Gaming has evolved into a global phenomenon, with the PC and console market set to generate a staggering $95.2 billion in revenue in 2023. This robust industry is not only a major player in the entertainment world but also a pivotal cultural touchpoint for diverse player communities across the globe. In this report, we dive into the state of the PC and console gaming industry, explore generational shifts in gaming audiences, and unveil the power of community, culture, and social media in driving game success. We also discuss the relevance of these findings to the world of web3.

TikTok & Newzoo: Navigating PC and Console Gaming Market in 2023

PC and Console Market

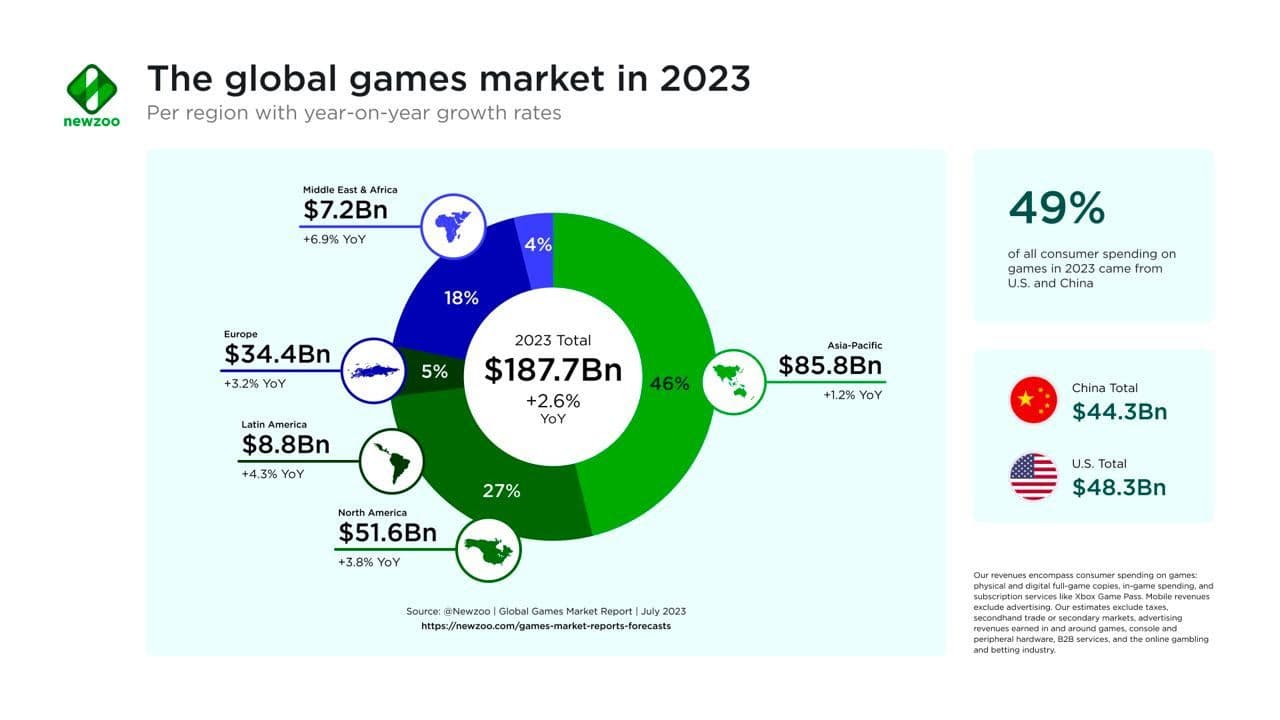

According to Newzoo, the PC and console gaming market is projected to generate $95.2 billion in 2023. Newzoo also estimates there are over 892 million PC gamers and 629 million console players worldwide. In 2022, seven out of the top 20 games by Monthly Active Users (MAU) were released after 2020. Notably, five of them were franchise games, such as FIFA and Call of Duty.

TikTok & Newzoo: Navigating PC and Console Gaming Market in 2023

However, 18 out of the top 20 MAU games were released before 2022. The Call of Duty series continues to dominate the charts, with six of the top 20 games coming from this iconic franchise. Hogwarts Legacy is the only 2023 release that managed to break into the top 20 by MAU in the first half of the year.

