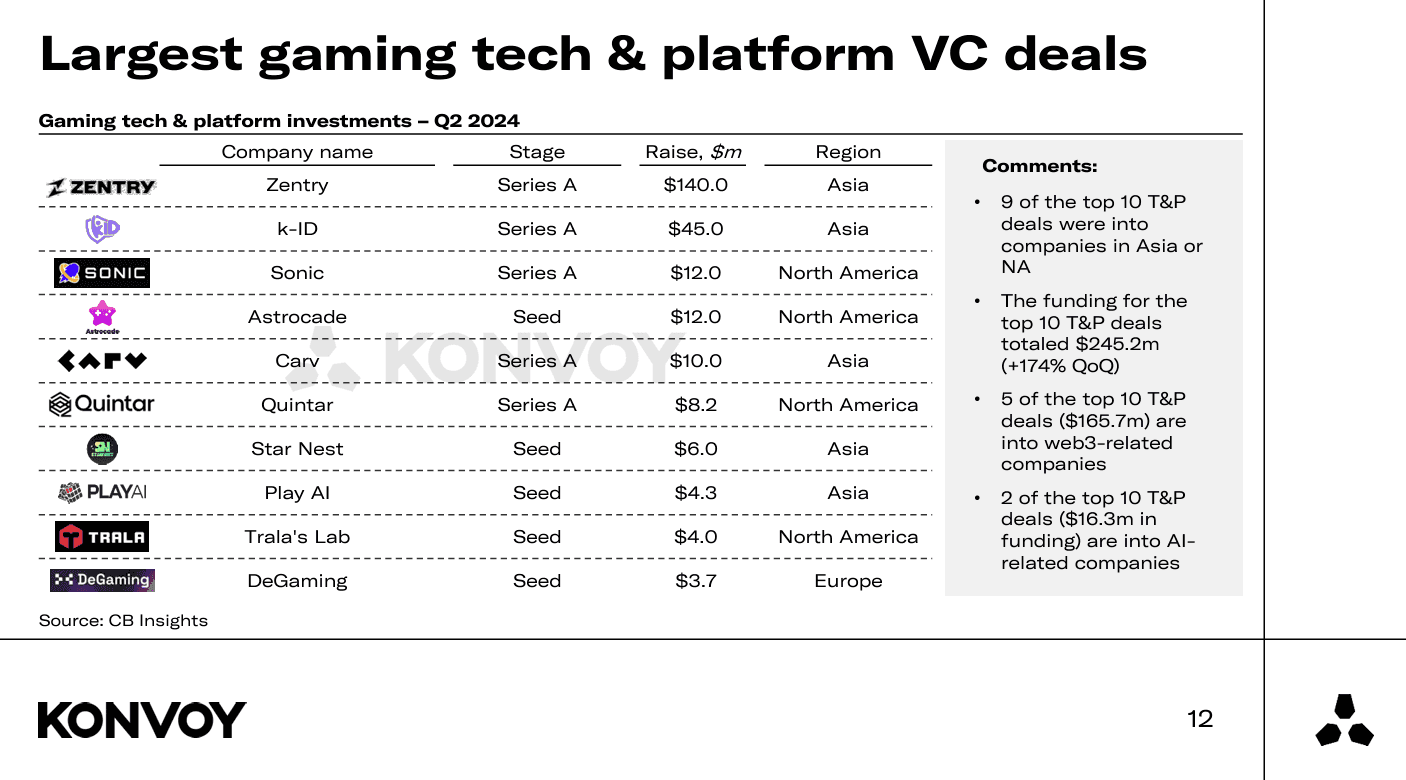

Significant VC Deals in Gaming Tech and Platforms

- Top Deals: 9 out of the top 10 tech and platform deals were in Asia or North America, totaling $245.2 million.

