In the ever-evolving landscape of the gaming industry, data-driven insights play a crucial role in understanding market trends. In a follow up from Drake Star's Global Gaming Market Report for Q2 2023 their newest publication shares data from Q3 of 2023. The gaming sector continues to witness significant changes in funding and M&A activities. In this article, we will break down the key points from the report and provide valuable insights for the web3 gaming community.

Q3 2023 Highlights

During Q3, gaming giants rekindled their M&A initiatives after a period of relative quiet. Tencent took the lead with five strategic moves, including a majority acquisition of Techland, securing its place among the top three largest deals of the year. Playtika expanded its casual gaming portfolio with the acquisitions of Innplay Labs and Youda Game, signaling a continued focus on diversification.

Goldman Sachs, joined by General Atlantic and LEGO, made headlines with a substantial $1.72 billion all-cash offer to acquire gamified e-learning platform Kahoot. Other notable players like Take-Two/Rockstar Games, Behavior Interactive, Capcom, and Roblox were also active, accounting for over 40% of M&A deals in the PC/console segment.

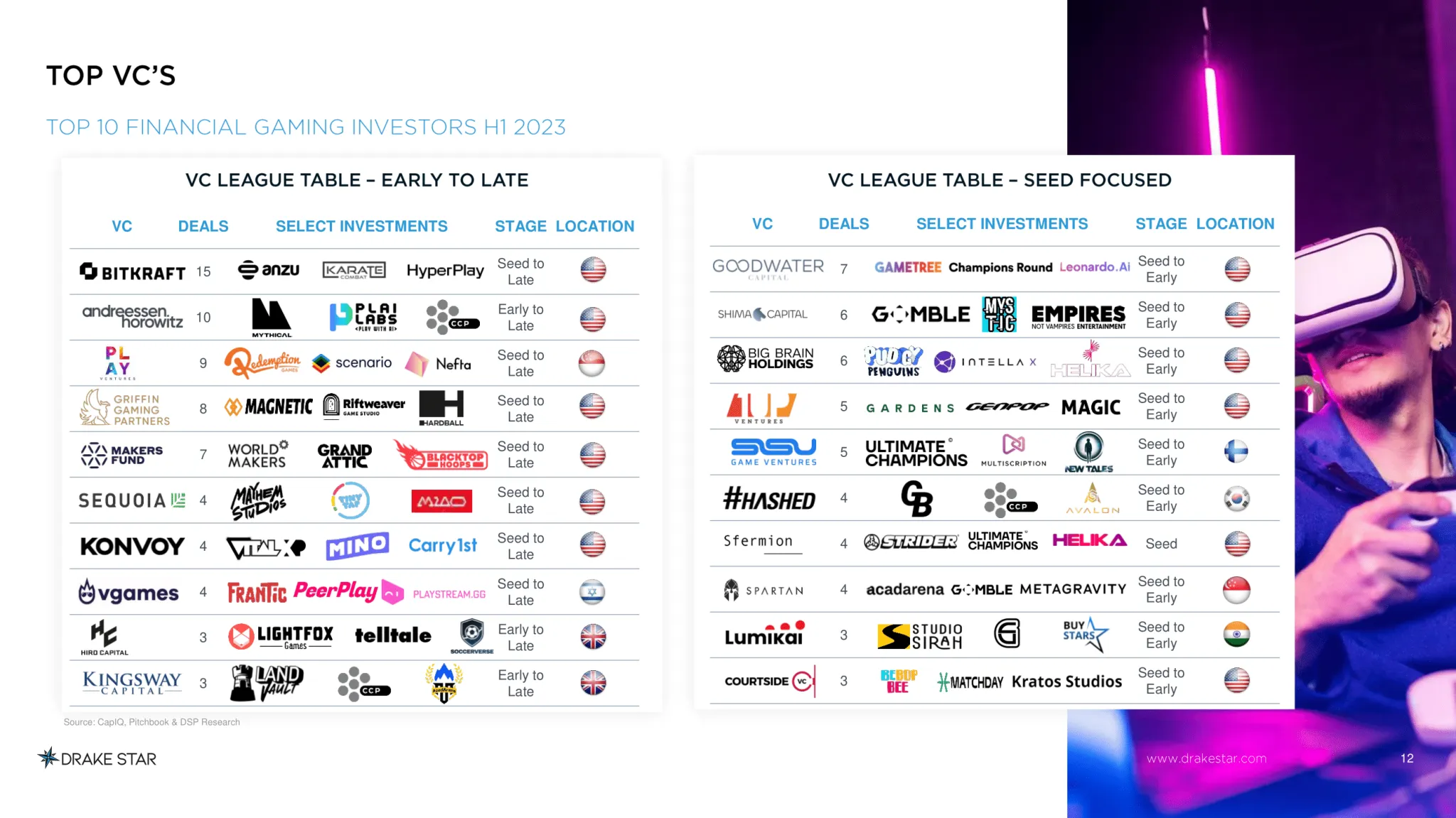

Simultaneously, private financing thrived, with over $1 billion raised in 185 deals during Q3. Early-stage companies secured over 85% of these financings, with standout raises for Candivore ($100M), Second Dinner ($90M), Story Protocol ($54M), Futureverse ($54M), Inworld AI ($50M), and Veloce Media Group ($50M). Venture capital heavyweights BITKRAFT, Andreessen Horowitz, Play Ventures, Griffin Gaming, and Vgames led the league table, affirming a robust financial landscape.

M&A

In the third quarter, 33 M&A deals were announced with a total value of $5 billion. One such deal, worth $1.72 billion, was the acquisition of Kahoot!, an interactive learning platform. Among other significant deals, Playtika acquired Youda Games ($165M) and Innplay Labs ($300M) for a total of $465 million. Tencent acquired Techland (developer of Dying Light) and Visual Arts (a Japanese game studio). Sumo Group acquired Midoki, a mobile game development studio. Supercell acquired a majority stake in Ultimate Studio. Capcom acquired Swordcanes Studio, a support studio that worked on Street Fighter Six. Take2/Rockstar Games acquired GTA 5 and RDR 2 modding team Cfx.re to support community activities. Roblox acquired Speechly, a voice moderation startup, to further expand into voice chat-based interactions by adding AI moderation tools. These strategic moves underscore the industry's dynamic evolution and global expansion.

Private Placements

