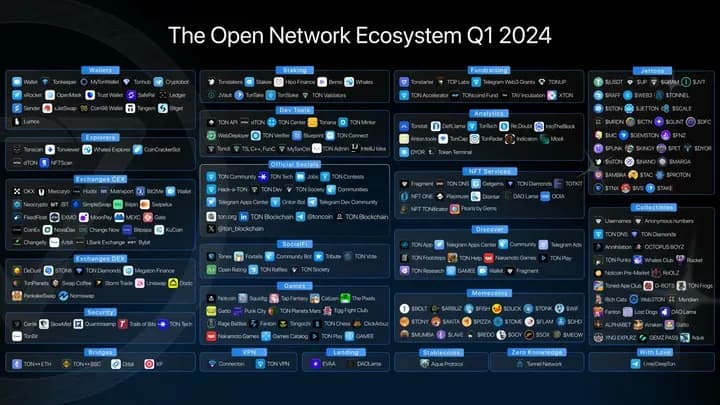

In this concluding installment of our four-part series on Telegram's gaming ecosystem within the Telegram Open Network (TON), we dive into the contrasting perspectives on its future potential. As Telegram seeks to carve out its niche in the global gaming market, it's essential to evaluate both the potential hurdles and opportunities that lie ahead.

By comparing the bear and bull cases, this article explores the challenges Telegram faces in achieving WeChat-like success and the unique advantages that could drive its growth. This analysis of data from a recent report by Delphi Digital will provide a comprehensive view of Telegram's position in the gaming sector, highlighting key factors that will influence its trajectory in the coming years.

Telegram vs WeChat

Can Telegram Beat WeChat?

The bear case for Telegram's gaming prospects largely stems from its comparison with WeChat, a dominant force in the social and gaming landscape in China. While some may draw parallels between Telegram's early-stage mini-game ecosystem and WeChat's initial growth trajectory.

significant differences suggest that Telegram may not achieve the same level of success in the near term. One primary concern is the scale and scope of competition. WeChat benefits from operating within China, where competition for user attention is less intense compared to the global market Telegram faces.

Gaming in China

Additionally, WeChat's centralized structure, backed by Tencent and favorable regulatory conditions, supports its extensive ecosystem, including seamless integrations with Chinese banks that simplify in-game purchases.

In contrast, Telegram users must first acquire Stars or deposit cryptocurrency, which complicates the purchasing process and may result in lower player-to-payer conversion rates. Another challenge lies in user acquisition (UA).

Telegram's current advertising networks are limited compared to WeChat's comprehensive data ecosystem, which includes detailed financial and social information about users. This data richness allows WeChat to optimize ad performance and user targeting effectively, a level of granularity that Telegram's privacy-centric approach does not currently match.

Can Telegram Out Perform WeChat

Is Telegram an On-Ramp for Web2?

Despite these challenges, the bull case for Telegram gaming is robust, driven by several unique features of the TON ecosystem. Telegram's substantial user base, approximately 900 million monthly active users (MAU), provides a significant onramp from web2 to web3, positioning it as a major player in the crypto market.

Unlike centralized exchanges, Telegram is fundamentally a social app, making it more amenable to integrating casual and social features such as mini-games. The compatibility between Telegram users and social-adjacent applications, including gaming, is promising.

Anomaly Telegram Game

Even with a significant portion of users potentially being bots, metrics for simple games on Telegram have already outperformed many high-budget titles. This success suggests that with appropriate user acquisition strategies and effective integration of live operations and monetization, Telegram mini-games could achieve substantial growth.

Moreover, Telegram's focus on improving third-party integrations and leveraging user behavior insights could enhance its gaming ecosystem. By adopting successful strategies from platforms like WeChat, Telegram can potentially overcome current limitations and foster a more dynamic gaming environment.

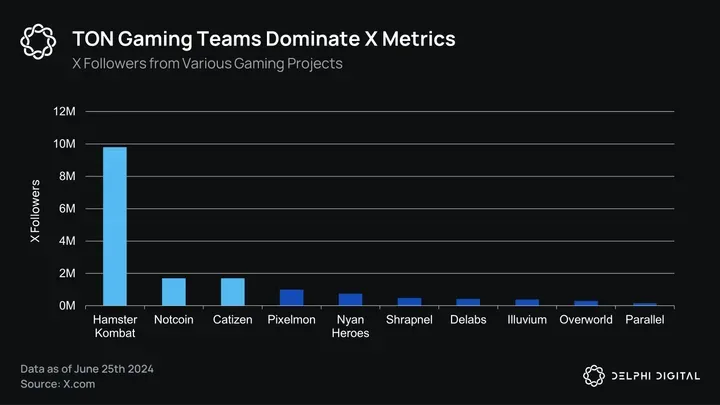

Telegram-based crypto games such as Hamster Kombat have seen a significant rise in popularity. Hamster Kombat now boasts over 150 million players. This figure marks a 50% increase from just a week ago, illustrating the game's quick ascent within the Telegram community.

Telegram App

Final Thoughts

In summary, Telegram's gaming ecosystem within the TON framework has made notable strides, evidenced by the success of games like Catizen, Notcoin, and Hamster Kombat. While the platform faces significant challenges, such as intense global competition and limitations in user acquisition and monetization compared to WeChat, it also presents unique opportunities.

Telegram's vast user base and its potential to integrate social and gaming experiences offer a promising foundation for growth. The real test for Telegram will be leveraging its current momentum to focus on user retention and lifetime value, adapting successful strategies from other platforms, and enhancing developer support.

As Telegram continues to evolve, its ability to navigate these factors will determine its future success in the competitive gaming landscape. This concludes our series on Telegram's gaming landscape. For more details, readers can refer to the original blog post by Delphi Digital.

Source: Delphi Digital