- Web3 and AI Investments: Half of the top deals were related to web3, while two were focused on AI, indicating growing interest in these technologies. Carv raised $10 million, Play AI raised $4.3 million and DeGaming raised $3.7 million.

Largest Gaming Tech and Platform VC Deals

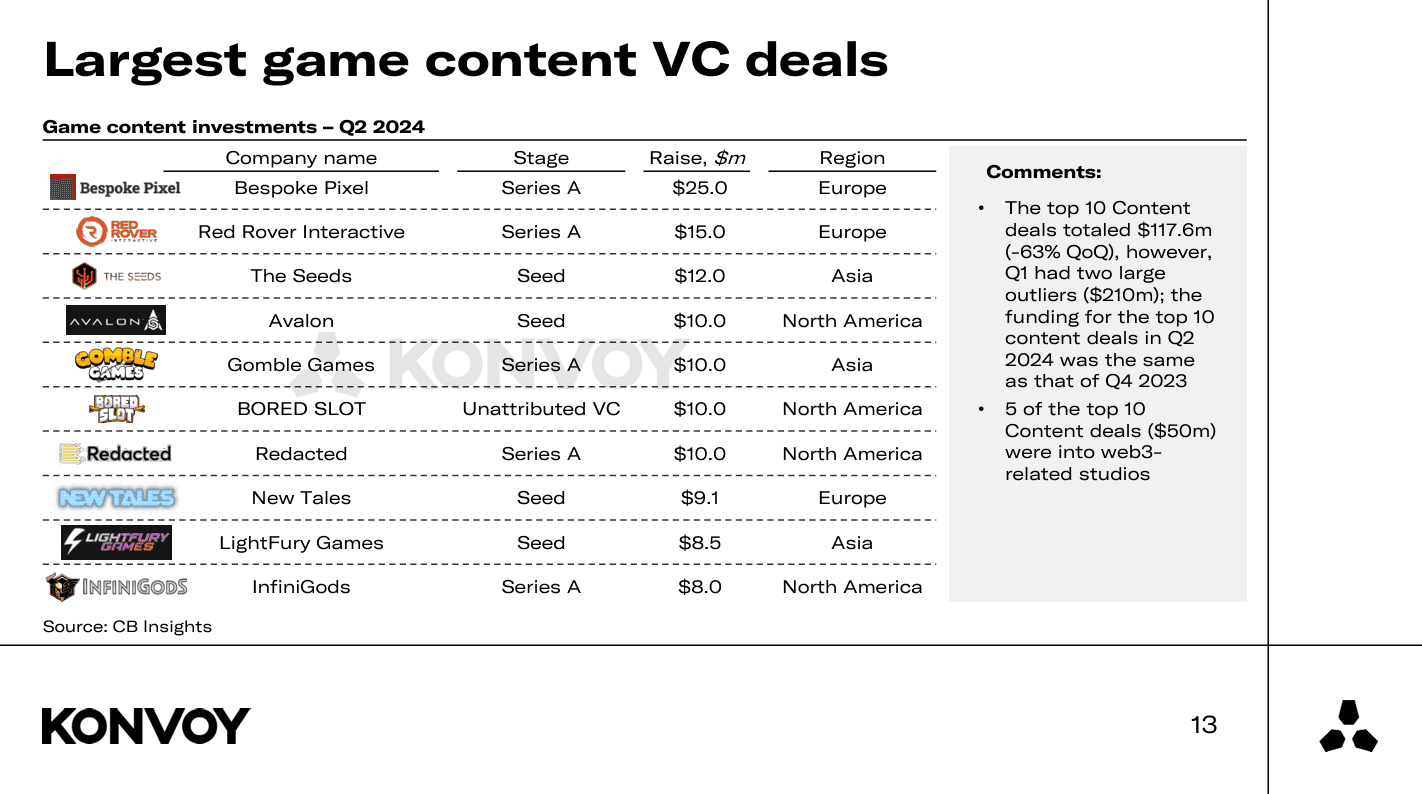

Content Development Deals

- Funding Trends: The top 10 content deals totaled $117.6 million, a 63% QoQ decrease, but consistent with Q4 2023 levels.