TikTok & Newzoo: Navigating PC and Console Gaming Market in 2023

Interestingly, the number of game releases on Steam is on the rise, with 12,690 games released in 2022. Nevertheless, the number of games that managed to secure an audience of 50,000 players or more is dwindling, both on PC and consoles.

TikTok & Newzoo: Navigating PC and Console Gaming Market in 2023

Audience and Engagement

The gaming audience is expanding across different generations. Generation Z is expected to see a 10% increase in gamers by 2023, and Baby Boomers are also joining the gaming community, with a 3% increase projected by 2023. However, Generation X is experiencing a decline, with a 4% decrease in the number of gamers.

TikTok & Newzoo: Navigating PC and Console Gaming Market in 2023

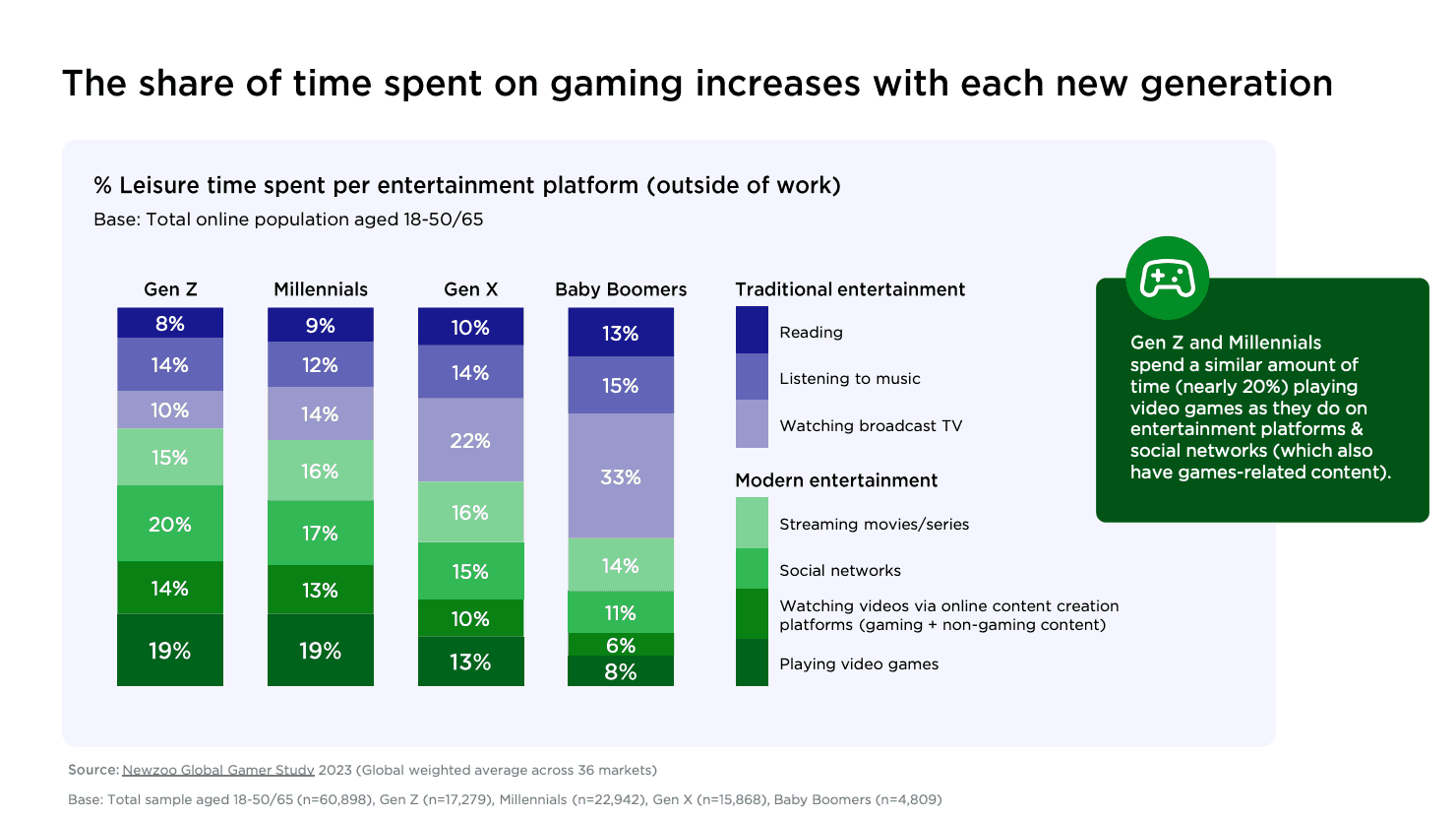

Gen Z and Millennials spend a similar amount of time (nearly 20%) playing video games as they do on entertainment platforms & social networks (which also have games-related content).

