The gaming industry is witnessing one of its largest transactions to date as Saudi Arabia’s Public Investment Fund (PIF) spearheads a $55 billion acquisition of Electronic Arts (EA). The buyout, which values EA at $210 per share in cash, will take the company private and is expected to close in EA’s fiscal Q1 2027. According to SuperJoost, PIF will roll over its approximate 10 percent stake, and CEO Andrew Wilson is set to remain in his current role.

Electronic Arts $55 Billion Acquisition

Electronic Arts $55 Billion Acquisition

The announcement caught many observers off guard, partly due to the speed with which the deal progressed. Initial discussions between EA’s management and a private equity bank in early August had stalled, giving the impression that no major transaction was imminent. The involvement of JP Morgan as the financing bank confirmed the seriousness of the deal, signaling that the buyout would move forward.

Valuation and Market Implications

The $55 billion valuation has raised questions among industry analysts. The offer represents roughly a 20 percent premium over EA’s market value and equates to nearly 19.6 times the company’s annual cash flow (EBITDA). For comparison, Microsoft’s 2023 acquisition of Activision Blizzard was valued at 21.5 times EBITDA, but that occurred in a stronger market environment.

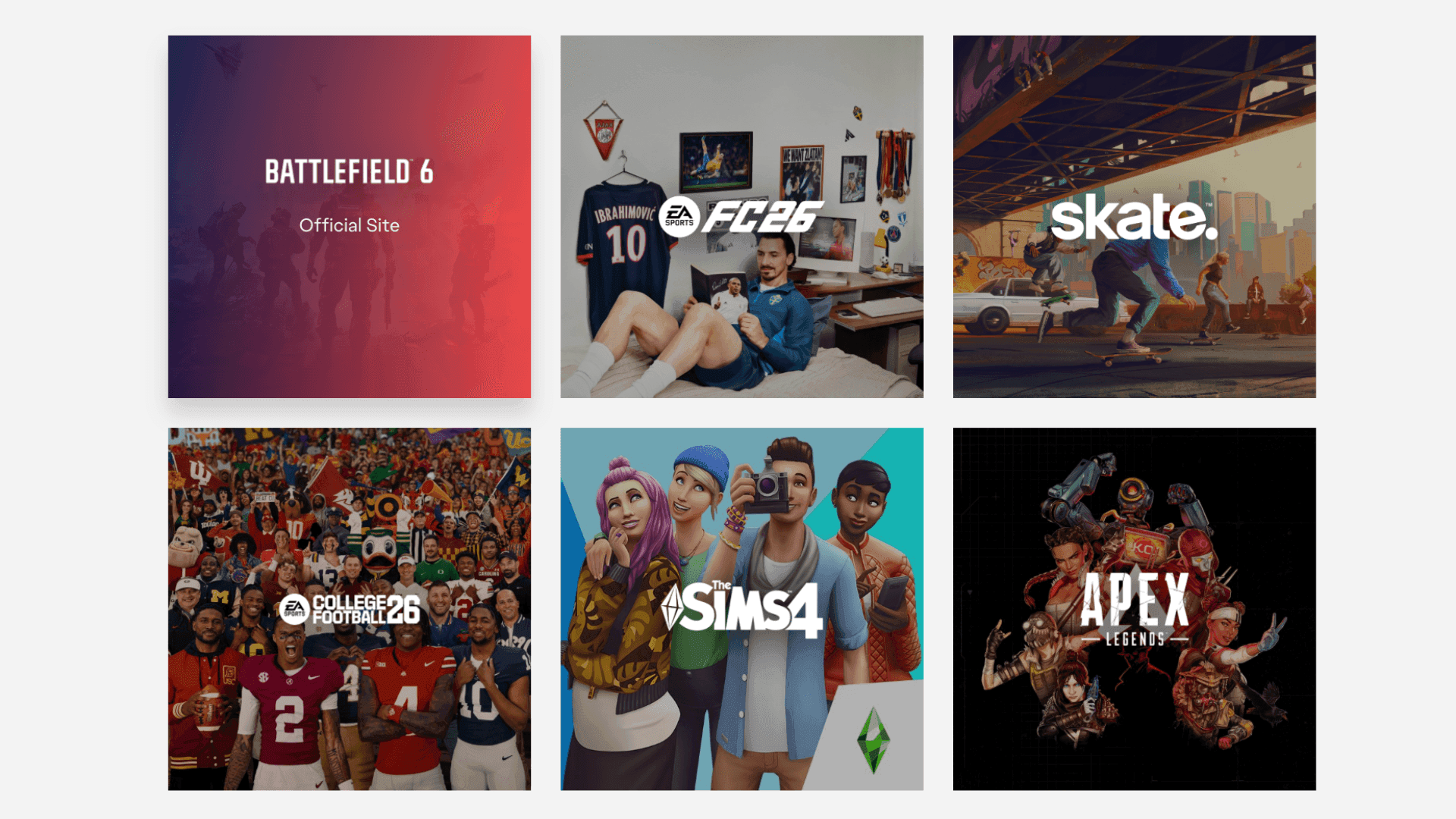

EA’s portfolio remains heavily reliant on sports titles such as Madden, EA Sports FC, and NHL, which contribute around 70 percent of its earnings. Its live-service games, including Apex Legends, have reached a plateau, and the company’s near-term growth hinges partly on the performance of Battlefield 6. With projected revenue growth of 5 to 7 percent annually through 2027, some analysts suggest the multiple is difficult to justify purely on financial metrics.

Despite these concerns, PIF appears to be evaluating EA not as a standalone asset but as part of a broader strategy to establish a significant presence in the global gaming industry.

Electronic Arts $55 Billion Acquisition

Saudi Arabia’s Strategic Gaming Investments

The acquisition aligns with Saudi Arabia’s broader Vision 2030 strategy, which aims to diversify the country’s economy beyond oil. Gaming is seen as a sector with global reach, cultural influence, and long-term monetization potential. Between 2023 and 2025, PIF focused its gaming investments in U.S.-based companies, increasing holdings from $13.1 billion to $25 billion while reducing exposure to Asian gaming firms.

Key investments include Scopely, Niantic’s gaming division, and stakes in Take-Two and Nintendo. PIF’s subsidiary, Savvy Games Group, has nearly tripled in value over the last few years, driven by successful mobile titles and strategic acquisitions. The approach suggests a clear focus on American gaming companies as vehicles for both financial and cultural influence.

Electronic Arts $55 Billion Acquisition

Potential Impacts on EA’s Operations

