As the American gaming market slows toward the end of the year, Europe is offering insight into how the industry is adapting to economic and structural challenges. Over the last decade, Europe’s gaming sector experienced rapid growth, with total publishing revenue rising from $6.3 billion in 2015 to nearly $20 billion by 2023.

Recent figures show a modest decline to $18 billion, reflecting a shift away from acquisition-driven growth toward operational discipline, audience retention, and differentiated content. This adjustment signals a more cautious phase for European publishers as capital flows tighten and demand stabilizes.

CD Projekt’s Path to Recovery

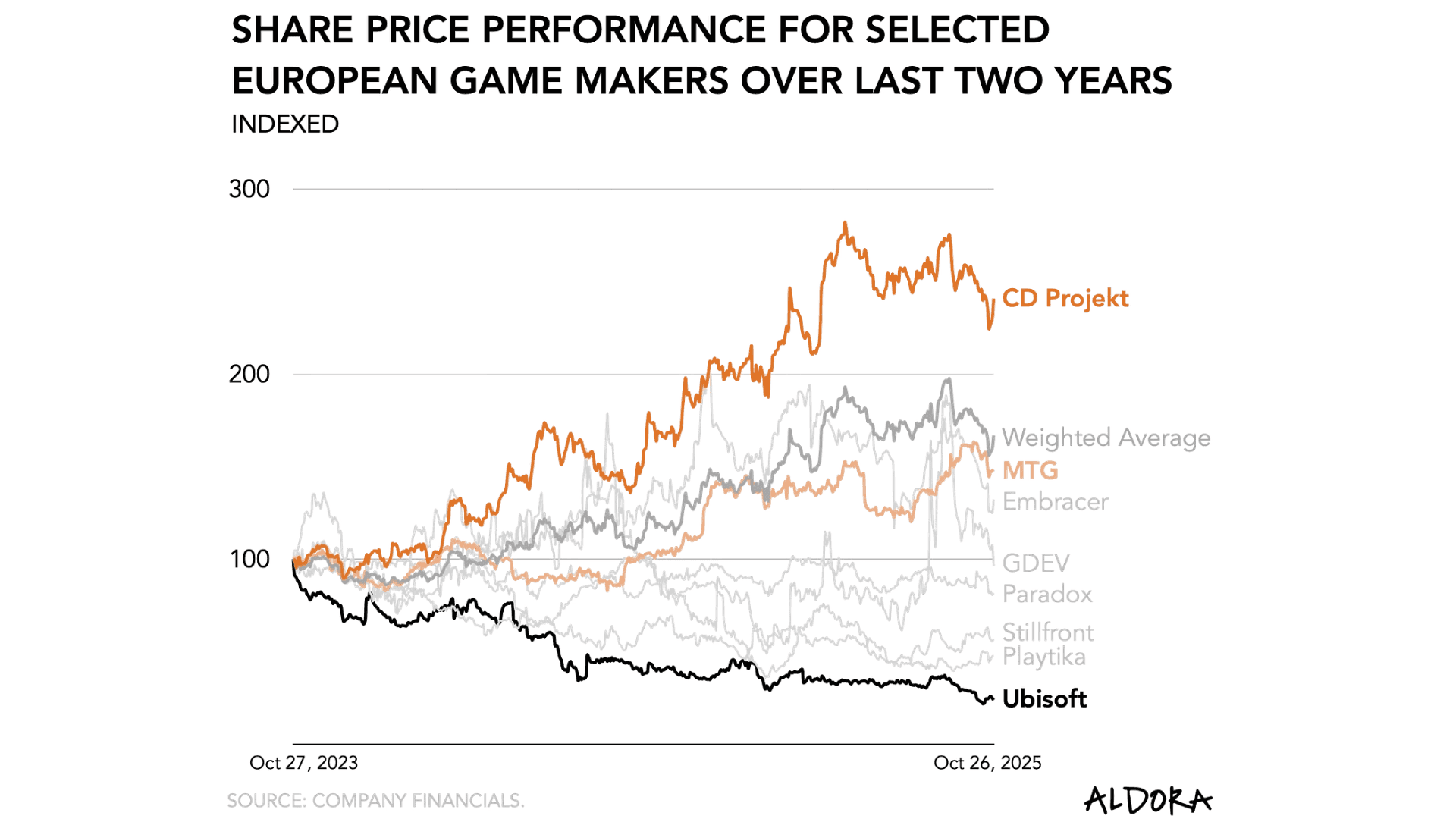

Polish studio CD Projekt exemplifies recovery through disciplined management. The troubled launch of Cyberpunk 2077 initially damaged the company’s reputation, but careful internal reforms and cost management have helped rebuild trust among players. Lifetime sales of the game have reached 35 million copies, and recent quarterly revenue grew 30 percent year-over-year, with a profit margin of 46 percent.