Beyond merely playing games, younger generations have enthusiastically embraced the phenomenon of game streaming. A remarkable 70% of Generation Alpha engages in watching others play, emphasizing the importance of community and cooperative play.

TikTok & Newzoo: Navigating PC and Console Gaming Market in 2023

Notably, PC and console games remain popular among representatives of all generations. For Generation Z and Millennials, games are more than just entertainment; they engage with games by discussing them with friends and family, reading news, and even listening to podcasts. Interestingly, the gender breakdown is roughly 60% men vs 40% women across generations. This split indicates that gaming is still more popular among males but that the disparity is getting smaller.

TikTok & Newzoo: Navigating PC and Console Gaming Market in 2023

Spending Habits

When it comes to spending in games, Baby Boomers, Generation X, Millennials, and Generation Z all contribute, with varying spending patterns. Baby Boomers spend an average of $9.96 per month on PC and $18.28 on consoles. Generation X gamers invest $13.94 on PC and $20.16 on consoles monthly. Three-quarters of Millennials engage in in-game purchases, with average monthly spending of $16.65 on PC and $20.4 on consoles. Generation Z is most active, with 72% making payments in games, spending $17.1 per month on PC and $19.16 on consoles.

TikTok & Newzoo: Navigating PC and Console Gaming Market in 2023

How to Promote Games in the Modern Market

To succeed in this competitive landscape, game developers and publishers are adopting various strategies, including:

Using Intellectual Property (IP) in Development: Examples include Hogwarts Legacy and Star Wars Jedi: Survivor.

Developing Existing IP and Launching Projects in New Media: Notable examples are the Castlevania anime and The Last of Us series.

Creating Cross-Franchise Collaborations: Games like Dead by Daylight and Mortal Kombat have successfully employed this strategy.

Reviving Old IP: Titles like Mega Man Legacy Collection, Resident Evil 4 Remake, and Final Fantasy 7 Remake breathe new life into beloved franchises.

Collaborating with Bloggers and Content Creators: The power of creators in marketing cannot be underestimated, with brands projected to spend $6 billion on creator marketing in 2023. Examples include Saints Row, The Sims 4, Dead Island 2, and Star Wars Jedi: Survivor.

Collaborating with Brands Outside the Entertainment Industry: Examples such as Nintendo & Oreo, Watch Dogs Legion & Stormzy, Xbox & Barbie, League of Legends & Louis Vuitton, and Animal Crossing & ColourPop Cosmetics showcase the potential of such collaborations.

TikTok & Newzoo: Navigating PC and Console Gaming Market in 2023

Key Takeaways

Community Engagement is Crucial: Building strong community engagement is essential, as ongoing player bases continue to grow. Games have evolved into IPs with global communities, influencing cultural narratives and shaping modern entertainment. Meeting players where they are, both within and beyond gaming, is essential for driving discovery, engagement, and conversion.

Diversity in Gaming: Gaming is increasingly diverse, with players from various countries, cultures, and generations. Publishers need to adapt to capture the attention of this continually evolving population.

Gaming Goes Mainstream: Gaming now competes with film and television for consumer attention. Brands are focusing on meeting players where they spend the most time and leveraging player interests outside gaming, making collaborations and creator marketing critical strategies.

Final Thoughts

As the gaming industry continues to flourish and adapt, these findings hold particular relevance for web3 gaming. The integration of blockchain technology and decentralized platforms is poised to revolutionize the gaming landscape. Community engagement, cross-franchise collaborations, and creator marketing will remain pivotal in the web3 era, connecting players with authentic and immersive gaming experiences. In this ever-evolving gaming world, staying attuned to market trends and embracing innovative strategies will be key to thriving in the exciting future of gaming.