Niko Partners, a leading market research firm, unveiled its China Games Market 2023 Half-Year Update Report, offering a comprehensive overview of the gaming landscape in China. In this article, we break down the report and analyze the market, economic conditions, regulatory changes, and ongoing industry trends to provide valuable insights for industry stakeholders with relevance for web3 gaming.

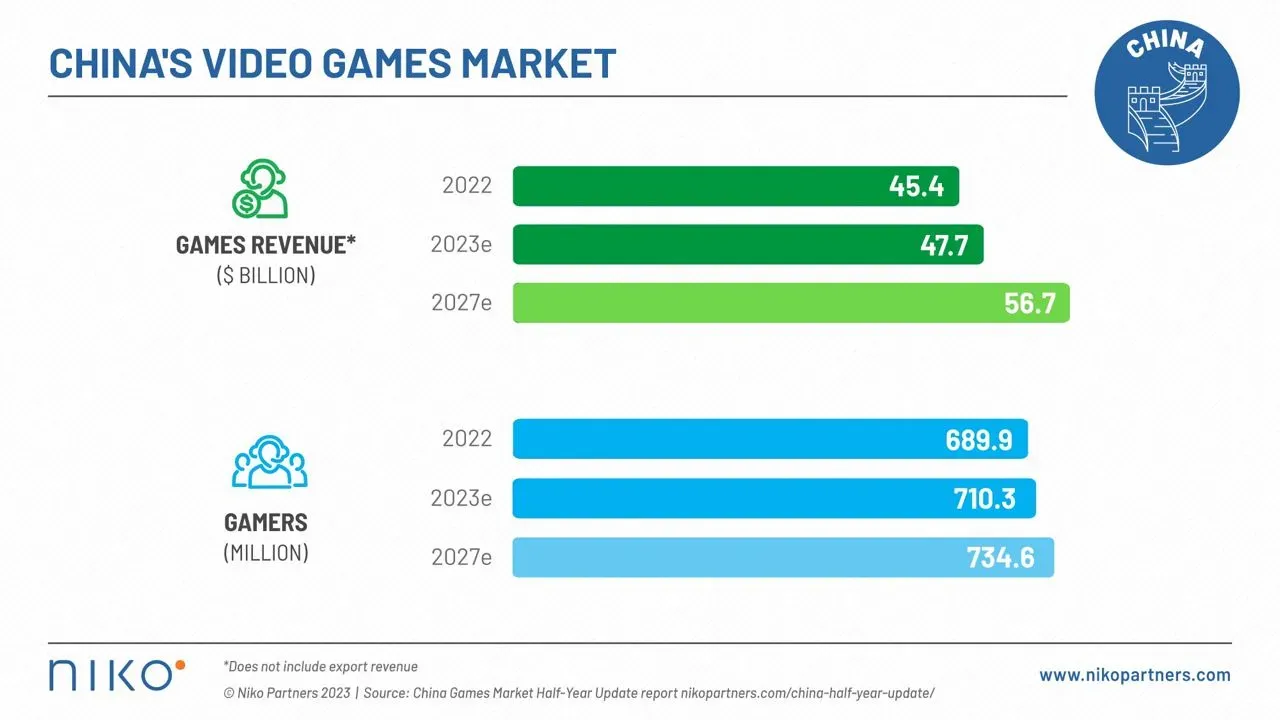

In 2023, Niko Partners predicted a noteworthy 5.2% YoY growth in video game software and services revenue, reaching a total of $47.76 billion. This positive trajectory followed a 2.5% decline in 2022, signaling a significant recovery for the gaming industry in China.

The report also highlighted that the total number of gamers reached 710.3 million in 2023, marking a 1.63% increase from the previous year. Additionally, the Monthly Average Revenue Per User (ARPU) reached $5.60, underlining the continued financial engagement of Chinese gamers.

Key drivers of growth in 2023 included the restoration of a regular game approval process, a surge in successful new game launches, increased spending on existing titles, and sustained access to unlicensed games on PC and consoles. Despite these positive trends, the report acknowledged that the weak Yuan and macroeconomic challenges may have partially offset the overall growth in the gaming market.

Looking ahead:

Niko Partners forecasts that China's video game market will surpass $56.7 billion in 2027, with a 5-Year Compound Annual Growth Rate (CAGR) of 4.5%. The projection aligns with the June 2023 forecast, indicating stability in the industry's growth trajectory. By 2027, the number of gamers is expected to grow to 734.6 million, demonstrating a 5-Year CAGR of 1.0%, in line with the earlier predictions.

Anticipated growth areas in 2024 and beyond include the integration of web3 tech, AI-generated content in gaming, new game launches driven by normalized approvals, increased spending in games, and the continual expansion of the esports industry.

The National Press and Publication Administration (NPPA) has already approved a total of 844 domestic and import video games in 2023, surpassing the figures of 512 and 755 games approved in 2022 and 2021, respectively. The NPPA recently published a draft guideline titled “Measures for the Administration of Online Games”. The draft regulations consolidate existing regulations into one document and introduce new clarifications and amendments across 8 chapters containing 64 articles.

Approximately 10 of the 64 articles contain new or amended guidelines representing the largest regulatory changes since additional restrictions were imposed on Chinese youth gamers in September 2021. The draft is under review for the next 30 days, to allow stakeholders to provide feedback and changes to be implemented.

Notably, Chinese game companies have shifted their focus from external investments to internal expansion, establishing newly owned studios as part of their growth strategy.

China retains its position as the world's largest esports market, boasting over 400 million fans and generating $445 million in industry revenue. With the easing of COVID controls, 53% of esports events have returned to in-person or hybrid formats in 2023, according to Niko's Asia & MENA Esports Tracker.

Additionally, recent data from Niko's China Games & Streaming Tracker reveals a 6.2% YoY increase in total viewers and tips for Douyu, Huya, and Bilibili, indicating a growing interest in game live-streaming platforms.

Relevance for Web3:

These findings hold particular significance for the evolving realm of web3 gaming, where decentralized technologies and blockchain integration are transforming traditional gaming paradigms.

As the gaming industry experiences a robust recovery in China, stakeholders in web3 gaming are presented with a unique opportunity to align their strategies with the growing market. The predicted 2027 forecast of $56.7 billion and 734.6 million players signifies a substantial user base for potential web3 gaming adoption. The integration of AI-generated content, new game launches, increased spending, and the booming esports industry, as outlined by Niko Partners, aligns with the principles of innovation and decentralization inherent in web3 gaming.

Furthermore, the shift towards internal expansion by Chinese game companies and the focus on owned studios offer a fertile ground for collaboration between traditional gaming giants and emerging web3 platforms. The increased government approvals and the rise in game licenses demonstrate a more favorable regulatory environment, encouraging the exploration of blockchain and decentralized technologies in gaming ecosystems.

Final Thoughts:

Niko Partners' insightful report not only sheds light on the current state and future trajectory of China's gaming market but also emphasizes the potential integration and synergy between these findings and the dynamic landscape of web3 gaming. As the industry continues to evolve, stakeholders are urged to leverage these insights to navigate the intersection of traditional and decentralized gaming, unlocking new possibilities for innovation and growth.