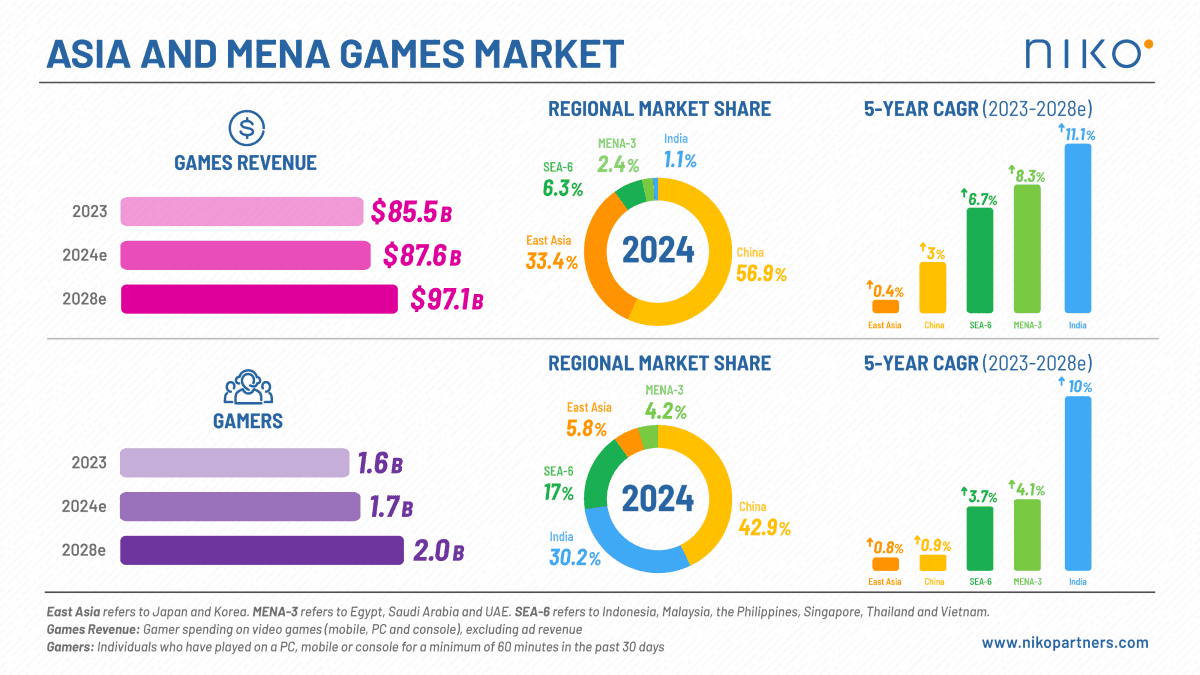

According to a new report by Niko Partners, the combined gaming markets of Asia and the MENA region are expected to reach a total value of $96 billion by 2029. As of 2024, the total market volume stood at $86.6 billion. Niko Partners forecasts an average annual growth rate of 2.1% over the next five years, despite a period of stagnation in 2024. The report positions these regions as the largest contributors to the global gaming industry, currently accounting for more than half of the world’s gaming revenue and user base.

Asian and MENA Gaming Market Projections

Asian and MENA Gaming Market Projections

The number of players in Asia and MENA is expected to reach 2 billion by the end of 2029, surpassing the combined player base of the rest of the world. Within Asia, China, Japan, and South Korea are projected to be the leading contributors in terms of revenue. By 2029, these three countries are expected to generate 88.7% of the total revenue from the Asian and MENA markets.

India is highlighted as a key growth market. It leads in projected average annual growth rate in both revenue and player numbers, with a forecasted year-over-year increase of 12.3% in revenue and 8.8% in players. By 2025, India is expected to have 724 million players, which will represent 30.3% of the player base across the regions under review.

However, it will account for only 1.2% of total revenue, indicating a high number of users with relatively low average spending. Thailand is identified as the largest and fastest-growing gaming market in Southeast Asia. Its market volume is projected to reach $2.4 billion by 2029, reflecting steady regional growth and increased user participation.

Asian and MENA Gaming Market Projections

Growth Trends in MENA Markets

The MENA-3 countries—Saudi Arabia, the United Arab Emirates, and Egypt—are forecasted to grow at an annual rate of 6.8% through 2029. Among these, the UAE is expected to reach an Average Revenue Per User (ARPU) exceeding $100 by the end of the forecast period. These figures indicate continued investment in gaming infrastructure and rising consumer engagement in the region.

Changing Demographics and Platform Shifts

A growing share of the gaming audience in these regions is made up of female players. In the MENA-3 region, women now represent 37% of the gaming population, while in India, this figure has reached 40%. These numbers show a significant increase from previous years, when female participation was below 20%. This shift points to broader demographic engagement in gaming and highlights changing social dynamics.

