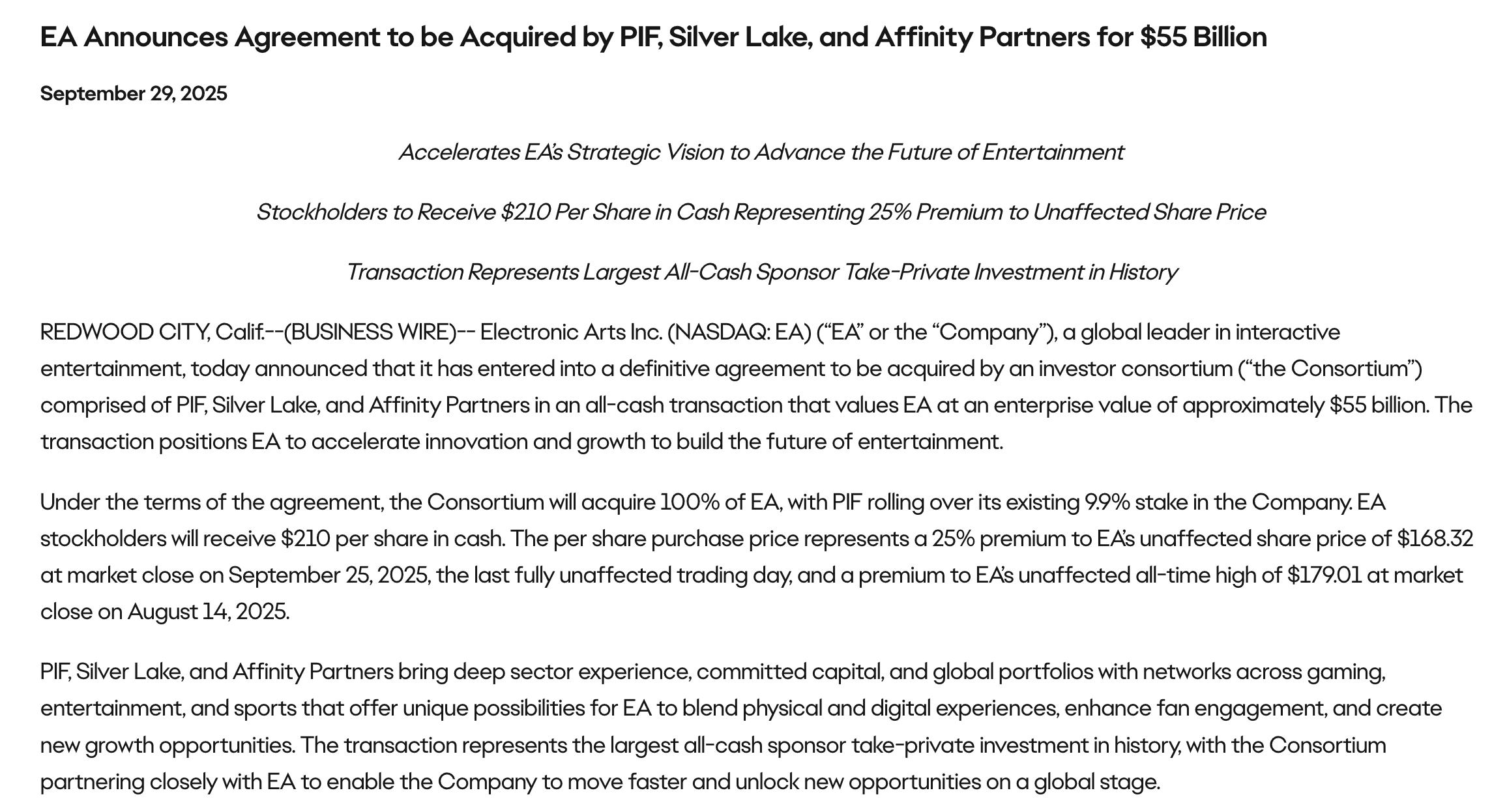

Electronic Arts has officially announced its sale to a consortium led by Saudi Arabia’s Public Investment Fund (PIF), Jared Kushner’s Affinity Partners, and private equity firm Silver Lake. The transaction, valued at $55 billion, provides EA shareholders $210 per share in cash, representing a sizable premium over recent trading prices. The agreement gives the investor group full control of EA, with PIF expanding its influence after previously holding a 9.9% stake in the publisher.