CD Projekt took early action to stabilize operations, implementing cost controls and restructuring shortly after Cyberpunk 2077’s issues. This proactive approach has positioned the studio more favorably than some peers. However, CD Projekt faces a near-term challenge as no major releases are planned until 2026, with development ongoing for titles such as The Witcher 4. While investors may be cautious about the slow release schedule, the strategy prioritizes polished and well-executed games for players.

Ubisoft’s Restructuring Efforts

French publisher Ubisoft illustrates the complexities of maintaining independence in today’s European gaming market. The company recently postponed its earnings, prompting investor concern, and has implemented cost-cutting measures, including laying off 1,500 employees. Much of its current revenue relies on older titles, reflecting the broader challenge of sustaining growth without frequent new releases.

Ubisoft has pursued partial divestment of its most popular intellectual property to Tencent to manage debt, while avoiding a full sale to private equity. The company’s ongoing “Creative Houses” reorganization, which promotes semi-autonomous teams for major franchises, highlights a shift in operational strategy.

Ubisoft’s size and cultural significance mean that any major collapse would have broader industry consequences, including potential labor displacement and impacts on subscription gaming services. Despite these pressures, the company continues to release content across platforms, including plans to expand franchises like Rabbids on Roblox.

MTG and the Rise of Structural Flexibility

Stockholm-based Modern Times Group (MTG) represents a different approach, focusing on structural reinvention and operational discipline. MTG allows its studios significant creative autonomy while maintaining strict oversight over marketing, capital allocation, and strategic planning.

This approach has enabled growth across multiple game types, including strategy and word puzzle titles, while preserving profitability. In Q2 2025, MTG doubled sales and maintained a 22 percent profit margin, despite increasing user acquisition spending by over 50 percent, guided by a return-on-investment model.

MTG’s strategy emphasizes adaptability, responding to new app store regulations, increased competition from Asian developers, and tightening platform economics. Unlike acquisition-focused models, MTG’s disciplined structure prioritizes sustainable growth and long-term efficiency.

Europe’s Gaming Outlook

The experiences of CD Projekt, Ubisoft, and MTG illustrate the range of strategies European publishers are adopting to navigate economic pressures and evolving market conditions. CD Projekt focuses on stabilizing operations and rebuilding trust, Ubisoft is undergoing complex restructuring to sustain its position, and MTG demonstrates the potential of disciplined, flexible operational models.

Europe’s gaming industry appears to be moving away from growth driven primarily by size and acquisitions, toward a focus on adaptability, operational efficiency, and cultural and regulatory advantages. Long-term competitiveness may depend on how well studios can leverage local talent, manage costs, and produce high-quality, engaging content in a crowded global market.

Source: SuperJoost

Frequently Asked Questions (FAQs)

Why is Europe’s gaming market in transition?

Europe’s gaming sector is adjusting to slower growth, tightening capital, and evolving consumer demand, shifting from acquisition-led expansion to operational discipline and sustainable content.

How has CD Projekt recovered from Cyberpunk 2077?

CD Projekt rebuilt player trust through cost management, internal reforms, and disciplined development. Its strong quarterly revenue and high profit margins reflect this recovery.

What challenges is Ubisoft facing?

Ubisoft is navigating investor skepticism, cost-cutting measures, and reliance on older titles. The company has partially divested IP to manage debt while restructuring teams under its Creative Houses model.

How does MTG’s strategy differ from other European publishers?

MTG emphasizes structural flexibility, studio autonomy, and disciplined capital allocation. It adapts to platform changes and competition while maintaining profitability through careful user acquisition strategies.

What does the future hold for European gaming?

Europe’s gaming industry will likely compete on adaptability, operational efficiency, and quality content rather than scale alone. Studios that manage costs, retain talent, and produce engaging games are better positioned for long-term success.