- Web3-Related Studios: Web3 remains a significant focus, with 5 out of the top 10 content deals involving web3-related studios. Avalon raised $10 million for their next-generation massively multiplayer online game featuring AI, currently in development. Redacted raised $10 million, led by the well-known VC Animoca Brands, to build a "web3 entertainment ecosystem". InfiniGods raised $8 million to continue building their portfolio of web3 games, most notably a mobile game called King of Destiny. Interestingly all three of these web3 deals were from North America.

Largest Game Content VC Deals

Shift in Investment Focus

A notable shift in investment focus was observed last quarter, with a significant increase in funding for companies focused on gaming technology, infrastructure, and platforms. This shift was driven by major investments such as a $140 million Series A into Zentry (formerly GuildFi) and a $45 million Series A into k-ID, a Konvoy portfolio company. These investments reflect a 175% QoQ increase in funding into the essential "picks and shovels" of the gaming industry.

Regional Investment Activity

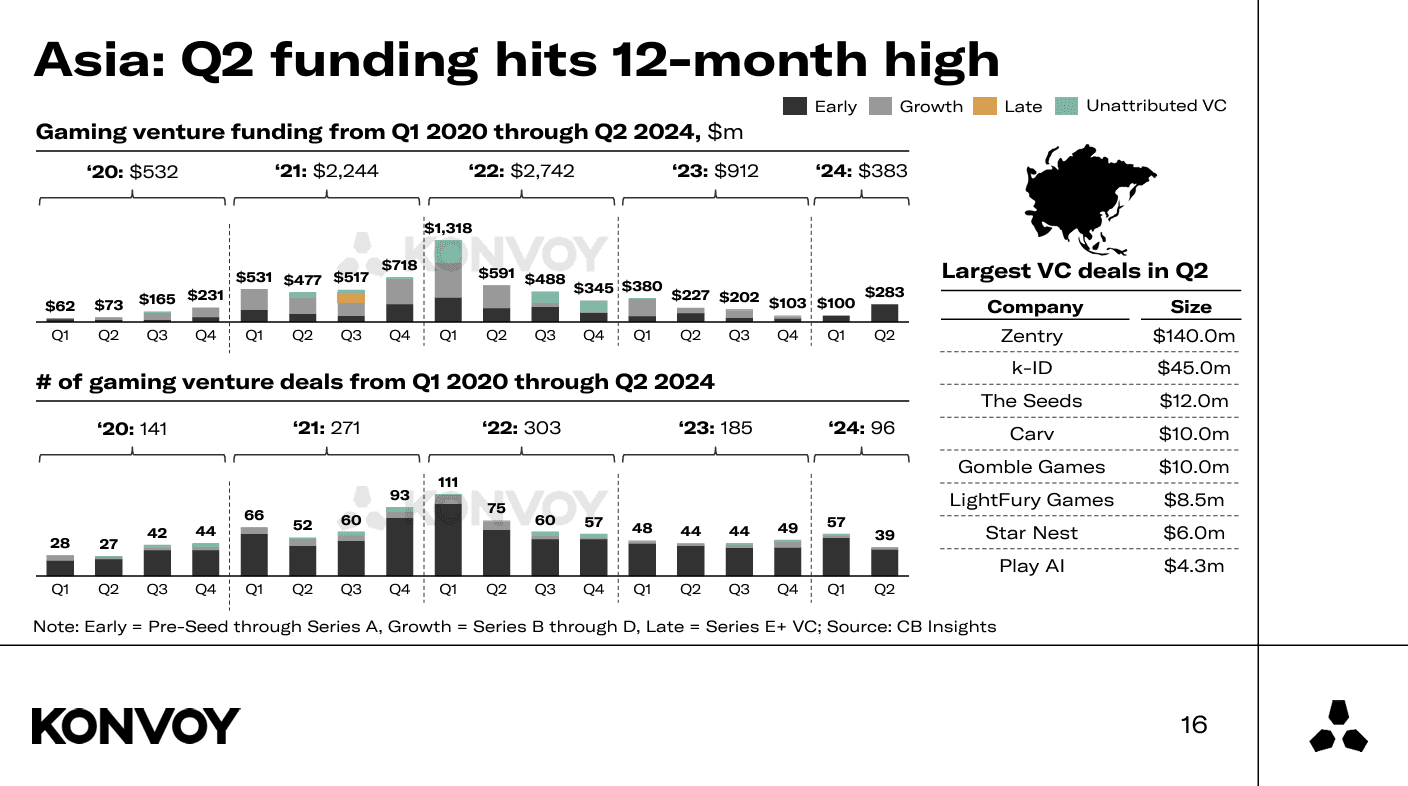

Asia continued to lead in investment activity, with 39 deals totaling $283 million. This region's dominance highlights the growing influence and market potential of the Asian gaming sector. Europe's funding was down 51% with a deal count of +32 QoQ. Australia only had one disclosed VC gaming deal done and South America had zero disclosed deals.

Asia: Q2 Funding Hits 12-Month High

Important Trends and Current Events

- YouTube and LinkedIn's Game Strategy: Both platforms have introduced gaming features, joining the competitive interactive entertainment landscape. This follows Netflix's significant investment in gaming since 2019.

- Olympic Esports Games: The introduction of esports into the Olympic Games marks a significant milestone for the industry.

- Epic Games Store and Fortnite Expansion: These platforms are expanding to iOS in the EU and Japan.

- Apple and TikTok Regulatory Challenges: Apple faces potential fines, while TikTok confronts a possible ban in the US.

- Voodoo's Acquisition of BeReal: The €500 million acquisition underscores the increasing consolidation in the gaming and tech sectors.