In the third quarter, private investments decreased to 185, with a total transaction volume of $1 billion. In terms of the number of transactions, this is the lowest figure since the second quarter of 2022. In terms of volume, the only lower quarter in the last 2.5 years was the second quarter of 2023.

Candivore, the maker of the hit multiplayer match-3 puzzle game Match Masters, raised $100M through a minority acquisition by Haveli Investments. Second Dinner, developer of social and casual mobile games, received $90M financing at $400M pre-money valuation from Griffin Gaming Partners and NetEase Games. Story Protocol, an IP-collaboration platform, raised $54M in a round led by a16z. Futureverse, a web3 metaverse platform for creators, received $54M financing by 10T Holdings and Ripple. Veloce Media Group, media platform for racing community in gaming, raised $50M from GEM Digital to support launch of its web3 tech.

These funds are earmarked for further innovation, market expansion, and the exploration of new gaming horizons, emphasizing the industry's resilience and appetite for growth.

Public Markets

Public markets experienced significant activity, with Embracer's restructuring program raising $182 million and Nazara securing over $61 million for strategic investments. AppLovin's $1.5 billion loan refinance signifies a buoyant financial market eager to support key players in their growth endeavors.

Q4 2023 & 2024 Outlook

Q4 commenced with the groundbreaking Microsoft-Activision deal, setting an optimistic tone for the quarter. Drake Star anticipates a steady rise in M&A activities throughout 2024, with Tencent, Sony, Take-Two, and Savvy/Scopely emerging as prominent buyers. Embracer is likely to divest some studios, and the overall M&A landscape is expected to witness increased participation from various strategies.

Investor caution in mid/later-stage financings is predicted to persist, while early-stage companies will continue to attract healthy investments. The allure of AI and web3 technologies remains strong, setting the stage for transformative developments.

Relevance for Web3 Gaming

As the gaming industry surges forward, the data presented in Drake Star's Q3 2023 Global Gaming Report holds particular relevance for the emerging era of web3. With a focus on web3, blockchain, AI, and transformative technologies, this data becomes a compass for developers, investors, and enthusiasts navigating the evolving landscape of digital entertainment. As the sector braces for increased funding, strategic partnerships, and technological innovation, the insights provided in this report serve as a valuable guide for stakeholders shaping the future of gaming in the web3 era.