EA To Be Sold for $55 Billion

Wilson Stays as CEO

Despite the change in ownership, EA’s leadership will remain consistent. Andrew Wilson will continue as CEO, guiding the company through what he described as “a new era of opportunity.” In his statement, Wilson credited EA’s teams with building some of the most recognizable franchises in gaming and emphasized the company’s ongoing commitment to players worldwide.

Statements from the new investors echoed that sentiment. PIF’s Turqi Alnowaiser highlighted the potential for long-term growth, while Silver Lake’s Egon Durban said the firm plans to invest heavily in EA’s future. Kushner called EA “an extraordinary company with a world-class management team.”

EA To Be Sold for $55 Billion

Questions Around Debt and Restructuring

The acquisition includes $20 billion in debt financing, which has raised concerns about possible cost-cutting measures. Large-scale acquisitions often lead to restructuring, but no official details have been announced. Wilson reassured staff in a memo that EA’s values and approach to game development would not change. He told employees the acquisition represents recognition of their creativity and innovation, while also framing it as an opportunity to expand EA’s presence in entertainment, sports, and technology.

Deal Still Awaiting Approval

While the agreement has been announced, it is not yet complete. The deal remains subject to regulatory approval, a shareholder vote, and other closing conditions. EA expects the process to be finalized in the first quarter of its 2027 fiscal year. Once complete, EA stock will be removed from public markets. The agreement also includes a termination fee of more than $1 billion if the deal is canceled.

EA To Be Sold for $55 Billion

PIF’s Growing Role in Gaming

The Saudi Public Investment Fund has been steadily building a larger footprint in the global gaming industry. Through its Savvy Games Group, PIF has acquired Scopely for $4.9 billion and purchased Niantic’s gaming division for $3.5 billion. It also holds stakes in Activision Blizzard, Take-Two, Embracer Group, and Nintendo.

With EA under its control, PIF now owns one of the largest publishers in the industry, known for franchises such as FIFA, Madden, and Battlefield. The acquisition is the second-largest in gaming history, behind Microsoft’s $75.4 billion purchase of Activision Blizzard.

About PIF

PIF is one of the world’s most impactful investors, enabling the creation of key sectors and opportunities that help shape the global economy, deliver returns and drive the economic transformation of Saudi Arabia. The gaming and esports industry is one of its priority sectors, contributing to the diversification of the local economy, while at the same time driving investment returns.

About Silver Lake

Silver Lake is a global technology investment firm, with more than $110 billion in combined assets under management and committed capital and a team of professionals based in North America, Europe and Asia. Silver Lake’s portfolio companies collectively generate approximately $260 billion of revenue annually and employ approximately 448,000 people globally.

About Affinity Partners

Affinity Partners is a Miami-based investment firm founded in 2021 by Jared Kushner. With over $5.4B under management and a team of 30+ professionals, Affinity focuses on growth equity, financial services, and technology investments at scale, with a flexible mandate across industries and geographies.

Frequently Asked Questions (FAQs)

Who bought Electronic Arts?

Electronic Arts was acquired by a consortium including Saudi Arabia’s Public Investment Fund, Jared Kushner’s Affinity Partners, and Silver Lake.

How much did the EA deal cost?

The acquisition was valued at $55 billion, with shareholders receiving $210 per share in cash.

Will Andrew Wilson remain CEO of EA?

Yes, Andrew Wilson will continue as CEO following the acquisition.

When will the EA acquisition be finalized?

The deal is expected to close in the first quarter of EA’s 2027 fiscal year, pending regulatory and shareholder approval.

Why is Saudi Arabia’s PIF investing in gaming?

The PIF has been expanding into gaming as part of its broader investment strategy, acquiring or investing in several companies to strengthen its presence in the industry.

What does this mean for EA employees?

No layoffs or restructuring have been announced. However, the deal includes $20 billion in debt financing, which has raised questions about possible cost-cutting measures.

Is this the largest gaming acquisition ever?

No, the largest remains Microsoft’s $75.4 billion acquisition of Activision Blizzard. EA’s $55 billion deal is the second-largest in gaming history.