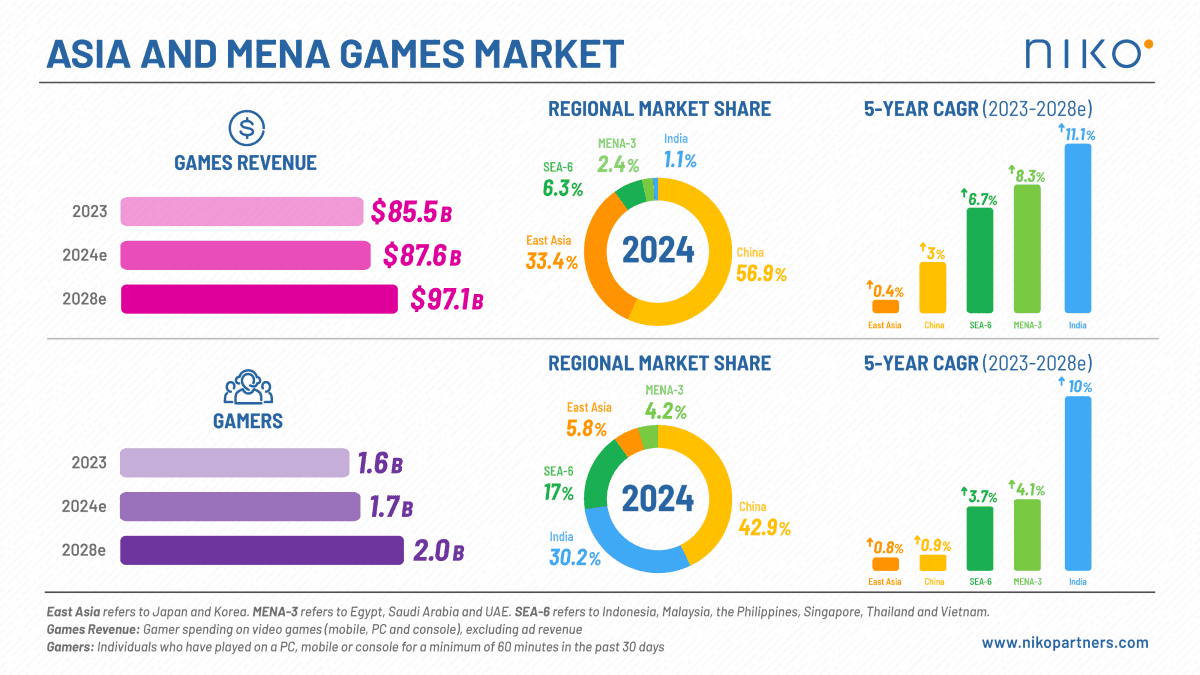

Niko Partners has released the half-year update to its Asia & MENA Video Game Market Model, showing stronger-than-expected growth across the region. Based on data from the second half of 2025 and insights from the 2025 Asia & MENA Gamer Behavior Reports, the market is projected to reach $88.97 billion this year, marking a 2.7% increase compared to 2024. The number of gamers across Asia and MENA is also expected to grow 2.7% to 1.70 billion.

The updated figures reflect improved consumer behavior, favorable regulatory conditions in several markets, and solid performance across mobile, PC, and console platforms. Analysts suggest that the region could represent a $100 billion opportunity by 2029 if current trends continue.

Mobile and PC Games Driving Momentum

Growth in mobile and PC games remains a key factor behind the region’s performance. Evergreen intellectual properties and new cross-platform titles offering AAA experiences are contributing to stronger player engagement. The increase in paying gamers in both Asia and MENA is supporting revenue growth, while broader accessibility and engagement of under-served audiences, including female gamers and fans of niche genres, have expanded the overall market.

India and Emerging Markets Show Rapid Growth

India, along with MENA and Southeast Asia, is projected to be among the fastest-growing regions in both revenue and gamer numbers through 2029. India is expected to reach 500 million gamers in 2025, rising to 700 million by 2029. Average revenue per user (ARPU) is also expected to increase, with player spending predicted to exceed $1.5 billion by 2028.

The introduction of the PROG Act in India, which banned real money gaming while increasing government support for video games and esports, is seen as a positive regulatory development for the domestic market. Southeast Asia presents a mixed picture, with Malaysia, the Philippines, and Vietnam showing strong growth potential, while economic and regulatory challenges have led to a downward revision in forecasts for Thailand and Indonesia.

Mature Markets Maintain Strong Revenue

China, Japan, and South Korea remain the largest markets in Asia & MENA, projected to account for $88.8 billion in player spending by 2029. South Korea’s mobile segment is showing improved revenue performance, while the launch of the Nintendo Switch 2 in Japan has strengthened console growth projections. In China, the continued success of both new and legacy games has led to upward revisions in long-term forecasts across all platforms.

Console Gaming Gains Traction

Although consoles currently account for just 6.3% of revenue in the region, this segment is expected to be the fastest-growing through 2029. The Nintendo Switch 2 launch, increased investment in free-to-play titles, subscription services, and the release of Grand Theft Auto VI are expected to drive further adoption. Rising demand for AAA and premium experiences is also contributing to a growing player base for console titles, benefiting major platform holders like Sony and Microsoft.

Source: Niko Partners

What is the projected size of the Asia & MENA video game market in 2025?

The market is expected to reach $88.97 billion in 2025, representing a 2.7% increase from 2024.

Which regions are driving the fastest growth?

India, MENA, and Southeast Asia are projected to grow the fastest in terms of revenue and gamer numbers through 2029.

How many gamers are expected in Asia & MENA in 2025?

The region is expected to have 1.70 billion gamers in 2025, a 2.7% increase compared to last year.

What platforms are contributing most to growth?

Mobile and PC games are leading the market, while console gaming, supported by the Nintendo Switch 2 and next-generation titles, is the fastest-growing segment.

How is India’s gaming market changing?

India is projected to reach 500 million gamers in 2025, with ARPU growth expected to surpass $1.5 billion by 2028. Regulatory support from the PROG Act is also encouraging domestic video game and esports development.

What is NikoIQ?

NikoIQ is Niko Partners’ online knowledge base providing market models, forecasts, gamer insights, and ongoing analysis for Asia & MENA markets.