Animoca Brands, a company known for its investments across blockchain gaming and the broader web3 ecosystem, is preparing to enter the U.S. public market. Instead of pursuing a traditional IPO, the company plans to achieve a Nasdaq listing through a reverse merger with fintech firm Currenc Group Inc. (CURR). The move is currently in a three-month exclusivity period while both sides negotiate terms.

The deal would turn Animoca Brands into a publicly traded company in the United States. After the merger, the combined entity would keep the Animoca Brands name.

Deal Structure and Valuation

As currently proposed, Animoca shareholders would retain 95% ownership of the merged company, while existing Currenc shareholders would receive the remaining 5%. Prior to the announcement, Currenc’s market valuation implies that the combined company would be valued at roughly $2.4 billion once listed.

Currenc operates in areas including AI-driven services for financial institutions and digital remittance platforms. Most of these businesses are planned to be spun off into a separate organization, keeping the Nasdaq-listed entity focused on blockchain and digital assets.

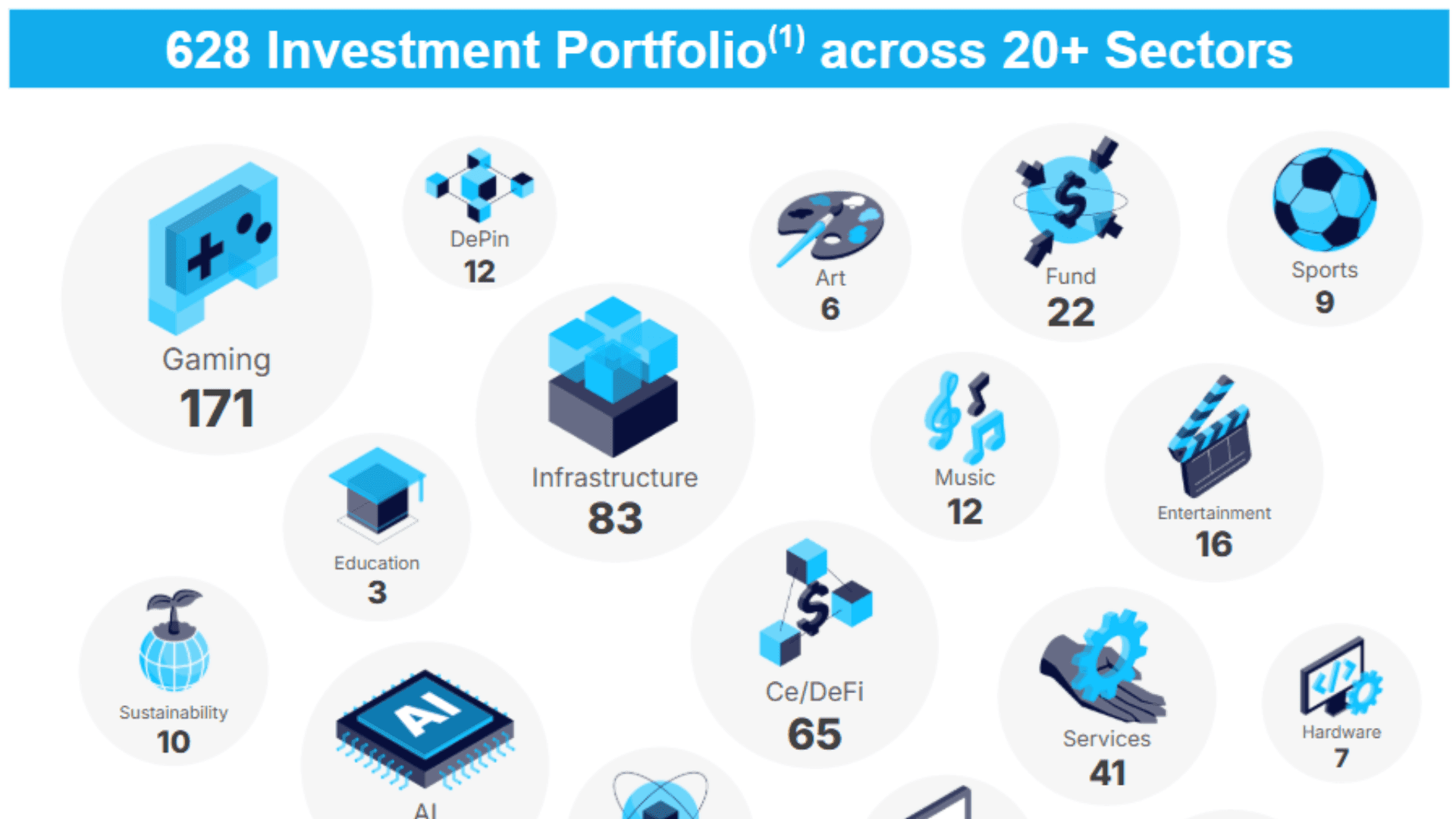

Animoca Brands reported $4.3 billion in total assets at the end of 2024. The company also states that it currently holds 628 investments across blockchain companies and web3 projects. These range across decentralized finance, NFTs, gaming, DeSci, and AI-related technologies.

Focus on Growth in the Digital Asset Market

The merger would position Animoca Brands as what it describes as a diversified digital assets company on the Nasdaq exchange. According to executive chairman Yat Siu, this structure aims to give investors direct exposure to the developing digital economy, including web3 gaming, altcoins, and decentralized platforms.

Siu noted that the goal is to introduce a new type of investable asset class built around emerging blockchain technologies. The company views public market access as a way to capture broader investor participation and fuel additional growth across its portfolio.

Expected Timeline

Both companies expect the merger agreement to be finalized sometime in 2025. The deal remains subject to shareholder approval, regulatory review, and standard closing conditions. If completed, the reverse listing will allow Animoca Brands to debut on the Nasdaq without going through the longer and more rigid IPO process.

Frequently Asked Questions (FAQs)

What is Animoca Brands?

Animoca Brands is a global investment company focused on blockchain, gaming, NFTs, and web3 technology. It currently holds hundreds of investments in digital asset and gaming projects.

Why is Animoca Brands using a reverse merger instead of an IPO?

A reverse merger allows Animoca to become a publicly traded company more quickly and with fewer procedural requirements than a traditional IPO, while still gaining access to public markets and U.S. investors.

What company is Animoca merging with?

Animoca Brands plans to merge with Currenc Group Inc., a fintech company listed on the OTC market.

What is the expected valuation of the new company?

Based on Currenc’s valuation before the announcement, the combined entity is expected to be valued at approximately $2.4 billion.

When is the deal expected to be completed?

The parties expect to finalize the agreement in 2025, pending shareholder and regulatory approvals.

What will happen to Currenc’s existing business operations?

Currenc’s existing operations related to AI financial tools and digital remittance services are expected to be spun off into a separate company.