Becoming privately held could provide EA with more operational flexibility. Freed from the pressures of quarterly earnings reports, the company may focus more on creative projects and long-term strategies. This could be particularly important for upcoming releases like Battlefield 6, which will be closely watched as a measure of the company’s competitive standing.

However, some restructuring appears likely. Given the dominance of sports titles in EA’s portfolio and their alignment with Saudi Arabia’s sports investment goals, the company may be divided into distinct divisions focused on sports and non-sports content. Additionally, regulatory review will likely play a role. The Committee on Foreign Investment in the United States (CFIUS) may examine the deal for national security considerations, given the transfer of a major U.S. publisher to a foreign sovereign wealth fund.

Electronic Arts $55 Billion Acquisition

Gaming as a Cultural and Strategic Asset

The acquisition underscores a broader trend in which video games are valued not just as entertainment but as instruments of cultural influence. Saudi Arabia’s investments demonstrate a strategy that combines financial returns with the potential for soft power. By positioning EA at the center of its gaming portfolio, PIF is signaling that interactive entertainment is now considered both economically significant and geopolitically relevant.

The deal highlights the evolving role of gaming companies in global markets. While financial metrics may not fully justify the valuation, the broader strategic ambitions of PIF suggest that the significance of the acquisition extends beyond traditional M&A considerations.

FAQ

Who is acquiring Electronic Arts? Saudi Arabia’s Public Investment Fund (PIF) is leading a $55 billion acquisition of EA, with support from Silver Lake and Affinity Partners.

When is the deal expected to close? The transaction is expected to close in EA’s fiscal Q1 2027.

Will EA’s CEO remain in charge? Yes, Andrew Wilson is set to continue as EA’s CEO following the buyout.

Why is Saudi Arabia investing in EA? The acquisition aligns with Saudi Arabia’s Vision 2030 strategy to diversify its economy, increase cultural influence, and develop a strong presence in global entertainment and gaming.

How will the acquisition affect EA’s games? Privatization may allow EA to focus on long-term development rather than quarterly earnings, potentially benefiting new projects like Battlefield 6. Some restructuring may occur, particularly between sports and non-sports divisions.

Will the deal face regulatory scrutiny? Yes, the Committee on Foreign Investment in the United States (CFIUS) is expected to review the deal due to national security and data considerations.

How does this compare to other gaming acquisitions? At $55 billion, it is the second-largest deal in gaming history, behind Microsoft’s $68.7 billion purchase of Activision Blizzard in 2023. The multiple of 19.6 times EBITDA is high relative to EA’s growth profile but consistent with PIF’s broader strategy in the sector.