The latest data from Circana reveals that in October 2023, the American gaming market faced a 5% decline, totaling $4.036 billion. Hardware sales experienced a significant drop of 23%, amounting to $327 million. However, amidst the downturn, the PlayStation 5 maintained its lead as the best-selling system in both units and dollar terms.

US Gaming Market Down 5% Totaling $4B

US Gaming Market Down 5% Totaling $4 Billion

Content sales, inclusive of games, saw a 4% decrease, reaching $3.562 billion. This dip is attributed in part to the release schedule, with last year's Call of Duty launch affecting October sales. Accessory sales also slipped by 2%, amounting to $147 million. The overall volume of the American gaming market as of October is $43.4 billion, reflecting a modest 2% increase from the previous year.

US Gaming Market Down 5% Totaling $4B

Top games in October included Marvel’s Spider-Man 2, Super Mario Bros. Wonder, and Assassin’s Creed: Mirage, spanning both PC and consoles. Hogwarts Legacy maintained its position as the most successful game of the year, with Marvel’s Spider-Man 2 rising to the 4th position in American sales for 2023.

US Gaming Market Down 5% Totaling $4B

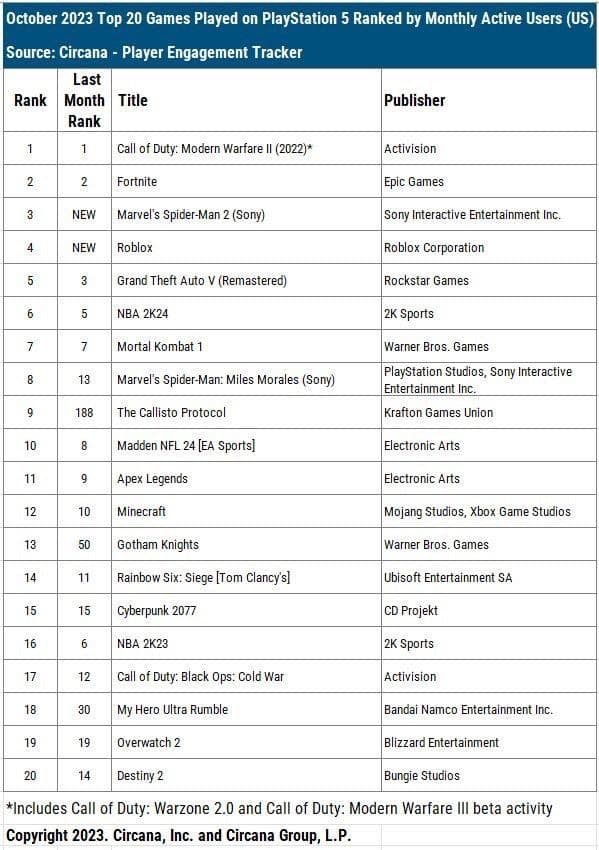

Mobile gaming spending in the USA grew by 2.1% in October. Leading the revenue charts were MONOPOLY GO!, Royal Match, and Roblox. Platform-wise, October's Monthly Active Users (MAU) on PlayStation were dominated by Call of Duty: Modern Warfare II (Call of Duty: Warzone 2.0), Fortnite, and Marvel’s Spider-Man 2. On Xbox, the leaders were Call of Duty: Modern Warfare II, Fortnite, and GTA V. Steam's MAU leaders included Counter-Strike 2, Baldur’s Gate III, and Cyberpunk 2077, with The Finals beta securing the 4th position.

US Gaming Market Down 5% Totaling $4B

Relevance to Web3 Gaming

As we analyze these findings, it becomes evident that the trends observed in October 2023 hold significance for the emerging landscape of web3 gaming. The decline in traditional gaming markets underscores the importance of exploring decentralized and blockchain-based gaming ecosystems. Understanding player preferences, sales patterns, and platform engagement in traditional gaming provides valuable insights for developers and stakeholders looking to adapt and innovate within the evolving web3 gaming space. Stay tuned for ongoing coverage as we explore the intersection of traditional and web3 gaming in the months ahead.