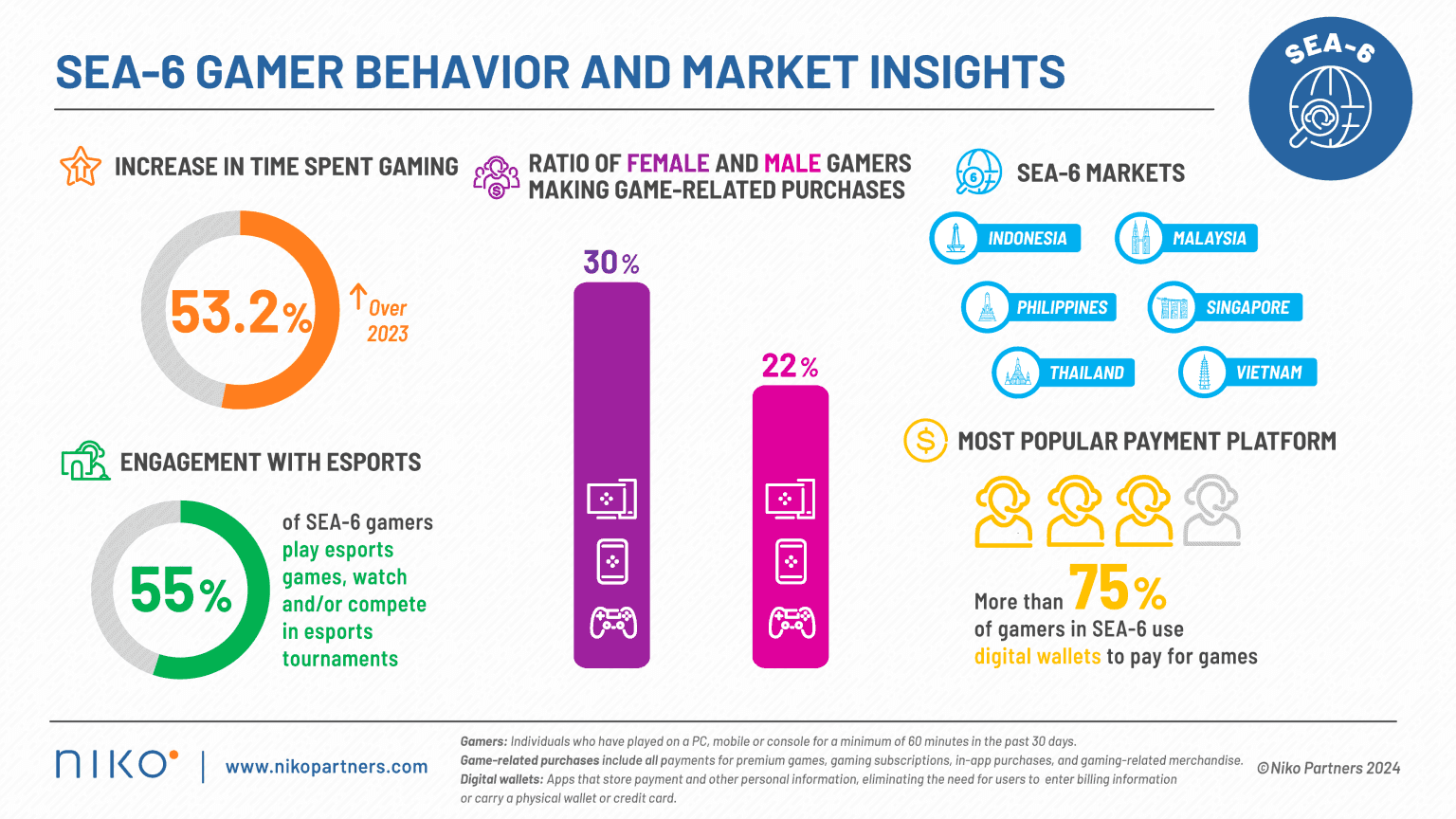

The report also notes that web3 technologies, eSports events, and the introduction of new gaming consoles are contributing to changes in how games are consumed. These developments are encouraging mobile-first players to explore PC and console platforms, further diversifying the market. Additionally, the growing number of paying users across both Asia and MENA supports the outlook for continued expansion in revenue and engagement.

Asian and MENA Gaming Market Projections

Conclusion

Despite a slowdown in 2024, the gaming markets in Asia and MENA are expected to grow steadily over the next five years. With a projected market volume of $96 billion by 2029 and a player base of 2 billion, these regions will remain central to the global gaming industry. Key drivers include rising user engagement, increased female participation, technological shifts, and regional investments in gaming infrastructure. Niko Partners’ findings indicate sustained long-term potential for industry stakeholders operating in these markets.