Introduction

In the ever-evolving landscape of the gaming industry, data-driven insights play a crucial role in understanding market trends. According to Drake Star's Global Gaming Market Report for Q2 2023, the gaming sector continues to witness significant changes in funding and M&A activities. In this article, we will break down the key points from the report and provide valuable insights for the gaming community.

Early-Stage Funding Takes Center Stage

In Q2 2023, the gaming industry saw a shift in funding preferences, with a strong emphasis on early-stage companies. Despite a modest decline in private financing, the financing activity remained robust, indicating the industry's resilience. Michael Metzger, a partner at Drake Star, highlighted the positive indication of opportunities, as there are now more gaming investors than ever before.

During the second quarter, Drake Star recorded 196 private funding deals totaling $663 million in disclosed value. However, the number of deals decreased by 7% compared to the previous quarter, and the disclosed deal value saw a substantial decline of nearly 50%. Early-stage start-ups emerged as the primary beneficiaries, with over 80% of Q2's closed deals and over 50% of disclosed funding directed towards them.

Metzger attributed this shift to the uncertainty about a potential recession both within and outside the gaming industry. As a result, investors have become more selective in their investments, setting higher bars for late-stage investments.

Mergers and Acquisitions Drive Gaming Consolidation

While the number of M&A deals in Q2 remained relatively stable, the disclosed deal value experienced a notable spike. The acquisition of mobile game publisher Scopely by Savvy Games Group for a staggering $4.9 billion accounted for nearly 80% of the $6.2 billion total quarterly deal value. Additionally, Sega's acquisition of Rovio contributed another 12.5% ($776.2 million) to the quarter's M&A deal value.

The reorganization and pause on investments by Embracer created an opening for Savvy Games Group, which possesses a substantial $38 billion fund, to lead the consolidation drive in the gaming industry. Drake Star predicts that SGG will continue to pursue further acquisitions and make minority investments in public companies like EA and Nintendo. There is also speculation that "Savvy might acquire a large PC/console publisher," presenting exciting prospects for industry watchers.

Public Gaming Stocks and IPO Opportunities

In Q2 2023, public gaming stocks tracked closely with the S&P 500, showcasing a 14.6% growth in the Drake Star Gaming Index. The VanEck Video Game Tech ETF experienced an even more impressive 30.1% surge, largely influenced by Nvida's historic growth.

Drake Star believes that if gaming companies continue to perform in line with the market, Q4 of 2023 or Q1 of 2024 may see a rise in opportunities for IPOs. This could be particularly advantageous for later-stage start-ups that may find it challenging to secure funding through traditional means.

Moreover, private equity firms have shown a growing interest in acquiring publicly-traded gaming companies. One prime candidate is Playtika, a mobile game developer with considerable potential for further growth and development.

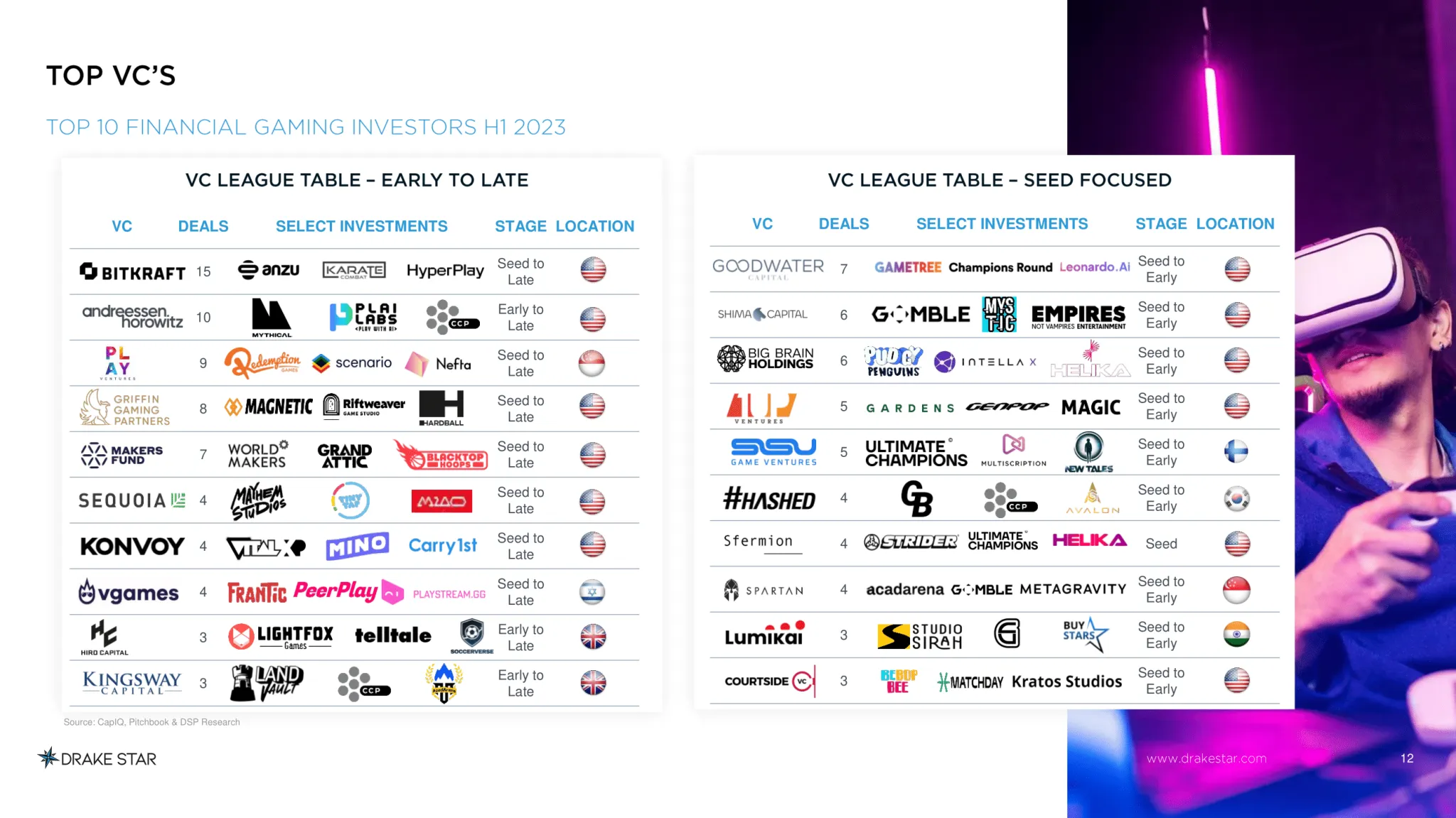

Top Venture Capitalists

BITKRAFT emerged as the leader in the VC league table for the first half of the year, followed closely by Andreessen Horowitz, Griffin Gaming, Makers Fund, and Play Ventures.

Q3 Expectations and Industry Impact

Early indications from Q3 2023 are promising, especially with Microsoft's acquisition of Activision Blizzard surviving the FTC's challenge. This deal's closure is expected to reduce uncertainty across the gaming industry, leading to potential positive impacts on gaming stocks.

Conclusion

The gaming industry's Q2 2023 report highlights a noteworthy shift towards early-stage funding and continued consolidation through M&A activities. As the industry evolves, opportunities for IPOs and acquisitions will create exciting prospects for investors and stakeholders. The future remains promising, and gaming enthusiasts can anticipate significant developments in the months ahead. As we eagerly await Q3 results, the gaming sector continues to captivate investors and players alike with its ever-growing potential.

Share this article and tag us on any of our socials to let us know.