Voodoo Acquires BeReal for €500 Million

Deep Dive on YouTube and LinkedIn

In recent developments, YouTube and LinkedIn have introduced gaming features, joining the competitive landscape of interactive entertainment platforms. This move follows a trend initiated by Netflix in 2019, which identified gaming platforms like Fortnite as its primary competitors over traditional streaming services. Netflix subsequently invested over $1 billion into expanding its gaming business, featuring approximately 100 games on its platform, most of which were developed by external partners.

Netflix Games

YouTube, in a notable announcement this May, unveiled 75 available games on its platform, including popular titles such as Angry Birds Showdown, Cut the Rope, and Trivia Crack. This marks Google's return to gaming after discontinuing the cloud streaming service Stadia in January 2023. Meanwhile, LinkedIn has launched its first three games aimed at fostering professional engagement through casual competition among users globally. These games are strategically designed to encourage daily interaction with features like daily streaks and high scores.

This strategic expansion by YouTube and LinkedIn reflects a broader industry trend where major tech companies are diversifying into gaming to engage audiences traditionally drawn to interactive media. While this move has the potential to enhance user retention, questions remain about how YouTube and LinkedIn will carve out their niches in an already saturated gaming market.

YouTube and LinkedIn Introduce New Game Strategy

Final Thoughts

The Q2 2024 Konvoy Gaming Industry Report paints a nuanced picture of a dynamic gaming sector experiencing both challenges and opportunities. While overall venture funding has decreased, the surge in early-stage investments and a strategic pivot towards gaming technology, infrastructure, and platforms indicate strong underlying potential.

Regional trends, particularly in Asia, and significant moves by tech giants like YouTube and LinkedIn into gaming underscore the sector's growing significance. As the industry navigates these shifts, stakeholders can look forward to a landscape ripe with innovation and poised for growth, especially with promising prospects on the horizon for 2025 and beyond.